Introduction: Navigating the Global Market for sheet metal ductwork

In every modern building, production facility, or infrastructure project, the efficiency of air movement depends on the quality and design of sheet metal ductwork. These essential components—whether transporting clean air through healthcare centers in Europe, extracting fumes from factories in Nigeria, or maintaining comfortable indoor climates across the Middle East and Latin America—are at the heart of safe, effective, and sustainable environments. For international B2B buyers, sheet metal ductwork is not just a commodity. It’s a strategic investment in operational reliability, regulatory compliance, and competitive differentiation.

The dynamics of global sourcing, however, present both opportunities and challenges. Diverse industrial requirements, rapid technological advances, supply chain complexities, and region-specific standards all converge in the sheet metal ductwork market. Navigating these factors is vital for sourcing managers and procurement leaders—especially those operating in Africa, South America, the Middle East, and Europe—who are tasked with delivering projects on time, within budget, and to stringent quality benchmarks.

This in-depth guide is designed to be your definitive sourcing companion. It explores all critical dimensions, including:

- Product Types & Industry Applications: From galvanized steel HVAC ductwork to custom stainless solutions, understand which duct types deliver the best performance for your sector and climate.

- Material Selection: Evaluate key properties—corrosion resistance, durability, weight, and cost—helping you choose the optimal metal for your project’s demands.

- Manufacturing & Quality Control: Demystify cutting-edge fabrication methods and best-in-class quality standards, ensuring you specify and receive ductwork that meets or exceeds expectations.

- Supplier Evaluation: Learn robust criteria for supplier selection, from technical competency and compliance to logistics and aftersales support.

- Cost Factors & Market Insights: Gain a clear picture of pricing drivers, regional market trends, and strategies to mitigate sourcing risks.

- Practical FAQs: Benefit from expert solutions to common procurement challenges.

Backed by actionable insights and tailored for the realities of international buyers, this guide empowers you to make confident, future-proof decisions—turning the complexity of global sheet metal ductwork procurement into a competitive advantage.

Understanding sheet metal ductwork Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Rectangular Ductwork | Flat-sided, fabricated from galvanized steel or aluminum | Commercial HVAC systems, industrial plants | Cost-efficient, easy to install in tight spaces; may have higher pressure loss |

| Round (Spiral) Ductwork | Cylindrical shape, often spiral-locked seams | Large-scale ventilation, warehouses | Superior airflow, low leakage; can be bulky and less flexible in layout |

| Flat Oval Ductwork | Elliptical cross-section, combines height/width benefits | Office complexes, space-constrained builds | Space-saving, improved airflow; requires specialized fabrication |

| Flexible Ductwork | Made from wire coil and insulated polymer or foil | Branch connections, retrofits, tight bends | Highly adaptable, quick install; susceptible to damage, airflow losses |

| Double-Wall Insulated Duct | Inner/outer metal shells with insulation between | Hospitals, cleanrooms, harsh environments | Excellent thermal/acoustic performance; higher material and installation cost |

Rectangular Ductwork

Rectangular ductwork is the traditional choice for many commercial and industrial HVAC applications due to its flat, space-efficient profile. Prefabricated from galvanized steel or aluminum sheets, it supports easy installation in areas with low ceilings or close quarters. For B2B buyers, key considerations include manufacturing tolerances (to ensure tight seals), local fabrication capacity, and the impact of increased friction losses on system design and energy efficiency. Rectangular ducting is advantageous in markets with standardization or retrofit needs.

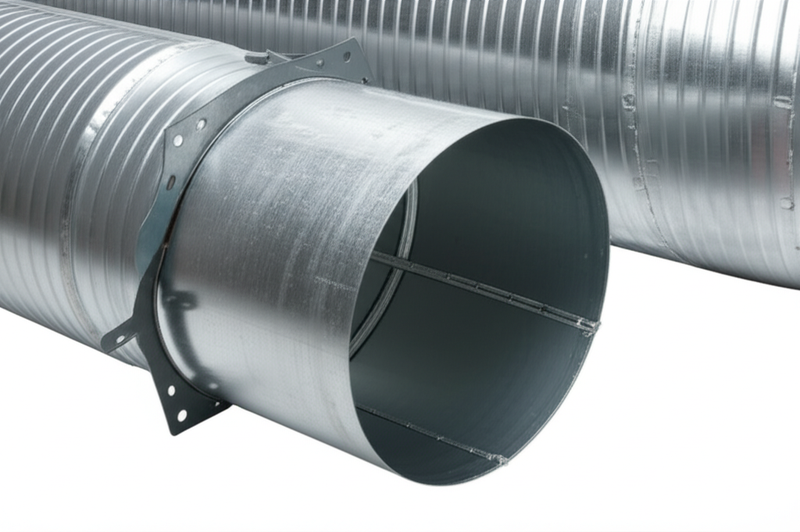

Round (Spiral) Ductwork

Round (often spiral-seamed) ductwork delivers superior airflow characteristics, thanks to its smooth interior and minimal leakage from continuous seams. This format is ideal for large-scale ventilation in manufacturing, warehousing, and logistics centers, especially where long, unobstructed runs are feasible. When sourcing, buyers should confirm compliance with international leakage standards (e.g., EN 12237, SMACNA), evaluate transport logistics for long sections, and weigh installation speed against on-site space limitations.

Flat Oval Ductwork

Flat oval ductwork blends the aerodynamic efficiency of round ducts with the space advantage of rectangular profiles. Its shape allows for higher airflow rates in shallow ceiling spaces, making it especially relevant in premium office, retail, and healthcare environments. As fabrication requires special dies and advanced forming capabilities, buyers should assess supplier expertise, tooling availability, and customization options. Flat oval is optimal in projects demanding both performance and architectural discretion.

Flexible Ductwork

Flexible ductwork consists of a spiraled wire core encased in plastic or foil, typically pre-insulated for thermal performance. Used mainly for short branches, retrofits, or areas requiring numerous bends, it enables fast and labor-saving installation. However, buyers must note that flexible ducts come with notable pressure loss and are prone to physical damage. Sourcing from reputable suppliers with certified product ratings is crucial to ensure long-term reliability, especially in markets with variable climate conditions.

Double-Wall Insulated Duct

Double-wall insulated ducting features two concentric metal shells separated by an insulation layer—either fiberglass or foam. This structure delivers exceptional thermal and acoustic insulation, critical in sensitive settings such as hospitals, high-end laboratories, or temperature-controlled storage. B2B buyers should prioritize suppliers with proven quality control, check compliance with fire safety and insulation standards, and factor in both higher upfront costs and the potential for reduced operating expenses over the duct lifecycle.

Related Video: How to Build A Beautiful Sheet Metal Ductwork Transition. | DIY HVAC GUY

Key Industrial Applications of sheet metal ductwork

| Industry/Sector | Specific Application of sheet metal ductwork | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Commercial Construction | HVAC ventilation and air conditioning distribution | Enhanced air quality, energy efficiency, occupant comfort | Material longevity, conformance to ASHRAE/EN standards, corrosion resistance |

| Industrial Manufacturing | Fume extraction and dust collection systems | Worker safety, regulatory compliance, equipment protection | Precise fabrication tolerances, resistance to chemicals/abrasives |

| Healthcare & Laboratories | Sterile air delivery and containment | Infection control, strict hygiene, controlled environments | Use of stainless/aluminum, airtight sealing, compliance with ISO/CEN standards |

| Agri-processing & Food Industries | Controlled environment & processing air flow | Product purity, contamination reduction, process consistency | Food-grade finishes, easy-to-clean designs, certification (e.g., HACCP) |

| Data Centers & Technology | Climate control and cooling airflow | Equipment reliability, uptime, optimized energy consumption | Low leakage rates, thermal insulation, fire resistance, rapid install/modular options |

Commercial Construction: HVAC Ventilation and Air Conditioning Distribution

Sheet metal ductwork is integral in commercial buildings for distributing conditioned air throughout offices, malls, hotels, and public facilities. It supports centralized or zoned HVAC systems, ensuring even air flow, regulated temperatures, and enhanced indoor air quality. For B2B buyers in regions like the Middle East and Europe, where climate control and energy efficiency are top priorities, specifying anti-corrosive galvanized or aluminum ducts is critical, especially in coastal or high-humidity environments. Ensuring compliance with ASHRAE or EN ventilation standards is also essential for project approval and operational efficiency.

Industrial Manufacturing: Fume Extraction and Dust Collection Systems

Manufacturing plants, such as those in automotive, textiles, or electronics sectors, utilize sheet metal ductwork in systems designed to extract hazardous fumes, dust, or particulates directly from process points. This protects worker health and ensures compliance with regional safety and environmental regulations. Buyers in Africa and South America should prioritize robust designs, often utilizing thicker galvanized or stainless steel to withstand abrasive or corrosive materials. Precision in fabrication ensures maximum capture efficiency and a reduction in maintenance needs, optimizing operational uptime.

Healthcare & Laboratories: Sterile Air Delivery and Containment

Hospitals and laboratories depend on ductwork to supply sterile, contaminant-free air or to create negative-pressure environments that contain pathogens. Ducts must feature airtight joints, be made from non-porous metals like stainless steel or coated aluminum, and meet strict hygiene requirements per ISO or CEN standards. B2B buyers in Europe and emerging Middle Eastern markets must ensure suppliers follow best practices for leak testing, easy-clean designs, and seamless welds to support infection control protocols and regulatory compliance.

Agri-processing & Food Industries: Controlled Environment & Processing Air Flow

In food processing plants, abattoirs, or beverage facilities, precise air flow via sheet metal ductwork is used for ventilation, dust control, and maintaining hygienic production conditions. Ducts in these environments must use food-grade, easy-to-clean finishes (e.g., polished stainless steel) to prevent contamination and support HACCP plans. International buyers should seek suppliers who provide certifications for hygienic design and can deliver custom configurations that address local climate variables found in Africa and South America.

Data Centers & Technology: Climate Control and Cooling Airflow

Data centers and electronics facilities rely heavily on optimized ductwork systems for cooling sensitive computing hardware, minimizing hot spots, and maintaining consistent operational temperatures. There is a strong business case for prefabricated, modular ductwork solutions that can be rapidly installed to align with project timelines and scaling demands. Buyers in Europe, Nigeria, and rapidly digitizing Middle Eastern markets should look for designs offering low air leakage rates, integrated thermal insulation, and fire-resistant materials to ensure both compliance and long-term asset protection.

Related Video: HVAC Ductwork/Sheet Metal Tools- Basics, Uses, & Demonstration of Each!

Strategic Material Selection Guide for sheet metal ductwork

Analysis of Common Materials for Sheet Metal Ductwork

Selecting the optimal material for sheet metal ductwork is critical for ensuring the long-term performance, cost-efficiency, and compliance of HVAC and industrial systems. B2B buyers across Africa, South America, the Middle East, and Europe must consider not only technical specifications and environmental adaptability but also regional market norms and regulatory standards. Below is a detailed analysis of four prevalent ductwork materials to help decision-makers navigate procurement choices confidently.

Galvanized Steel

Key Properties:

Galvanized steel consists of carbon steel sheets coated with a protective zinc layer, enhancing resistance to rust and corrosion. It operates effectively in typical residential and commercial HVAC temperature and pressure ranges. The zinc coating typically conforms to standards such as ASTM A653 and EN 10346.

Pros & Cons:

– Pros: Widely available globally, cost-effective, and highly durable for standard ducting. The zinc layer provides reliable corrosion resistance, making it suitable for environments with moderate humidity.

– Cons: Not ideal in coastal or extremely humid areas, as salt air may eventually penetrate the coating. Welding can compromise the zinc protection, requiring post-fabrication touch-ups.

Impact on Application:

Galvanized steel is well-suited to general HVAC ductwork, including main trunk lines and branches for supply and return air. It supports standard rectangular and spiral duct designs.

Regional Considerations:

Preferred for mass-market projects in the UK, Nigeria, and the Middle East due to its reliability and broad supplier base. Ensure compliance with local fire and smoke standards (e.g., EN 13501, BS 476), especially for public buildings. Buyers should confirm coating thickness due to regional variations in humidity and air pollution.

Aluminum

Key Properties:

Aluminum is valued for its light weight, workable formability, and inherent corrosion resistance, even in marine and highly humid environments. Its thermal conductivity is higher than steel, which can impact insulation strategies. Common grades include EN AW-1050A/3003 and ASTM B209.

Pros & Cons:

– Pros: Easily handled and installed due to low weight, excellent for coastal or corrosive environments, and typically requires less maintenance.

– Cons: Lower structural strength than steel, more expensive, and may be more prone to deformation in high-pressure applications unless thickness is increased.

Impact on Application:

Best chosen for ductwork in aggressive atmospheres—such as industrial plants, food processing facilities, or coastal installations—where long-term corrosion resistance is paramount.

Regional Considerations:

Increasingly used in Africa and South America for modern energy-efficient buildings. In Europe and the Middle East, aluminum is favored for high-spec or exposed ductwork. Buyers should specify the required grade and thickness to align with both mechanical and insulation needs.

Stainless Steel

Key Properties:

Stainless steel is renowned for outstanding corrosion resistance, hygienic properties, and the ability to withstand high temperatures and chemicals. Grades such as 304 and 316 (ASTM A240, EN 1.4301/1.4401) offer increasing resistance to chlorides and industrial pollutants.

Pros & Cons:

– Pros: Exceptionally durable, maintenance-free, suitable for corrosive, high-hygiene, or high-temperature environments. Ideal when long service life is required.

– Cons: Significantly higher material and fabrication costs, heavier than aluminum, and can be more challenging to fabricate and install (requires expertise).

Impact on Application:

Critical for ductwork in food, pharmaceutical, hospital, or laboratory settings, and wherever ducting is exposed to chemicals or cleaning agents.

Regional Considerations:

Mandated for selected environments in Western Europe and increasingly specified in the Middle East for luxury or specialty buildings. Buyers must specify grade according to local air quality and chemical exposure, and verify compliance with standards such as ASTM A240, EN 10028-7, or JIS G4304.

Mild (Carbon) Steel

Key Properties:

Mild steel offers robust mechanical strength at a low price point. Unless protected by paint or coatings, it is highly susceptible to rust, especially in humid or polluted air. Specifications often include ASTM A366/A1008 or EN 10130.

Pros & Cons:

– Pros: Very affordable and readily available worldwide, easy to fabricate, and offers high rigidity for large duct runs.

– Cons: Low inherent corrosion resistance, requiring careful surface protection (paint, epoxy, or duct liner), and increased maintenance. Shorter lifetime in damp or coastal environments.

Impact on Application:

Useful for interior duct runs in dry environments or when cost is the overriding consideration. Not recommended for concealed or inaccessible installations without robust protection.

Regional Considerations:

Popular for budget projects in West Africa and South America. Regional standards and best practices require anti-corrosion treatment, and local fire regulations may limit use in some applications. Always clarify required coatings and testing procedures.

Comparative Summary Table

| Material | Typical Use Case for sheet metal ductwork | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Galvanized Steel | Standard HVAC ducting (supply/return air), general infrastructure | Balanced cost/durability, good global availability | Vulnerable to moisture/salt in harsh environments, welding can compromise coating | Low |

| Aluminum | Coastal, industrial, or high-humidity duct installations | Lightweight, superior corrosion resistance | Lower strength, higher cost, potential deformation | Medium |

| Stainless Steel | Chemical, hygienic, or high-temperature HVAC (e.g., hospitals, labs) | Superior corrosion/chemical resistance, long service life | Highest cost, heavier, complex fabrication | High |

| Mild (Carbon) Steel | Low-budget, dry indoor ducting, protected interior runs | Very affordable, high strength, easy fabrication | Poor corrosion resistance without coating, maintenance required | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for sheet metal ductwork

Key Manufacturing Stages of Sheet Metal Ductwork

Sheet metal ductwork is a core component in HVAC systems, industrial ventilation, and specialized infrastructure projects worldwide. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, understanding the typical manufacturing process is essential to ensure you receive consistent, high-quality, and project-appropriate products. The manufacturing workflow for sheet metal ductwork can be divided into four primary stages: material preparation, forming and cutting, assembly and joining, and finishing.

1. Material Preparation

The process begins with the selection and inspection of raw materials. The most common materials are galvanized steel, aluminum, and stainless steel. Raw sheets or rolls are checked for thickness, surface defects, and compliance with specified grades, as the material quality directly impacts duct longevity and performance, particularly in humid climates or corrosive environments common across Africa and coastal regions of Europe and South America.

- Actionable Takeaway for Buyers: Always require mill certificates and batch traceability for raw materials. Ask for incoming quality reports and insist on recognized grades (such as ASTM, EN, or equivalent).

2. Forming and Cutting

The next stage involves transforming flat sheets into ductwork components of varying shapes and sizes:

Cutting Techniques:

– Shearing: For high-volume, straight cuts.

– Laser Cutting: Delivers intricate and precise cuts, ideal for custom or complex duct profiles.

– Plasma and Waterjet Cutting: Used for thicker materials or when minimal heat distortion is required.

Forming Techniques:

– Bending: Performed using press brakes or roll formers, creating U or L shapes for standard duct sections.

– Roll Forming: Enables continuous, uniform shapes, especially for long straight ducts.

– Hydroforming: Utilized for complex or round shapes requiring seamless integrity.

For European and Middle Eastern buyers, specify advanced cutting and forming, as it ensures tighter tolerances needed for energy-efficient or leak-free HVAC installations.

- Actionable Takeaway for Buyers: Specify your required tolerances and preferred forming/cutting technologies in your RFQs (Requests for Quotation). Ask for samples or dimension verification reports during the qualification phase.

3. Assembly and Joining

Once individual pieces are shaped, the assembly phase begins:

Common Assembly Techniques:

– Welding: MIG, TIG, or spot welding for high-strength, continuous seams, particularly in stainless steel ducts.

– Riveting and Clinching: Provide strong, mechanical joints without excessive heat—commonly used in large-section or modular ductwork.

– Pittsburgh Locking/Seaming: Enables quick and airtight connections in rectangular ducts.

Selection depends on the application environment; for example, heavy-duty welded joints are preferred for dust extraction in industrial settings, while Pittsburgh locks are popular in commercial HVAC due to lower production costs and faster installation.

- Actionable Takeaway for Buyers: Request details of joint types used and seek samples or test data on seam strength and air-tightness, especially for projects where leakage or contamination poses substantial risks.

4. Surface Finishing

Proper finishing is vital for resilience against environmental factors:

Finishing Options:

– Galvanizing: Adds a zinc layer to steel, preventing rust (standard in most commercial HVAC).

– Powder Coating: Provides additional corrosion resistance and aesthetic customization.

– Anodizing (for Aluminum): Increases surface hardness and protects against oxidation, highly recommended for ductwork in marine or chemical environments.

– Polishing or Buffing: Used in stainless steel ducts for hygiene-critical applications such as food processing or laboratories.

- Actionable Takeaway for Buyers: Specify required finishes based on environmental exposure. For export-bound projects, confirm compliance with destination country regulations on coatings and emissions.

Quality Assurance in Ductwork Manufacturing

Ensuring consistent quality across international shipments is challenging, especially with the diverse regulatory expectations found in the UK, Nigeria, Brazil, and the Middle East. Robust quality assurance frameworks are necessary to reduce risk and assure suitability for local installations.

International and Industry Standards

Key Standards Relevant to Sheet Metal Ductwork:

– ISO 9001: International benchmark for Quality Management Systems (QMS); ensures manufacturers have reliable, repeatable processes.

– EN 1507 / EN 12237 (Europe): Specific standards for the airtightness and strength of metal ductwork.

– ASHRAE and SMACNA (Americas & Middle East): Offer guidelines for fabrication tolerances, joint construction, and leakage classification.

– CE Marking (Europe): Indicates product meets EU safety and performance requirements.

– Other Regional Standards: Some African countries or Gulf states reference international codes or have adopted ISO/EN equivalents.

- Actionable Takeaway for Buyers: Insist on documented compliance with relevant standards for your region. Require up-to-date copies of certifications, and verify their authenticity with issuing bodies.

Key Quality Control Checkpoints

A strong QC process spans all production stages:

- Incoming Quality Control (IQC): Verifies raw material conformity, preventing defects before fabrication starts.

- In-Process Quality Control (IPQC): Ongoing checks during cutting, forming, and assembly, focusing on dimensional tolerances, weld integrity, and surface finish.

- Final Quality Control (FQC): Comprehensive inspection before packing, including compliance with drawings, leak tests (where required), and packaging suitability.

Common Testing and Inspection Methods:

– Dimensional Inspections: Use of gauges, calipers, and CMMs (Coordinate Measuring Machines) for shape accuracy.

– Leakage Testing: Blower door or pressure drop tests, typically for HVAC ducts, to ensure compliance with airtightness classes.

– Material Analysis: Spectrometry or XRF testing to confirm alloy composition.

– Adhesion and Corrosion Testing: Confirms that coatings or finishes meet durability expectations.

– Visual and Dye Penetrant Inspection: Checks for weld cracks, surface defects, or incomplete coatings.

- Actionable Takeaway for Buyers: Request detailed QC process documentation, sample inspection reports, and traceability logs with each shipment.

Supplier Quality Verification: Best Practices for B2B Buyers

To assure consistent product quality from overseas suppliers, adopt the following strategies:

- Conduct Factory Audits: On-site or virtual audits, ideally based on ISO 9001 guidelines, assess workflow, equipment, and in-house QC competency.

- Request Third-Party Inspection: Engage independent inspection agencies for pre-shipment checks, especially for high-value or custom orders. Many buyers in Africa and South America use SGS, Bureau Veritas, or Intertek for this purpose.

- Obtain Regular Quality Reports: Insist on receiving batch QC documents, test certificates, and compliance records with every order.

- Establish an Approved Vendor List: Work only with suppliers who have a proven QC record and references in your sector.

- Negotiate Quality Clauses: Include clear penalties and remedies for non-conformity in your purchase contracts to mitigate risks associated with international trade.

Regional Nuances and Challenges

International buyers must account for differences in climate, regulatory requirements, and logistics infrastructure:

- Africa & South America: Pay close attention to materials and coatings due to high humidity or industrial pollution, which accelerate corrosion.

- Middle East: Extreme heat and sand can stress ductwork, making material certification and finish quality critical.

- Europe (including UK): Stringent adoption of EN and CE standards means compliance documentation is mandatory. Expect more rigorous project submittal processes.

- Logistics and Handling: For markets where handling infrastructure may be limited, validate packaging methods to prevent in-transit damage.

Summary: Maximizing Value and Reducing Risks

For international B2B buyers, mastering the manufacturing and QC process of sheet metal ductwork is key to ensuring product reliability, safety, and regulatory compliance across diverse operating environments. By specifying advanced manufacturing methods, requiring detailed QC verification, and tailoring due diligence to local requirements, buyers from Africa, South America, the Middle East, and Europe can confidently secure ductwork solutions that deliver value, durability, and peace of mind.

Related Video: Amazing factories | Manufacturing method and top 4 processes | Mass production process

Comprehensive Cost and Pricing Analysis for sheet metal ductwork Sourcing

Understanding the Cost Structure of Sheet Metal Ductwork

Successfully sourcing sheet metal ductwork for commercial or industrial projects requires a clear grasp of the various cost components involved. For international B2B buyers—from Africa and South America to the Middle East and Europe—accurate cost analysis is essential to secure competitive pricing, plan budgets effectively, and make strategic procurement decisions. Below is a breakdown of key cost factors and actionable insights to maximize value in sheet metal ductwork sourcing.

Key Cost Components

1. Raw Material Costs

Materials (galvanized steel, aluminum, stainless steel) typically account for the largest share of ductwork costs—often 40-60% of the final price. Commodity prices fluctuate due to global steel markets, regional supply-demand dynamics, and currency exchange rates. Material grade, thickness, and coatings (e.g., for corrosion resistance) all impact cost.

2. Labor Costs

Fabrication involves skilled labor for processes such as cutting, bending, welding, and finishing. Labor rates vary significantly by region; sourcing from low-cost manufacturing hubs can yield savings but may affect lead times, quality, or supply reliability.

3. Manufacturing Overhead

Facility operating costs—utilities, maintenance, machine depreciation, and compliance with environmental or safety standards—all contribute to the final price.

4. Tooling and Setup

Custom ductwork or large orders may require unique dies, molds, or programming for CNC machines. There are often non-recurring engineering (NRE) charges if your project calls for non-standard shapes or advanced features.

5. Quality Control and Certifications

Testing (e.g., for air-tightness or material compliance), documentation, and certifications (such as ISO or EN standards) can add to costs, especially for export or projects with strict regulatory requirements.

6. Logistics and Shipping

Transport costs (sea, air, or land), insurance, customs duties, and local handling can account for 10-25% of total expenditure—particularly for overseas buyers in Africa and South America. Ductwork’s bulky nature means efficient packing and Incoterm clarity (e.g., FOB, CIF, DAP) are crucial.

7. Supplier Margin

Suppliers’ markup will reflect their value proposition, capacity, service, and risk factors.

Primary Price Influencers

- Order Volume & Minimum Order Quantities (MOQ): Larger orders benefit from economies of scale, reducing per-unit costs. Be mindful of minimum batch requirements.

- Design Complexity & Customization: Non-standard shapes, tight tolerances, and special finishes (e.g., powder coating, insulation) increase both tooling and labor costs.

- Material Choice & Grade: Premium materials or thicker gauges command higher prices but may offer longer lifespan or lower maintenance, especially important in high-corrosion or mission-critical installations.

- Required Certifications & Quality Standards: Projects needing stringent certifications or third-party inspections will be quoted at a premium.

- Supplier Reputation & Capacity: Established, highly certified manufacturers may charge more but reduce risk and may offer better after-sales support.

- Market Region & Incoterms: Local availability, tariffs, and the chosen Incoterm affect landed costs. For example, DDP (Delivered Duty Paid) quotes ease customs processes for buyers in the Middle East or Africa but come at a higher price.

Practical Tips for Achieving Cost-Efficiency

- Negotiate Comprehensive Quotations: Request itemized quotes covering raw materials, fabrication, QC, packaging, and logistics. This helps identify cost-saving opportunities.

- Leverage Volume Discounts: Where possible, consolidate orders or collaborate regionally to meet higher MOQs for lower per-unit pricing.

- Optimize Specifications: Specify only essential customization and material grades required for your application. Over-specifying can unnecessarily inflate costs.

- Clarify Quality Expectations Upfront: Align on QA/QC procedures early in supplier discussions to avoid unforeseen surcharges or delays.

- Analyze Total Cost of Ownership (TCO): Factor in not just the upfront purchase price but also shipping, installation, lifespan, and maintenance. Sometimes, a higher upfront investment in better material or fabrication pays off over time.

- Plan Logistics Strategically: Choose suppliers with experience exporting to your region—ones familiar with local compliance and customs can reduce risks and hidden fees.

- Leverage Incoterm Knowledge: Opt for Incoterms that best suit your organization’s import capabilities—FOB for direct control, CIF/DDP for simplicity in complex customs environments.

Indicative Pricing Disclaimer: Sheet metal ductwork pricing can vary widely based on market conditions, specifications, and supplier factors. All cost and pricing information provided here is for guidance only and should be validated with up-to-date supplier quotations.

By understanding and managing these factors, international B2B buyers in Africa, South America, the Middle East, and Europe can confidently negotiate competitive, transparent, and sustainable ductwork sourcing agreements.

Spotlight on Potential sheet metal ductwork Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘sheet metal ductwork’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

38 Duct Manufacturers in 2025 (us.metoree.com)

As of 2025, the “38 Duct Manufacturers” listing on Metoree represents a curated group of top-ranked U.S.-based suppliers specializing in sheet metal ductwork for HVAC and industrial applications. These manufacturers collectively offer a comprehensive range of duct solutions, including customized products in various shapes and materials such as galvanized steel, aluminum, and stainless steel. By leveraging advanced fabrication techniques and adhering to recognized industry standards, these companies deliver ductwork designed for energy efficiency, durability, and secure integration with rooftop and exposed HVAC systems. Many manufacturers in this listing have established export capabilities, supporting projects in Europe, the Middle East, Africa, and South America. For international B2B buyers, the breadth of options offers flexibility in project specification and streamlined sourcing from vetted, quality-driven partners. Note that individual certifications and specialties may vary; direct engagement is recommended for up-to-date compliance and tailored quotations.

10 Ductwork suppliers in the World 2025 (www.sourcifychina.com)

10 Ductwork suppliers in the World 2025 is recognized for enabling global B2B buyers to efficiently compare and select top-tier sheet metal ductwork manufacturers. The platform highlights suppliers offering a diverse range of galvanized sheet metal duct pipes and fittings, including elbows, boots, collars, spiral pipes, rectangular, and flat oval solutions tailored for both residential and large-scale commercial HVAC projects. Notable technical strengths include the use of durable, corrosion-resistant materials (such as G-90 galvanized, aluminum, and stainless steel) with options for custom connectors and advanced complete-seal systems for superior airtight performance. Buyers benefit from access to multiple gauge options and strict attention to quality, though certification requirements and regional availability should be verified in advance. While specific certifications and facility details are not always public, the platform’s portfolio suggests broad international export experience—serving Africa, South America, the Middle East, and Europe—and a focus on connecting buyers to pre-vetted, competitively priced suppliers.

12 Sheet Metal Manufacturers In The World (proleantech.com)

ProleanTech, recognized among the world’s top sheet metal manufacturers, operates out of China with a strong global presence and extensive B2B experience. The company leverages advanced fabrication techniques—including plasma cutting, CNC machining, and precision punching—to deliver high-quality sheet metal ductwork suited for diverse industrial and commercial applications. Its portfolio covers a wide range of materials and thicknesses, meeting the rigorous requirements of HVAC, construction, and mechanical systems. ProleanTech’s reputation is built on its ability to provide tailored solutions, large-volume production capacity, and consistent product quality, making it a reliable choice for international buyers. With a client base spanning over 120 countries, they are well-versed in serving demanding specifications for buyers throughout Africa, South America, the Middle East, and Europe.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 38 Duct Manufacturers in 2025 | Broad-range ductwork, export-ready, advanced fabrication | us.metoree.com |

| 10 Ductwork suppliers in the World 2025 | Global comparison of pre-vetted ductwork manufacturers. | www.sourcifychina.com |

| 12 Sheet Metal Manufacturers In The World | Global, advanced, high-volume ductwork solutions | proleantech.com |

Essential Technical Properties and Trade Terminology for sheet metal ductwork

Key Technical Properties for Sheet Metal Ductwork Procurement

Understanding and specifying the correct technical properties is crucial when sourcing sheet metal ductwork internationally. These specifications do not just impact product performance, but also influence total cost of ownership, compliance with local standards, and the longevity of your HVAC or industrial systems. Below are the most critical technical properties to consider, along with their implications for B2B buyers:

-

Material Grade

The material grade describes the precise alloy composition and mechanical properties of the sheet metal. Common options for ductwork include galvanized steel (e.g., DX51D+Z), stainless steel (such as 304 or 316), and aluminum grades (e.g., 3003, 5052). Selecting the right grade determines resistance to corrosion, strength, suitability for local climate conditions, and compatibility with fire and hygiene regulations—a vital consideration for projects in diverse regions like Nigeria’s humidity, Gulf coast salt air, or the chill of European winters. -

Gauge (Thickness)

Gauge indicates the thickness of the sheet metal, typically measured in millimeters or standardized gauge numbers (e.g., 24GA, 18GA). The appropriate gauge ensures ducts are robust enough to withstand operating pressures without unnecessary over-specification, which can drive up costs and weight. For large commercial projects, referencing the correct gauge also ensures compliance with local building codes and safety standards. -

Coating and Surface Treatment

Many duct systems use coated sheet metal—such as zinc-galvanized or powder-coated surfaces—to enhance corrosion resistance, thermal stability, or aesthetic appearance. The specification of coatings (type, thickness, and application standard) is especially critical for outdoor, industrial, or coastal deployments, where environmental aggressors threaten product longevity and safety. -

Dimensional Tolerance

Tolerance defines the acceptable range of variation in key dimensions (width, thickness, length, and fit). Tight tolerances are essential for modular systems, seamless installation, and maintaining consistent airflow characteristics. Precise tolerancing reduces on-site adjustments, supports lean construction workflows, and minimizes waste—crucial for complex projects or where international shipping adds logistics challenges. -

Formability and Weldability

These properties indicate how easily the metal can be cut, bent, welded, or joined without cracking or losing structural integrity. High formability is important for creating complex duct geometries and rapid on-site modifications. Weldability is especially critical if local installation teams will fabricate final connections, as not all alloys or coatings permit easy or strong welds. -

Fire Resistance Rating

For buyers in regions with strict safety standards—such as the EU or Gulf states—demanding certified fire resistance ensures ductwork will not propagate flames or emit harmful gases, protecting occupant safety and meeting insurance or building code requirements.

Vital Trade and Industry Terms for B2B Buyers

Grasping industry-specific terminology enables effective communication with suppliers, prevents misunderstandings, and supports professional negotiations. Here are key terms commonly encountered during sheet metal ductwork procurement:

-

OEM (Original Equipment Manufacturer)

An OEM is a company that produces components or products, sometimes to be rebranded or integrated by another business. When sourcing ductwork, specifying an OEM relationship means you’re buying products developed to your design or performance needs—important for bespoke or branded projects. -

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity a supplier is willing to sell per order or batch. Understanding and negotiating MOQ helps B2B buyers optimize inventory management, control cash flow, and align order sizes with project phases, especially vital for large or multi-site international projects. -

RFQ (Request for Quotation)

An RFQ is a formal document sent to suppliers requesting price offers and terms for specific sheet metal ductwork packages. Crafting detailed RFQs facilitates apples-to-apples price and quality comparisons, speeds up supplier selection, and provides negotiation leverage. -

Lead Time

Lead time refers to the total duration from order placement to delivery at your site. Clear understanding and management of lead times are essential to prevent project delays, account for international shipping, and coordinate with installation schedules. -

Incoterms (International Commercial Terms)

Incoterms are globally standardized rules defining buyer-seller responsibilities for delivery, insurance, customs clearance, and loss risk during international trade. Terms like FOB (Free on Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid) directly impact landed costs, logistics decisions, and risk management for cross-continental procurements. -

QA/QC (Quality Assurance/Quality Control)

QA/QC refers to the processes and documentation ensuring the ductwork conforms to technical and regulatory standards. Asking suppliers about their QA/QC practices and certifications (e.g., ISO 9001) is essential for risk mitigation, especially when purchasing from overseas manufacturers.

Awareness of these properties and terms empowers international buyers across Africa, South America, the Middle East, and Europe to confidently specify, source, and negotiate for the most suitable sheet metal ductwork—ensuring long-term system performance, regulatory compliance, and fundamentally stronger B2B supplier relationships.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the sheet metal ductwork Sector

Global Market Dynamics and B2B Sourcing Trends in Sheet Metal Ductwork

As commercial construction, urbanization, and climate-control demands intensify globally, sheet metal ductwork remains foundational to essential sectors—from HVAC and data centers to healthcare, agriculture, and logistics. Infrastructure expansion across Africa, rapid industrialization in South America, and green building mandates in the Middle East and Europe are collectively driving sustained demand. Coupled with greater project complexity and tighter efficiency targets, the sheet metal ductwork supply chain is experiencing significant transformation.

Key Market Drivers for International Buyers:

- Urbanization and Infrastructure Growth: Mega-projects in cities like Lagos, Nairobi, and São Paulo necessitate scalable, reliable HVAC and air management systems. Sheet metal ductwork is central to supporting new residential, commercial, and industrial developments.

- Technological Advancements: Adoption of automation (CNC cutting, automated bending) and digital procurement platforms streamlines custom fabrication, reduces lead times, and enables precise quality control. European and Middle Eastern buyers are increasingly leveraging digital twins and Building Information Modeling (BIM) integration for ductwork planning and specification.

- Customization and Compliance Demands: Buyers are prioritizing ductwork suppliers who can offer tailored solutions—such as antimicrobial coatings for healthcare, high-strength alloys for logistics, or advanced acoustical linings for commercial buildings—to meet both regulatory and performance standards.

- Supply Chain Shifts: Global disruptions and shifting trade policies have led to nearshoring and regional supplier diversification—especially in Europe and the Middle East, where reliability and delivery assurance are paramount.

- Cost Volatility: Fluctuations in metal prices, logistics rates, and energy costs impact total landed cost. Buyers are increasingly negotiating for longer-term contracts and price locks or seeking bundled services for fabrication, finishing, and installation.

Emerging Sourcing Trends:

- End-to-End Digitalization: Leading suppliers now offer online configurators, real-time quotes, and virtual product sampling, accelerating design-to-delivery cycles.

- Green Procurement: Value chains are responding to end-client and regulatory pressures for low-carbon materials and supply transparency (see sustainability section below).

- Focus on Supplier Vetting: Due diligence frameworks now include robust evaluation of supplier compliance (ISO, EN, ASTM), environmental track records, and data security—especially for cloud-based design collaboration.

For B2B buyers in fast-growing markets like Nigeria and Brazil, these dynamics underscore the importance of maintaining a flexible, technology-enabled sourcing strategy with a clear focus on supplier reliability, cost control, and regulatory alignment.

Sustainability and Ethical Supply Chains in Sheet Metal Ductwork

Heightened awareness of environmental impact and supply chain ethics has deeply reshaped sheet metal ductwork procurement. Both private and public sector buyers face growing pressure to deliver infrastructure upgrades and new builds with minimal environmental footprint and maximum transparency.

Environmental Considerations:

- Material Sourcing: Opting for ductwork made from recycled or recyclable metals (such as recycled galvanized steel or aluminum) can significantly reduce embodied carbon. Availability of Environmental Product Declarations (EPDs) for metal duct products enables buyers to assess lifecycle impact.

- Energy Efficiency: Modern ductwork systems are being designed to minimize air leakage, optimize airflow, and support high-efficiency HVAC operations—reducing energy consumption and operational emissions.

Ethical and Responsible Sourcing:

- Certifications and Standards: Buyers are prioritizing suppliers with recognized environmental and ethical certifications:

- ISO 14001: Environmental management systems.

- LEED/BREEAM Compliance: Ductwork that contributes to green building certification.

- ResponsibleSteel™ and Aluminum Stewardship Initiative: Certification ensuring that materials are responsibly sourced and produced.

- Transparency and Traceability: Digital tracking of raw materials, manufacturing, and distribution processes allows buyers to verify supplier claims and ensure chain-of-custody—critical in regions with heightened anti-corruption and sustainability regulations.

Actionable Steps for Buyers:

– Request documentation proving the use of certified low-carbon materials.

– Include sustainability and ethical sourcing clauses in procurement contracts.

– Evaluate supplier ESG disclosures and third-party audit results during vetting.

Embracing sustainability and ethical procurement not only enhances corporate reputation but increasingly acts as a qualifier (or disqualifier) in both public and private tenders, especially within the European Union and Gulf Cooperation Council (GCC).

A Brief Evolutionary Perspective on Sheet Metal Ductwork

The sheet metal ductwork industry has evolved from local, manual fabrication practices to a high-precision, globalized sector. In the early 20th century, most ductwork for ventilation and heating was handcrafted on-site, with quality and performance dependent largely on individual skills. The postwar construction boom saw rapid adoption of standardized, prefabricated duct systems—accelerating project timelines and ensuring greater consistency.

Today, innovations such as CNC profiling, robotic welding, and mass customization through modular design allow B2B buyers to access highly engineered ductwork solutions regardless of geography. The integration of digital design tools and advanced analytics supports lifecycle optimization—a critical factor as buildings become “smarter” and more efficient.

For international buyers, understanding these industry shifts is key to capitalizing on new opportunities and partnerships while minimizing risk in a fast-changing landscape.

Related Video: THINK GLOBAL CONFERENCE 2021 – The basics of international trade compliance

Frequently Asked Questions (FAQs) for B2B Buyers of sheet metal ductwork

-

How should I evaluate and vet international suppliers of sheet metal ductwork?

Begin by assessing the supplier’s experience, export track record, and key client references in your region. Request documentation of quality management systems, such as ISO 9001 certification, and inspect sample products for compliance with required material grades and standards (e.g., EN, ASTM, BS, or local codes). Prioritize suppliers offering transparent production processes and robust after-sales support. Conduct site audits—virtually or physically—when feasible, and review third-party audit reports or factory accreditations to minimize supply chain risk. -

What customization options are generally available, and what information will I need to provide?

Most reputable manufacturers can offer extensive customization, including specific dimensions, material types (galvanized steel, stainless, aluminum), thicknesses, shapes, flange options, and surface finishes. For optimal results, prepare detailed technical drawings or CAD files, along with specifications for tolerances, airflow requirements, and intended environments. Clearly communicating standards (such as SMACNA or DW144) and local regulatory needs will help avoid costly misunderstandings and rework. -

What are typical minimum order quantities (MOQs), lead times, and payment terms for international sheet metal ductwork orders?

MOQs can vary by supplier and depend on product complexity—smaller factories may accept 100–300 units, while larger manufacturers may require orders of 500 units or more. Standard lead times for production range from 2–6 weeks, plus international shipping (2–5 weeks, depending on region and mode). Payment terms typically include a 30–50% deposit with the balance due before shipment or upon receipt of shipping documents. For new buyers, letters of credit can provide additional transaction security. -

Which quality assurance (QA) checks and certifications should I require for ductwork sourced internationally?

Insist on thorough incoming, in-process, and final inspections, with documentation of material certificates, dimensional checks, and weld/finish quality. Essential certifications include ISO 9001 (quality management), and compliance to relevant product standards (e.g., EN 1505, SMACNA standards, or BS specifications). For projects with high safety or environmental demands, request test reports for fire resistance, corrosion protection, and hygiene. Independent third-party inspection prior to shipment safeguards your interests further. -

What are the main logistical considerations when importing sheet metal ductwork (shipping, packaging, and delivery)?

Carefully assess the packaging used—ductwork should be palletized, strapped, and, if necessary, wrapped or crated to protect coatings and prevent deformation during transit. Clarify Incoterms (e.g., FOB, CIF, DDP) and ensure you or your agent have visibility over freight, customs clearance, and last-mile delivery. Larger shipments benefit from consolidated containers to reduce damage risk. Consider working with freight forwarders experienced with oversized or irregular loads common to ductwork consignments. -

How do I handle product defects or disputes with an overseas supplier?

Ensure all contractual documents detail acceptance criteria, inspection protocols, and dispute resolution processes—including remedy timelines and responsibilities. If defects are discovered, document the issues thoroughly with photos and written reports immediately upon arrival and notify the supplier. Established suppliers often offer credit notes, replacements, or partial refunds. Leverage payment protection tools such as letters of credit or escrow services and consider appointing a local inspection agency pre-shipment to prevent costly disputes. -

Are there region-specific considerations (regulation, climate, infrastructure) I should be aware of?

Absolutely. For example, buyers in humid or coastal Africa and the Middle East should prioritize corrosion-resistant materials and coatings. European projects may need to comply with CE markings or local fire safety standards, while South American buyers should verify compatibility with regional building codes and installation practices. Always cross-check material grades and specifications against your country’s standards and consider local infrastructure limitations (such as narrow access or power supply) in your planning. -

Can I request samples or a factory visit before placing a large order, and is this recommended?

Requesting samples—physical or production-quality prototypes—is highly advisable to verify actual material quality, workmanship, and compliance with specifications before committing to bulk orders. Many reputable manufacturers accommodate this for a nominal fee or deduct sample costs from subsequent orders. Factory visits (virtual or in-person) offer deeper insight into a supplier’s production capacity, process control, and quality culture. Pre-order engagement builds trust and can streamline communication throughout the sourcing process.

Strategic Sourcing Conclusion and Outlook for sheet metal ductwork

Selecting the right sheet metal ductwork partners is now more strategic than ever for B2B buyers targeting reliable, cost-effective, and compliant project delivery. Carefully aligning your material choices—such as galvanized steel, aluminum, or stainless steel—with your application’s demands unlocks operational efficiencies and long-term value. Considerations around fabrication techniques, supplier certifications, and regional logistical realities are just as crucial, particularly navigating diverse markets in Africa, South America, the Middle East, and Europe.

Key B2B takeaways include:

– Prioritize suppliers offering traceable quality standards and proven delivery records.

– Balance cost with durability and environmental suitability (e.g., corrosion resistance for coastal or humid climates).

– Leverage advanced fabrication technologies for customization and reduced waste, ensuring precision while supporting sustainability targets.

– Stay alert to global supply chain trends, regulatory shifts, and new material innovations that can affect timelines and project specifications.

Strategic sourcing is not a one-time transaction but an ongoing partnership that keeps your business competitive amid evolving industry challenges and opportunities. By investing in robust supplier relationships and informed procurement strategies, B2B buyers across emerging and developed markets can safeguard project timelines, minimize risk, and access premium quality at scale.

Looking ahead, agility will remain vital. Sourcing leaders who proactively monitor market shifts, build diverse supplier networks, and champion innovation will be best positioned for sustained success. Now is the time to reconsider your sheet metal ductwork sourcing approach—act strategically, think globally, and secure your business future.