Introduction: Navigating the Global Market for selective laser melting 3d printer

Selective laser melting (SLM), also known as laser powder bed fusion (LPBF), stands at the forefront of the global transition toward advanced metal additive manufacturing. For international B2B buyers—whether navigating the robust industrial centers of Europe, emerging tech landscapes in Africa and South America, or innovation-driven markets in the Middle East—SLM 3D printers represent a strategic investment capable of unlocking new levels of design freedom, supply chain resilience, and production efficiency. As demand accelerates across sectors like automotive, aerospace, energy, and healthcare, understanding this technology and the global ecosystem surrounding it is essential for driving competitive advantage.

What makes SLM 3D printers indispensable? Their unrivaled ability to produce complex, high-performance metal parts—layer by layer, directly from digital files—enables organizations to rapidly prototype, customize, or mass-produce components using a variety of metals, from titanium and aluminum to stainless steel and copper alloys. The widespread adoption of SLM also brings up new questions: Which machine types, build volumes, and laser configurations best match your needs? Which material handling and quality assurance protocols ensure regulatory compliance and part reliability? And, crucially, what are the supply chain, cost, and market variables unique to your operating region?

This guide is crafted to deliver actionable clarity for B2B buyers facing these challenges. Key topics include:

– Technology varieties and their business implications

– Material options and sourcing strategies

– Manufacturing processes, quality control, and compliance

– How to select and qualify suppliers globally

– Cost structures, lead times, and total cost of ownership

– Regional market trends and opportunities

– Practical FAQs for procurement and deployment

By demystifying the SLM global market, this resource empowers you to make informed and confident sourcing decisions, ensuring your organization maximizes ROI and future-proofs its manufacturing capabilities in an increasingly competitive, interconnected world.

Understanding selective laser melting 3d printer Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Single-Laser LPBF Printer | One high-powered laser, compact design | Prototyping, small-batch parts, R&D | Lower cost and footprint; limited throughput and build volume |

| Multi-Laser LPBF Printer | Multiple synchronized lasers, larger build area | Series production, large components, aerospace | High-speed, high-volume production; greater capital and maintenance cost |

| Bidirectional Coater LPBF Printer | Bidirectional recoating mechanism for powder distribution | Rapid prototyping, cost-sensitive production | Faster layer speeds, improved productivity; more complex mechanical system |

| Open-Material LPBF Platform | Accepts 3rd-party powders, wide material customization | R&D, specialist alloys, emerging market needs | Material flexibility, cost savings; variability in print consistency and potential support challenges |

| Industrial-Scale LPBF Printer | Large build chamber, robust automation, integrated QA systems | Automotive, energy, high-value end-use parts | Maximum throughput and automation; significant floor space and infrastructure required |

Single-Laser LPBF Printer

Characteristics & Suitability:

Single-laser LPBF printers utilize one high-powered laser to selectively fuse metal powders. Their compact design makes them suitable for labs, R&D facilities, and small manufacturers. These systems excel at producing prototypes and small production runs with lower upfront cost and reduced consumable needs.

Key B2B Considerations:

Ideal for buyers prioritizing entry-level adoption or space constraints. Evaluate build volume against your production requirements. While affordable, expect longer print times for larger parts and limited scalability.

Multi-Laser LPBF Printer

Characteristics & Suitability:

With two or more synchronized lasers, these systems dramatically boost build speed and throughput. They support larger build plates and more complex part geometries, meeting the demands of aerospace, automotive, and other industries needing serial production of metal components.

Key B2B Considerations:

Recommended for buyers facing volume production, lead time reduction, or complex part needs. Consider the higher capital, operation, and maintenance costs alongside improved efficiency. Ensure supplier support for synchronization and calibration of the multi-laser system.

Bidirectional Coater LPBF Printer

Characteristics & Suitability:

This variation uses a coater mechanism that applies powder in both directions, cutting recoating time and increasing overall printing speed. Beneficial for buyers with tight turnaround needs and smaller to medium part volumes.

Key B2B Considerations:

Improved productivity can offset higher mechanical complexity. Assess serviceability, and ensure your workforce is trained for advanced maintenance. This type is advantageous in high-mix, low-to-mid volume operations, such as contract manufacturing or job shops.

Open-Material LPBF Platform

Characteristics & Suitability:

Unlike closed systems, these printers allow use of third-party powders and enable tuning of print parameters. Particularly attractive for R&D, custom alloys, and buyers in regions like Africa, South America, or the Middle East where supply chains favor flexible sourcing.

Key B2B Considerations:

Material flexibility can offer substantial cost and innovation advantages. However, buyers must weigh this against potential variability in print quality and additional process development time. Partnering with experienced technology providers helps mitigate these risks.

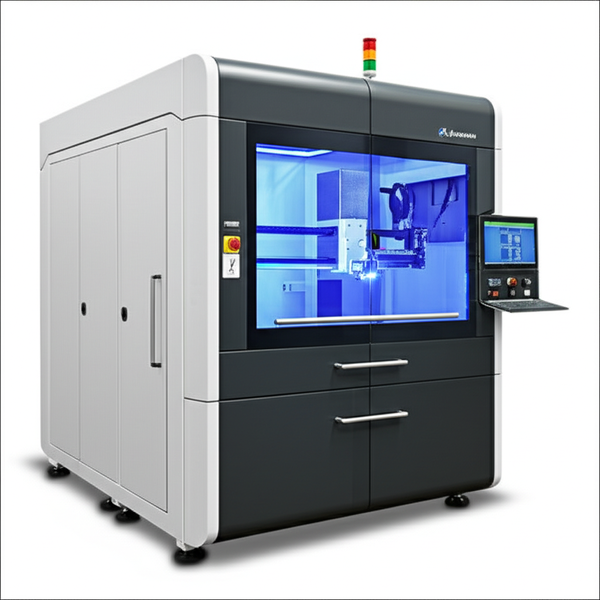

Industrial-Scale LPBF Printer

Characteristics & Suitability:

These are large-format, fully integrated systems with advanced monitoring, automatic powder handling, and safety features. Designed for 24/7 operation in demanding sectors—such as automotive, energy, and medical devices—they deliver maximum productivity and quality assurance.

Key B2B Considerations:

Suited for organizations with high throughput needs and established additive workflows. Consider facility readiness (power, space, metallurgy lab support), and total cost of ownership, including training and after-sales service. Automation advantages often justify the premium in fast-growing or export-driven markets.

Related Video: 3D Printing Technologies: Selective Laser Melting (SLM)

Key Industrial Applications of selective laser melting 3d printer

| Industry/Sector | Specific Application of selective laser melting 3d printer | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Aviation | Lightweight, complex engine components (e.g., turbine blades, fuel nozzles) | Weight reduction, improved performance, short lead times | Metal powder quality, certification (e.g., AS9100), multi-laser capability |

| Medical Devices | Patient-specific implants and surgical instruments | Customization, biocompatibility, faster design-to-delivery | Material biocompatibility, surface finish, regulatory compliance (ISO 13485) |

| Automotive & Motorsport | Rapid prototyping of metal parts and production of high-performance components | High precision, faster iteration, optimized design | Production scalability, mechanical properties, powder reuse rates |

| Energy & Oil/Gas | Custom heat exchangers, turbine and pump parts | Corrosion resistance, enhanced efficiency, reduced downtime | Alloy selection, part certification, build volume flexibility |

| Industrial Tooling | Molds, dies, and complex tooling inserts | Improved tool life, cooling efficiency, design freedom | Tool steel compatibility, post-processing support, repeatability |

Aerospace & Aviation

Selective laser melting (SLM) has transformed how aerospace companies design and manufacture critical components such as turbine blades, fuel nozzles, and structural brackets. Its capability to produce lightweight, highly intricate geometries with internal channels enables significant fuel savings and improved performance. For international buyers, particularly in regions like the UAE or Europe, sourcing SLM solutions with certified metal powders (e.g., titanium, Inconel) and multi-laser printers ensures compliance with global aerospace standards (such as AS9100) and addresses high production demands with faster build speeds.

Medical Devices

In the medical sector, SLM 3D printers facilitate the manufacture of implants and instruments tailored to individual patients. This customization supports faster recovery and better clinical outcomes. International B2B buyers must prioritize biocompatible metal powders (such as titanium or cobalt-chrome) and invest in systems capable of producing parts with excellent surface finishes and low porosity. Ensuring compliance with medical regulations (like ISO 13485) and traceability throughout the manufacturing process is essential, especially for importation into markets with strict health standards.

Automotive & Motorsport

For automotive and motorsport manufacturers, SLM unlocks rapid prototyping and the production of custom or performance-critical parts such as brackets, manifolds, and gear housings. The ability to quickly iterate designs accelerates time-to-market and supports weight reduction for enhanced vehicle performance. Buyers from regions like South America or Africa should examine the printer’s scalability, powder recyclability, and consistency in mechanical properties, as these factors directly impact product development cycles and operational costs.

Energy & Oil/Gas

SLM is increasingly used to produce specialized parts for pumps, turbines, and heat exchangers in the energy sector, benefiting operations in oil-rich regions like Nigeria or the Middle East. The technology’s flexibility in handling corrosion-resistant and high-temperature alloys is critical for applications in challenging environments. Decision-makers must assess build volume, alloy compatibility, and the ability to meet rigorous part certification requirements (such as NORSOK or ASTM standards). Flexible sourcing arrangements can help manage supply chain disruptions common in volatile markets.

Industrial Tooling

Manufacturers of molds, dies, and tooling inserts leverage SLM to achieve conformal cooling channels and complex geometries not possible with traditional manufacturing. This leads to extended tool life, enhanced cooling efficiency, and reduced cycle times. International buyers should investigate the printer’s compatibility with tool steels, post-processing support options, and repeatability of results, as high tool quality directly influences productivity and profitability across diverse manufacturing settings.

Related Video: Metal 3D Printing: What is Selective Laser Melting(SLM )and how does it work | JLC3DP

Strategic Material Selection Guide for selective laser melting 3d printer

Understanding Key Material Options in Selective Laser Melting (SLM) for B2B Buyers

Selecting the optimal material for selective laser melting (SLM) 3D printing is crucial for achieving the intended performance, durability, and cost-efficiency in industrial applications. International B2B buyers, especially in diverse regions such as Africa, South America, the Middle East, and Europe, must balance technical parameters with local standards, supply chain considerations, and end-use requirements. Below, we provide an in-depth analysis of some widely used SLM metals—aluminum alloys, stainless steel, titanium alloys, and Inconel (nickel-based superalloys)—from a B2B perspective.

Aluminum Alloys

Aluminum alloys (notably AlSi10Mg and similar grades) are favored for high strength-to-weight ratio, good thermal conductivity, and corrosion resistance. These properties make them ideal for aerospace, automotive, and lightweight structural components. The advantages of aluminum include reduced part weight, energy savings in use-phase, and post-processing flexibility (machining, anodizing).

Pros:

– Lightweight, suitable for parts where reduced mass is critical

– Corrosion-resistant, particularly attractive for humid or coastal regions

– Rapid build rates and relatively easy post-processing

Cons:

– Lower strength and temperature resistance versus superalloys

– Susceptible to warping during printing if thermal management is insufficient

– Higher gas porosity risk if powder quality is inconsistent

Regional/Application Insights:

In markets like the UAE and Nigeria, where high ambient temperatures and possible supply chain delays can affect operations, aluminum’s corrosion resistance and availability through multiple global suppliers are both critical. European buyers often seek compliance to EN and ASTM standards (e.g., ASTM F3318 for AlSi10Mg), which must be cross-checked in procurement. End-users in automotive and custom machinery sectors in South America and the Middle East demand lightweight, corrosion-resistant parts.

Stainless Steel

Stainless steel grades (such as 316L and 17-4PH) provide a robust balance between mechanical strength, corrosion resistance, and manufacturability. These properties make stainless steels the go-to for medical, energy, oil & gas, and general industrial components.

Pros:

– Excellent for functional prototypes and production parts

– High resistance to corrosion and chemical exposure

– Good weldability and post-processing characteristics

Cons:

– Heavier parts compared to aluminum, not optimal for weight-saving designs

– Medium build rates; processing times are longer than aluminum

– Can be prone to internal stresses; sometimes necessitates additional heat treatment

Regional/Application Insights:

For Africa and the Middle East, 316L’s chemical resistance is essential for components exposed to brine, chlorine, or industrial chemicals. European B2B buyers often require documentation to DIN/EN standards. Stainless steel is widely preferred for critical infrastructure, food processing, and medical device production—even where resource or technical constraints exist (as in certain African and South American markets), since it can often be sourced reliably.

Titanium Alloys

Titanium alloys (notably Ti6Al4V/Grade 5) boast remarkable specific strength, corrosion resistance, and biocompatibility, making them indispensable in aerospace, medical, and offshore energy industries.

Pros:

– Outstanding corrosion resistance (sea water, acids)

– Very high strength-to-weight ratio; ideal for weight-sensitive, high-stress parts

– Excellent biocompatibility for surgical implants or devices

Cons:

– High raw material and powder cost

– Challenging to process—requires high-purity inert gas atmospheres and careful handling

– Post-processing (e.g., hot isostatic pressing) often required to ensure full density

Regional/Application Insights:

Titanium is less universally available and more expensive, which can be a limitation in regions with less developed supply chains. For B2B buyers in Nigeria or the Gulf countries, it’s crucial to confirm grade equivalency with ASTM (e.g., ASTM F2924 for Ti6Al4V) or ISO standards to ensure global acceptance, especially for medical or aerospace exports. Logistics and powder quality control are key procurement considerations.

Inconel (Nickel-Based Superalloys)

Inconel alloys (such as Inconel 718 and 625) are designed for extreme service environments—high temperature, high pressure, and aggressive media.

Pros:

– Exceptional thermal and oxidation resistance up to 700°C+

– High strength under load at elevated temperatures

– Maintains dimensional stability in demanding conditions

Cons:

– Among the highest-cost materials in SLM; powder can be hard to source reliably

– Difficult to machine; post-print finishing often requires specialized tools

– Slower build rates due to high laser power requirements

Regional/Application Insights:

Inconel is preferred for oil & gas, power generation, and aerospace hot-section components—typical needs in the Middle East and parts of Africa. Procurement needs to account for strict adherence to international standards (ASTM B637 or equivalent). For European buyers, thorough traceability and compliance documentation are often required. Metallic powder supply chains can be volatile; buyers should evaluate suppliers’ stability and logistics capabilities.

Material Selection Summary Table

| Material | Typical Use Case for selective laser melting 3d printer | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Aluminum Alloys (e.g., AlSi10Mg) | Lightweight automotive, aerospace parts, prototyping | Low density, corrosion resistant, fast build | Lower high-temp strength, risk of porosity | Medium |

| Stainless Steel (e.g., 316L, 17-4PH) | Medical, energy, industrial & food equipment, tooling | Balanced strength and corrosion resistance | Heavier parts, moderate build speed, internal stresses possible | Low to Medium |

| Titanium Alloys (e.g., Ti6Al4V) | Aerospace, medical implants, offshore & critical parts | High strength-to-weight, excellent biocompatibility | High cost, processing complexity, limited supply | High |

| Inconel (e.g., 718, 625) | High-temp applications: turbine, O&G, powergen | Extreme temperature & oxidation resistance | Very high cost, hard to post-process, slower builds | High |

In-depth Look: Manufacturing Processes and Quality Assurance for selective laser melting 3d printer

Selective laser melting (SLM), often formally referred to as laser powder bed fusion (LPBF), has rapidly become the backbone of industrial metal additive manufacturing. For procurement managers and technical buyers, a clear understanding of both the intricate manufacturing chain and robust quality controls is essential to minimize risk, ensure part reliability, and streamline cross-border transactions. Below is a comprehensive exploration of how modern SLM 3D printer manufacturing is executed, along with practical quality assurance strategies specifically tailored for international B2B buyers.

Overview of Manufacturing Stages for SLM 3D Printers

The production of SLM 3D printers is a multi-stage process involving precision engineering, integration of high-grade components, and thorough testing. The main stages typically include:

1. Material Preparation

- Metal Powder Sourcing & Qualification: The performance of an SLM printer depends heavily on the purity, particle size, and flowability of the metal powder. Manufacturers usually source powder from certified suppliers, demanding stringent documentation—such as Certificates of Analysis—to validate composition and batch consistency.

- Powder Handling Systems: Specialized systems are installed for powder feeding and recycling. These must meet strict cleanliness and containment criteria, ensuring safety and minimizing contamination.

2. Core Assembly & Component Integration

- Main Structural Build: Precision-machined frames and build chambers are fabricated to hold tight dimensional tolerances. Material choices (e.g., high-grade steel, sealed glass) affect printer durability and performance.

- Laser Module Installation: High-power fiber lasers and their optics are installed in clean-room environments, with automated alignment systems to limit human error.

- Recoater and Powder Delivery Setup: Integration of powder recoating mechanisms (blades, rollers, or bidirectional systems) is performed to guarantee even powder layers.

- Integrated Electronics and Software: Custom motion control systems, safety interlocks, and proprietary software (for print management, build monitoring, etc.) are installed and factory-calibrated.

3. System Calibration and Validation

- Laser Path Calibration: Automated or manual calibration procedures align the laser path with the build plate, ensuring consistent energy delivery.

- Environmental Controls: Gas flow, temperature, and humidity systems are installed and calibrated to meet process consistency requirements across global ambient environments.

4. Finishing and Functional Testing

- Final Assembly & Enclosure: Machine panels, filtration systems, and access doors are fitted. Safety systems are checked for compliance with electrical and mechanical standards.

- Core Functional Testing: Printers undergo a “dry run” and sometimes a sample build to verify subsystem integration, print repeatability, and operator controls before packaging.

Key Manufacturing Techniques and Innovations

- Multi-Laser Coordination: Advanced SLM printers may use several synchronized lasers to increase throughput, demanding sophisticated hardware and software integration.

- Automated Powder Management: Some systems incorporate closed-loop powder handling, automated sieving, and oxygen-level monitoring to enhance quality and operator safety.

- Modular Design: Scalable systems enable easier upgrades and maintenance, a vital factor for buyers in regions where specialized service technicians may be scarce.

Critical Quality Control (QC) Standards and Certifications

Adherence to international and industry-specific standards is non-negotiable for SLM printer manufacturers. B2B buyers must be vigilant regarding the following aspects:

International Standards

- ISO 9001: Certification assures that the manufacturer has an established quality management system, covering everything from raw material procurement to customer feedback loops.

- ISO/ASTM 52900 series: These standards define additive manufacturing processes and terminology, providing a common technical language for contractual agreements.

Regional and Industry-Specific Certifications

- CE Marking (Europe): SLM printers entering the EU market require CE conformity, demonstrating compliance with relevant health, safety, and environmental regulations (e.g., EMC, Machinery Directive).

- API Spec Q1/Q2 (Oil & Gas): For printers destined for use in demanding sectors, such as oil & gas, adherence to API standards may be necessary.

- UL/CSA (Electrical Safety): Certification to UL (North America) or CSA (Canada) for electrical safety can be required, especially for facilities with strict EHS policies.

- Local Compliance: Markets such as UAE may mandate Emirates Conformity Assessment Scheme (ECAS) for electrical equipment; Nigeria’s SONCAP or NAFDAC may apply depending on end-use and sector.

QC Protocols Across the Product Lifecycle

Quality control checkpoints are systematically placed throughout the manufacturing pipeline:

- Incoming Quality Control (IQC): Inspection of raw materials, especially metal powders (composition analysis, flow tests), laser modules, and critical electronics against supplier certifications.

- In-Process Quality Control (IPQC): Real-time monitoring of assembly (bolt torques, seal integrity), subassembly testing (recoater smoothness, gas flow rates), and software integration.

- Final Quality Control (FQC): Complete system testing, including dry and wet runs, environmental stress testing, electrical safety verification, and documentation audits (factory acceptance tests, operator manuals).

Common Testing Methods

- Metallurgical Analysis: Testing sample prints for density, porosity, and mechanical properties to ensure the printer meets specification.

- Laser Power & Alignment Testing: Using calibrated sensors to verify energy consistency and alignment accuracy.

- Environmental Stress Testing: Assessing machine robustness under varied humidity and temperature to mimic real-world deployment conditions.

- Safety System Checks: Testing emergency interlocks, fire suppression, and inert gas controls for compliance.

Verifying Supplier Quality as a B2B Buyer

Procurement professionals from Africa, South America, the Middle East, and Europe should use the following strategies to ensure supplier claims are trustworthy and relevant:

1. Request Detailed Documentation

- Audit Reports: Ask for recent ISO or CE audits, as well as supplier evaluation records.

- Test Certificates: Secure batch certificates for critical components (metal powders, lasers) and final system validation reports.

- Factory Acceptance Test (FAT) Protocols: Ensure these protocols map to your specific site and usage requirements.

2. On-Site Audits or Virtual Tours

- Third-Party Inspections: Engage certified international inspection firms to perform pre-shipment and in-process audits.

- Remote Video Inspections: Increasingly, virtual tours are being offered where travel is challenging, allowing buyers to monitor live assembly and testing.

3. Leverage Regional Expertise

- Local Compliance Agencies: Work with regional conformity bodies to validate that global certifications align with local import and operation requirements.

- Customs and Regulatory Intelligence: Stay abreast of evolving local laws (e.g., technology import restrictions, documentation formats) which may differ substantially between, for example, the EU and Nigerian or UAE standards.

4. After-Sales and Technical Support Review

- Training and Maintenance Capability: Evaluate whether the supplier or their regional partners can provide installation, calibration, and ongoing support, critical for buyers in regions with developing AM expertise.

Nuances for International B2B Buyers

- Language and Documentation: Insist on English-language (or local-official language) versions of all technical documents, QC checklists, and training materials to avoid miscommunication during import or commissioning.

- Supply Chain Considerations: Confirm the supplier’s ability to deliver consumables and spare parts to your geography; customs clearance for metal powders can add complexity in regions with tight import controls.

- Warranty and Service Contracts: Negotiate clear service-level agreements (SLAs) with response times adapted to your region’s infrastructure.

Key Takeaways:

For international B2B buyers, especially across Africa, South America, the Middle East, and Europe, robust quality assurance extends far beyond product specs. Assess manufacturing rigor, demand globally recognized certifications, verify processes through independent means, and ensure the supplier’s ability to support installation and ongoing operations regionally. These proactive steps will minimize procurement risk and ensure that your investment in SLM 3D printing technology delivers long-term value and reliable performance.

Related Video: MADIT METAL – Selective Laser Melting (SLM) Process – Metal 3D Printing

Comprehensive Cost and Pricing Analysis for selective laser melting 3d printer Sourcing

Key Cost Components of SLM 3D Printer Procurement

When sourcing selective laser melting (SLM) 3D printers for B2B applications, understanding the total cost structure is essential for budget optimization and risk management. The primary cost components include:

-

Material Costs: SLM printers require high-purity metal powders, such as titanium, stainless steel, Inconel, aluminum, or cobalt-chrome. These can constitute a significant proportion of both initial and ongoing expenses, with prices varying greatly by metal type, supplier, and regional availability. For example, titanium powder is often twice as expensive as stainless steel.

-

Labor: Skilled technicians are required for installation, operation, maintenance, and troubleshooting. Costs may be higher in regions with a shortage of experienced additive manufacturing professionals.

-

Manufacturing Overhead: This includes facility requirements (climate control, dust filtration, safety systems), energy consumption (high for multi-laser machines), and machine maintenance.

-

Tooling and Setup: Although SLM is often regarded as a “tool-less” process, initial setup requires calibration tools, material handling accessories, and sometimes custom build plates or fixtures, especially for new applications.

-

Quality Control (QC) and Certifications: Investment in advanced inspection systems (CT scanning, metallurgy labs) and compliance with international standards (ISO 9001, AS 9100, medical) can add measurable costs, especially if parts are for regulated industries.

-

Logistics and Import Duties: Shipping bulky, sensitive equipment internationally can be costly. Buyers in Africa, South America, the Middle East, and certain European regions must factor in customs, taxes, local handling, and last-mile delivery.

-

Supplier and Distribution Margins: Manufacturers and regional distributors apply markups reflecting service support, warranties, and local business conditions.

Major Price Influencers and Customization Factors

Several variables can significantly impact pricing for SLM 3D printers beyond the bill of materials:

-

Order Volume / Minimum Order Quantity (MOQ): Larger orders or fleet purchases often unlock volume discounts. Single-unit purchases, common in new markets, may carry higher per-unit costs.

-

Technical Specifications: The number and power of lasers, build chamber size, print speed, and software capabilities (monitoring, workflow automation) all drive price variability. Multi-laser, high-throughput systems are substantially more expensive than entry-level models.

-

Degree of Customization: Modifying machine hardware, software, or safety features for specific industrial needs (e.g., local voltage, enclosure standards) typically increases the lead time and price.

-

Materials and Certification Requirements: Machines certified for sensitive sectors—such as aerospace, medical, or automotive—command premium pricing owing to enhanced traceability and documented process control.

-

Supplier-Specific Support Packages: Installation, operator training, remote monitoring, and on-site service contracts can introduce additional costs, but are often critical for buyers in emerging markets with limited in-country expertise.

-

Incoterms and Delivery: Prices can vary dramatically depending on the agreed Incoterms (EXW, FOB, CIF, DAP, etc.), influencing not only overall cost but also buyer responsibility and risk during transit.

Strategies for Cost-Efficiency and Pricing Optimization

International B2B buyers can adopt several strategies to ensure cost transparency and favorable terms:

- Request Detailed Quotations: Insist on a breakdown of costs (machine, materials starter kit, installation, training, warranty, spare parts) to facilitate apples-to-apples comparison.

- Negotiate Total Cost of Ownership (TCO): Factor in long-term expenses—including consumables, service contracts, software updates, and operator training—rather than focusing solely on the purchase price.

- Leverage Local Partnerships: Where possible, collaborate with local agents or distributors with established service networks to reduce lead times and ongoing support costs.

- Assess Import and Compliance Requirements Early: Work with logistics specialists to estimate customs duties, taxes, and any required certifications, especially in countries with evolving import regulations.

- Pursue Volume Bundling: If scalable, structure deals to include multiple printers or combine purchases with accessories and materials to negotiate better margins and value-added service agreements.

- Compare Warranty and Service Levels: Strong after-sales support is crucial, particularly for buyers in Africa, South America, and the Middle East, where local expertise may be scarce. Opt for vendors with robust remote support and immediate-access spare parts warehousing.

Pricing Realities and Considerations for Global Buyers

SLM printer prices can range from approximately $200,000 for smaller, single-laser desktop systems to over $2 million for industrial multi-laser solutions. Variations are wide due to the above factors, and all prices should be considered indicative; market dynamics, regional import conditions, and currency fluctuations can impact final offers.

Disclaimer: All pricing and cost references provided are for general guidance only and are subject to change based on project specifics, supplier negotiations, and macroeconomic factors. Buyers should conduct due diligence and solicit firm quotes to inform critical investment decisions.

Spotlight on Potential selective laser melting 3d printer Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘selective laser melting 3d printer’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Selective Laser Melting (SLM) 3D Printer Market 2025-2034 (markwideresearch.com)

Markwide Research’s analysis of the Selective Laser Melting (SLM) 3D Printer Market 2025-2034 highlights a rapidly evolving sector focused on advanced additive manufacturing solutions for complex metal parts. The research indicates a strong presence in global regions—including North America, with an outlook relevant for B2B buyers in Africa, the Middle East, South America, and Europe. The market features manufacturers that prioritize precision manufacturing, modular machine options, and next-generation powder bed fusion technology, supporting a broad array of industries from aerospace to automotive.

Key strengths identified include adaptability to client-specific needs, extensive segmentation, and tailored solutions—ideal for buyers seeking custom production capacity or regional compliance. While explicit certification details are limited, leading firms in this market are renowned for innovation, robust supply chains, and advanced production capabilities, positioning them to serve international procurement requirements.

Selective Laser Melting (SLM) 3D Printer Market Report (dataintelo.com)

Selective Laser Melting (SLM) 3D Printer Market Report specializes in delivering comprehensive market intelligence on the global SLM 3D printer sector. Their expertise centers on tracking industry growth, technological advancements, and emerging trends that affect buyers in sectors such as aerospace, automotive, and healthcare. With a robust focus on international markets—including Europe, the Middle East, Africa, and South America—they distill actionable insights critical for B2B procurement decisions.

Key strengths include in-depth analysis of SLM 3D printer manufacturers, assessment of quality standards, and benchmarking of manufacturing capabilities. The firm is known for facilitating access to real-time market data, supporting buyers aiming to identify suppliers with advanced additive manufacturing solutions. Detailed public information on their own manufacturing or direct product offerings is limited, but they are highly regarded as a sector resource for up-to-date market trends, technological innovation, and supply evaluation.

The Top Metal 3D Printer Manufacturers in 2025 (www.3dnatives.com)

With a rapidly expanding market presence, this manufacturer is recognized as a key player in the global metal additive manufacturing sector, offering a versatile range of systems across leading Powder Bed Fusion technologies, including Selective Laser Melting (SLM). Their portfolio, featuring solutions like the EOS M 290-2 and EOS M 400-4, demonstrates robust capabilities suitable for both prototyping and industrial-scale production. These printers are valued for high build quality, adaptable build volumes, and compatibility with diverse metal powders, catering to sectors such as aerospace, automotive, and medical devices. While specific quality certifications are not detailed, their international orientation is evident, with distribution and support spanning Africa, South America, the Middle East, and Europe, making them a reliable partner for buyers seeking scalable, advanced SLM solutions.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Selective Laser Melting (SLM) 3D Printer Market 2025-2034 | Global SLM market insights, custom-tailored solutions. | markwideresearch.com |

| Selective Laser Melting (SLM) 3D Printer Market Report | Global SLM 3D printer market analytics. | dataintelo.com |

| The Top Metal 3D Printer Manufacturers in 2025 | Global SLM printer range, industrial-scale capabilities. | www.3dnatives.com |

Essential Technical Properties and Trade Terminology for selective laser melting 3d printer

Key Technical Properties to Evaluate

When sourcing selective laser melting (SLM) 3D printers for industrial applications, it is crucial to understand the technical parameters that directly impact part quality, operational reliability, and long-term value. The following technical properties should be scrutinized during vendor evaluation:

-

Build Volume

The build volume specifies the maximum size of a single printed part, typically stated as length × width × height (e.g., 250 × 250 × 325 mm). For buyers serving diverse industries—such as aerospace or automotive—larger build volumes enable the production of bigger or multiple small parts in a single batch. Clarifying your typical part dimensions ensures the selected printer aligns with your production needs and reduces unnecessary capital expenditure. -

Laser Power and Configuration

Laser wattage and the number of lasers (e.g., single 500W laser, quad 700W lasers) dictate both printing speed and compatibility with certain metal powders. Higher laser power supports faster builds and challenging materials (like titanium), while multi-laser systems increase productivity. Buyers should align laser specs with their throughput targets and material requirements to maximize ROI. -

Layer Thickness (Resolution)

Layer thickness, listed in microns (µm), defines each deposited powder layer’s height, affecting part accuracy and surface finish. Common ranges are 20–60 µm. Finer layers offer high detail and smoother surfaces but increase print times. Precision-critical sectors (such as medical) should prioritize printers with flexible layering options. -

Supported Materials

SLM printers support various metals: stainless steel, aluminum, titanium, Inconel, cobalt-chrome, and even precious metals for specialized fields. Check compatibility with your targeted alloys and if post-processing (e.g., heat treatment) is supported. International buyers must also consider regional supply chains for certified metal powders. -

Dimensional Accuracy and Tolerance

Tolerance indicates the deviation between designed and printed part dimensions, often ±0.1 mm or better. Strict tolerances are essential for components that require post-process assembly or regulatory certification. Suppliers should provide tested data and references for part accuracy. -

Automated Features and Workflow Integration

Look for printers offering automated powder handling, real-time build monitoring, or safety-integrated features. These can reduce operator training, improve workplace safety, and enhance consistency—key considerations for facilities in regions with limited additive manufacturing experience.

Common Trade Terms and Industry Jargon

In B2B negotiations, understanding trade terminology avoids costly miscommunication and inefficient procurement cycles. Here are terms every buyer should master:

-

LPBF (Laser Powder Bed Fusion) / SLM (Selective Laser Melting) / DMLS / DMLM

While SLM is a popular term, “LPBF” is the industry-standard for this technology. DMLS and DMLM are manufacturer-specific names for essentially the same process. Clarifying terminology during discussions ensures technical alignment with vendors and avoids confusion. -

OEM (Original Equipment Manufacturer)

Refers to the company that produces the 3D printer. Engaging directly with OEMs can unlock better technical support, training, and genuine spare parts—important for buyers in emerging regions where local servicing may be limited. -

MOQ (Minimum Order Quantity)

The lowest number of units (or batch of consumables, such as powder) a supplier will accept. Ensuring the MOQ matches your usage forecasts is critical for managing working capital and minimizing excess stock, especially when importing consumables. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing and terms. A well-drafted RFQ clearly specifies desired specs (build volume, laser power, supported materials) and commercial terms, expediting competitive quotations and reducing procurement cycles. -

Incoterms (International Commercial Terms)

Standardized trading terms (e.g., EXW, CIF, DDP) defining responsibilities for shipping, insurance, duties, and delivery. Selecting the right Incoterm is vital for international buyers, impacting landed costs and risk management. -

After-Sales Support / Service Level Agreement (SLA)

Reference to the level of technical and maintenance support the supplier commits to provide. SLAs clarify response times, spare parts availability, and on-site repair obligations—factors crucial for uptime in regions with limited local expertise.

By mastering these technical and commercial aspects, buyers across Africa, South America, the Middle East, and Europe can confidently negotiate SLM 3D printer acquisitions, ensuring their investment meets project demands and delivers long-term value.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the selective laser melting 3d printer Sector

Market Overview and Key Trends

The global market for selective laser melting (SLM) 3D printers—more accurately termed laser powder bed fusion (LPBF)—continues to experience robust expansion, spurred by advances in manufacturing digitization, material versatility, and the growing need for high-performance, complex metal parts across multiple industries. Automotive, aerospace, energy, and healthcare sectors are significant adopters, leveraging LPBF to reduce lead times, enhance functional customization, and optimize part performance. As the technology matures, the demand for larger build volumes, faster production cycles, and greater material diversity has spurred fierce competition among manufacturers.

Key market drivers include increased demand for localized manufacturing, supply chain resilience, and the global shift toward Industry 4.0. For B2B buyers in Africa, South America, the Middle East, and Europe, recent trends show a growing presence of modular and scalable printer architectures that address regional scalability and varying levels of technical infrastructure. European vendors remain technological leaders, but Asian manufacturers are gaining ground by offering competitive pricing and flexible support models.

Emerging trends valuable to international buyers include multi-laser and high-wattage machines that bolster productivity, as well as open material platforms enabling use of locally sourced metal powders. Additionally, an upsurge in remote diagnostics, cloud-based process monitoring, and automation solutions is notable, catering to buyers in regions with limited on-site technical expertise. Strategic partnerships—especially with service bureaus and local distributors—are becoming increasingly important for after-sales support and training, particularly in Africa and the Middle East where local technical know-how is still developing.

For buyers in resource-rich regions, such as Nigeria and the UAE, the ability to source feedstock materials domestically, while leveraging global best practices in additive manufacturing, offers both economic and logistical advantages. However, prospective buyers should remain vigilant regarding intellectual property concerns, equipment certification, and after-market service availability.

Sustainability and Ethical Sourcing in B2B

The sustainability profile of SLM/LPBF technology is rapidly becoming a deciding factor in B2B procurement, reflecting wider corporate ESG (Environmental, Social, Governance) mandates. Compared to traditional subtractive manufacturing, SLM’s inherent efficiencies—such as near-net-shape part production and reduced material waste—deliver significant environmental benefits. However, challenges remain, including the energy-intensive nature of laser melting and the safe handling of fine metal powders.

Responsible supply chains are gaining prominence, with international buyers seeking assurance that their machinery and feedstocks comply with recognized environmental standards. Certifications such as ISO 14001 (environmental management) and RoHS (Restriction of Hazardous Substances) are now frequently stipulated in tenders and procurement documents. Additionally, demand is rising for “green” metal powders, produced using renewable energy or recycled feedstock, helping buyers in Europe or eco-conscious Middle Eastern firms to meet stringent sustainability targets.

Ethical sourcing encompasses both the printer hardware and the consumable metal powders. Auditing vendors’ raw materials for traceability, conflict-free sourcing, and labor practices is increasingly necessary—particularly for buyers in regions facing global scrutiny on supply chain ethics. Some leading manufacturers now offer documented proof of ethical sourcing aligned with UN Sustainable Development Goals, which can be crucial for B2B buyers with multinational customers or stakeholders.

Operational sustainability also extends to end-of-life management and recyclability of the metal powders. Closed-loop systems, material reclamation protocols, and the development of circular economy models are important trends that buyers should monitor, especially when scaling additive manufacturing operations.

Brief Evolution and Historical Significance

Since its inception in the late 1990s, selective laser melting—now officially referred to as laser powder bed fusion—has transitioned from a niche prototyping process to a mainstay of industrial metal part production. Initially developed and patented by German researchers, the technology rapidly gained traction, leading to widespread commercialization across Europe and, subsequently, the globe.

Over two decades, SLM/LPBF has evolved from single-laser, small-format machines to sophisticated systems featuring multiple high-power lasers and automated material handling. Early adopter industries, such as aerospace and medical device manufacturing, have driven much of the process refinement, informing today’s standards for part quality, repeatability, and production scalability. For B2B buyers in emerging regions, understanding this evolution is key; it contextualizes the technical maturity of current solutions and highlights the role of strategic partnerships in overcoming implementation barriers.

By carefully assessing global market trends, prioritizing sustainability, and appreciating the evolutionary context of SLM technology, international B2B buyers are better positioned to make informed procurement decisions, maximize ROI, and align with future industry developments.

Related Video: SLM Solutions: Selective Laser Melting

Frequently Asked Questions (FAQs) for B2B Buyers of selective laser melting 3d printer

-

How do I effectively vet suppliers of selective laser melting (SLM) 3D printers from overseas?

Thorough supplier vetting is crucial in international B2B trade. Begin by verifying company background, financial stability, and their export history—preferably with clients in your region. Request product certifications (like ISO 9001 or CE marking), visit or commission an audit of their factory, and ask for references from previous international buyers. Attend industry expos or request live product demonstrations via video. For high-value purchases, consider third-party inspection services to confirm quality and compliance before shipping. -

Can SLM 3D printers be customized for specific industrial applications or regional requirements?

Most reputable SLM 3D printer manufacturers offer customization options, such as adjustable build volumes, multi-laser arrays, or tailored powder handling solutions. Discuss your operational needs, power supply standards, and preferred materials (e.g., titanium, Inconel, cobalt chrome) with the supplier in advance. Request technical consultations to address climate adaptation, integration with existing systems, and post-processing requirements. Be explicit about any localization needs, such as language settings or regulatory compliance for your region. -

What are typical minimum order quantities (MOQ), lead times, and payment terms for international buyers?

For capital equipment like SLM 3D printers, MOQ is usually one unit, but volume discounts may apply for multiple machines. Lead times range from 8–24 weeks, depending on machine complexity, customization level, and logistics. Payment terms typically require an upfront deposit (30–50%), with the balance payable before shipment or via an irrevocable letter of credit. Always clarify payment milestones and retain proof for all transactions. For buyers in Africa, South America, and the Middle East, negotiate flexible payment and delivery options to accommodate local banking and regulatory realities. -

Which quality assurance (QA) processes and certifications should I demand from SLM 3D printer suppliers?

Quality assurance is non-negotiable—insist on machines that meet international standards such as ISO 9001 for manufacturing quality, CE marking (for Europe), and, where relevant, FDA or regional approvals for healthcare applications. Request detailed QA documentation, including factory acceptance tests (FAT), calibration certificates, and laser safety compliance. Post-shipment, confirm that the supplier provides remote or onsite commissioning support, and offers warranties and spare parts availability. Always verify the validity of certificates with the respective issuing authorities. -

How can I ensure the SLM 3D printer is compatible with my preferred metal powders and existing workflows?

Before purchase, request a list of supported powders by grade and supplier, and inquire if the printer allows open material systems or is restricted to proprietary powders. Ask for technical datasheets, sample print reports, and—if possible—test prints using your chosen material. Discuss integration with your existing software and post-processing infrastructure. For ongoing operations, clarify training provisions for your staff and the availability of technical support, especially in your specific time zone or region. -

What are key logistics considerations for importing an SLM 3D printer into Africa, South America, the Middle East, or Europe?

SLM 3D printers are complex, heavy capital goods. Plan for secure crating, moisture protection, and insurance during transport. Obtain shipping quotes for air and sea freight, considering the nearest ports and customs clearance procedures in your country. Verify the supplier’s export experience with your region and ask if they can recommend local customs agents. Prepare all import documentation in advance, including commercial invoice, packing list, bill of lading, and any required technical certificates. Factor in local taxes, duties, and any special permits necessary for laser equipment. -

How are service, training, and after-sales support typically handled for international customers?

Premium suppliers provide initial remote or onsite installation, staff training, and a clear service agreement specifying response times and warranty terms. For regions with fewer on-the-ground resources, ensure the supplier offers 24/7 remote technical support, readily available spare parts, and clear escalation procedures. Request access to training materials in local languages if possible. For long-term security, clarify whether the supplier has local service partners or certified third-party technicians in your region. -

What steps should I take if there are disputes or issues with the delivered SLM 3D printer?

Before signing the contract, ensure it includes detailed terms regarding after-sales support, dispute resolution (including governing law and arbitration location), and clear remedies for equipment defects or non-performance. If issues arise post-delivery (e.g., damage, missing parts, or underperformance), document everything with photos and detailed reports. Notify the supplier formally and adhere to the dispute escalation process. Engaging an international trade lawyer or your chamber of commerce may help resolve complex issues. Consider procuring trade insurance to protect against financial losses in the event of irreconcilable disputes.

Strategic Sourcing Conclusion and Outlook for selective laser melting 3d printer

As global industries continue to advance towards high-performance, complex, and customized metal parts, selective laser melting (SLM), or laser powder bed fusion (LPBF), stands out as a transformative technology. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, strategic sourcing of SLM 3D printers is integral to gaining a technological and economic edge. Key considerations include evaluating machine capabilities—such as laser power, build volume, and multi-laser configurations—as well as ensuring access to reliable technical support, a diverse range of compatible metals, and scalable supply chains.

Buyers should emphasize building resilient supply partnerships and assessing post-sale service levels, which are crucial in regions facing logistical or infrastructural challenges. Additionally, leveraging global procurement channels alongside local market insights empowers organizations to optimize cost, minimize lead times, and ensure compliance with both international and regional standards.

Looking ahead, SLM 3D printing is poised for rapid growth, driven by expanding application areas in aerospace, automotive, medical, and industrial sectors. Forward-thinking B2B buyers who invest in robust sourcing strategies and foster partnerships with innovative suppliers will be well-positioned to capitalize on this evolving landscape. Now is the time to assess your procurement approach, develop strong supplier networks, and actively shape the future of advanced manufacturing in your region. Strategic investment today will drive your organization’s competitive advantage tomorrow.