Introduction: Navigating the Global Market for cast iron vs

In today’s fast-evolving global supply landscape, cast iron stands as a critical material backbone for manufacturers, infrastructure developers, and OEMs across diverse sectors. From engine components driving South America’s automotive growth to pipeline systems supporting Africa’s expanding metropolises, the right cast iron selection directly shapes operational reliability, cost structures, and long-term business success. For international B2B buyers—especially those from regions like Kenya, Colombia, the Middle East, and Europe—the challenge isn’t merely acquiring cast iron parts, but mastering the intricacies of specification, sourcing, and supplier validation amid a marketplace defined by fluctuating standards, cost pressures, and logistical complexity.

The stakes are high: a poor match between material grade and application can cause premature failure and drive up maintenance costs, while inadequate supplier scrutiny risks compliance issues and costly delays. With cast iron’s many grades—gray, ductile, white, malleable, and specialized alloys—each offering unique performance characteristics, the procurement process becomes a high-stakes decision point influencing your product lifecycle and competitiveness.

This guide was meticulously developed for international buyers navigating “cast iron vs” solutions. It delivers actionable, sector-specific insights across all critical touchpoints, including:

– Cast iron types and their comparative advantages in real-world B2B applications

– Material composition and how to match grades to performance requirements

– Manufacturing technologies, quality assurance benchmarks, and inspection protocols

– Assessing and partnering with reputable suppliers across global and local markets

– Cost drivers, logistics, and current trends impacting global cast iron trade

– Common sourcing pitfalls, FAQs, and expert troubleshooting guidance

Armed with this comprehensive knowledge, buyers can confidently evaluate options, negotiate globally competitive deals, and build resilient supply chains. Whether your priorities are reducing total cost of ownership, ensuring product integrity, or securing consistent deliveries, this guide empowers you with the strategies and clarity needed to succeed in the international cast iron marketplace.

Understanding cast iron vs Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Gray Cast Iron | Flake graphite structure, excellent damping | Engine blocks, machinery bases, pipes | Low cost, easy machining; less ductile and lower impact strength |

| Ductile (Nodular) Iron | Spheroidal graphite inclusions, high ductility | Pressure pipes, gears, automotive components | Superior toughness, impact resistance; moderately higher price, process control |

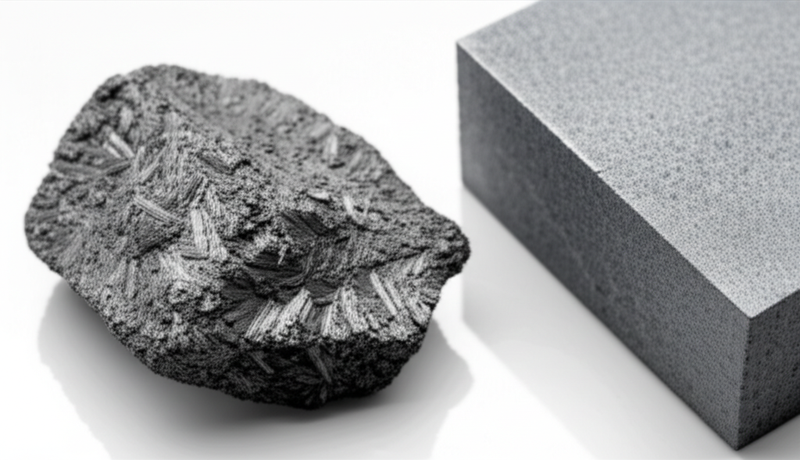

| White Cast Iron | Hard, carbide-rich, brittle, white fracture | Wear plates, mining equipment, shot blasting parts | Exceptional abrasion resistance; challenging to machine, very brittle |

| Malleable Iron | Heat-treated white iron, shaped graphite | Pipe fittings, brackets, hand tools | Good ductility, machinability; longer lead times due to heat treatment |

| Alloyed Cast Iron | Enhanced with Ni, Cr, Mo for specific properties | Pumps, high-temp components, chemical equipment | Customizable performance; highest cost, limited supplier base |

Gray Cast Iron

Gray cast iron is defined by its flake graphite microstructure, which delivers excellent vibration damping and makes it highly machinable. These attributes suit gray iron for static parts such as machinery bases, engine blocks, and piping—ideal for sectors prioritizing cost control and reliable, abundant supply. For B2B buyers in emerging and established markets alike, gray iron offers low upfront costs and broad availability; however, it is more brittle than other iron types and should be reserved for applications that are not subject to high impact or tensile stresses.

Ductile (Nodular) Iron

Ductile iron, also called nodular or spheroidal graphite iron, is produced by adding magnesium to molten iron, resulting in graphite spheroids within the microstructure. This transformation yields high tensile strength, ductility, and improved shock absorption—key for demanding uses such as automotive gears, pressure pipes, and load-bearing components. B2B buyers benefit from its versatility and performance in dynamic environments but should ensure suppliers maintain strict metallurgical processes and certifications to achieve consistent properties, especially for mission-critical applications.

White Cast Iron

White cast iron is distinguished by its iron carbide network, producing a hard, abrasive-resistant material with a bright, white fracture. Its primary value lies in high-wear applications—mining wear plates, mill liners, and shot-blasting equipment—where longevity outweighs the risks of brittleness. For procurement teams, white iron’s virtually non-machinable nature mandates ordering finished-to-spec parts and working with suppliers who can guarantee casting precision to avoid costly rework or part failure.

Malleable Iron

Malleable iron is created by heat-treating white cast iron, which transforms the brittle carbide microstructure into clusters of tempered graphite. This process imparts both strength and flexibility, making it suitable for small, impact-prone items such as pipe fittings, fasteners, and brackets. B2B buyers should account for the longer production cycles required for annealing and prioritize suppliers with expertise in heat treatment and mechanical testing to ensure reliable product quality and timely deliveries.

Alloyed Cast Iron

Alloyed cast irons integrate elements like nickel, chromium, and molybdenum to impart enhanced resistance to wear, heat, or corrosion—vital for aggressive chemical and high-temperature environments. These specialized grades find critical roles in pump bodies, furnace internals, and chemical process equipment. While offering tailored durability and service life, they come with a higher price tag and often require strategic sourcing partnerships with suppliers experienced in complex alloy formulations and rigorous quality assurance, particularly for multinational buyers seeking dependable, application-specific solutions.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of cast iron vs

| Industry/Sector | Specific Application of cast iron vs | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Municipal Infrastructure | Water and sewage piping, manhole covers | Durability, cost-efficiency, corrosion resistance | Compliance with local standards, anti-corrosion coatings, delivery lead time |

| Automotive & Transport | Engine blocks, brake components | High thermal stability, vibration damping, machinability | Metallurgical certification, dimensional accuracy, supply consistency |

| Energy & Mining | Pump housings, wear liners, heavy-duty valves | Exceptional wear resistance, longevity in abrasive conditions | Selection of suitable iron grade, finished tolerances, reliable logistics |

| Construction & Agriculture | Machinery frames, pipe fittings, tractors | Structural integrity, adaptability for various climates | Supplier’s quality controls, tailored casting capabilities, after-sales support |

| Industrial Equipment | Machine tool bases, compressors | Vibration dampening, stable precision, long service life | Accurate machining, inspection protocols, batch traceability |

Municipal Infrastructure

Cast iron is a foundational material in municipal piping networks, including water supply, drainage, and sewage systems. Its combination of corrosion resistance and structural strength is especially valuable in infrastructure spanning diverse climates, from humid African cities to arid Middle Eastern towns. B2B buyers must ensure cast iron meets local and international standards (such as ISO, DIN, or ASTM), as well as utility-specific requirements for jointing and lining. Timely logistics and robust anti-corrosion treatments are essential to ensure long-term performance and cost-effectiveness.

Automotive & Transport

In automotive and transport manufacturing, cast iron is the material of choice for critical engine components, such as engine blocks, heads, and brake drums. The high thermal conductivity and vibration dampening properties of gray and ductile iron enhance engine efficiency and lifespan. International buyers—especially in growth markets like Colombia or Kenya—must prioritize suppliers with proven metallurgical quality, strict process control, and the flexibility to scale production based on fluctuating market demands. Certifications and repeatable tight tolerances are non-negotiable for safety and regulatory compliance.

Energy & Mining

Casting solutions for the energy and mining sectors must withstand erosive and corrosive environments. Applications like pump housings, valve bodies, and wear-resistant liners benefit from both white and alloyed cast irons’ superior hardness and wear resistance. Proper material selection extends service life, lowering downtime and replacement rates—critical in remote operations or high-capex mining projects in Africa or South America. Buyers need access to manufacturers able to customize grades and geometries, while ensuring timely delivery and traceable quality documentation.

Construction & Agriculture

Machinery frames, pipe fittings, and tractor components require cast iron for its robustness and adaptability to extreme use in the field. This is particularly relevant for agricultural exporters and construction contractors dealing with tough terrains in rural Europe or dynamic growing regions in South America. B2B buyers should assess suppliers for their ability to customize fittings, ensure consistent mechanical properties, and provide swift after-sales support, which can be vital in rural or remote areas.

Industrial Equipment

For industrial machinery such as compressors and machine tool bases, cast iron’s vibration-dampening characteristics ensure stable, high-precision operations. This directly impacts product consistency and tool longevity for OEMs and equipment service providers. International buyers must work with partners excelling in finishing processes and inspection regimes, guaranteeing that each batch meets precise specifications. Batch traceability and conformance reports are valuable to mitigate supply chain and operational risks.

Related Video: Cast Iron vs Cast Steel

Strategic Material Selection Guide for cast iron vs

Comparative Analysis of Cast Iron, Carbon Steel, Stainless Steel, and Bronze

Selecting the optimum material for industrial castings, valve bodies, fittings, or mechanical components often boils down to determining the balance of cost, durability, processibility, and application-specific properties. Here is a deep-dive comparison of cast iron versus carbon steel, stainless steel, and bronze—materials frequently considered in global B2B procurement scenarios.

1. Cast Iron

Key Properties:

Cast iron’s most distinguishing features include high castability, excellent machinability (especially gray iron), vibration damping, and good compressive strength. Variants like ductile iron offer improved tensile strength and impact resistance; white iron is notable for extreme wear resistance but is brittle. Typical maximum temperature ratings are moderate (up to ~500°C), with fair corrosion resistance unless alloyed.

Pros:

– Cost-effective for large-volume casting

– Superior damping and dimensional stability

– Good wear resistance in select variants

– Broad global availability, common compliance standards (ASTM A48, EN 1561)

Cons:

– Brittle under shock or tension (especially gray/white irons)

– Limited ductility

– Weaker corrosion resistance versus stainless steel or bronze

– Dimensional control can be challenging in thinner or intricate geometries

International B2B Considerations:

– Cast iron foundries with ISO 9001, ASTM, or DIN certification are common in Europe, India, China, and emerging in Africa and South America

– Ensure familiarity with water, waste, energy, and municipal standards (EN for Europe, ASTM for Americas)

– Logistics for heavy components can be costlier for landlocked regions

– Quality control and sample validation are essential due to variable metallurgy

2. Carbon Steel (e.g., ASTM A216 WCB)

Key Properties:

Carbon steel delivers higher tensile strength, impact resistance, and ductility than most cast irons, with generally good pressure ratings and operational temperatures similar to cast iron. However, it is more susceptible to rust and corrosion unless externally coated or alloyed.

Pros:

– High strength-to-weight ratio

– Reliable under high pressure or mechanical loads

– Well-established standards (ASTM, JIS, DIN)

Cons:

– Prone to corrosion unless properly protected

– Machinability is generally lower than gray cast iron

– Weldability can be limited in higher-carbon grades

Impact on Application:

Widely used for critical piping, pressure vessels, structural and valve bodies requiring robust strength. Not suitable for corrosive media without internal/external protections.

International Buyer Notes:

– Compliance with local pressure vessel and pipeline standards is critical

– North American buyers favor ASTM, EU prefers EN, while regions like Colombia or Kenya often accept both

– Sourcing may face cost variability tied to global steel prices

3. Stainless Steel

Key Properties:

Stainless steel’s hallmark is its excellent corrosion and chemical resistance, particularly in chloride or acidic environments. It maintains mechanical integrity at high (up to 800°C, depending on grade) and low temperatures and displays good ductility.

Pros:

– Superior resistance to corrosion and scaling

– Long service life, even with aggressive media

– Suitable for sanitary, food, chemical, and marine applications

– Wide range of grades and standards (ASTM A351, DIN EN 10088)

Cons:

– High material and manufacturing cost

– More challenging to machine and cast than cast iron

– Heavier and potentially slower delivery due to limited foundry specialization, especially in emerging markets

Implications for B2B Buyers:

– Ideal where regulatory compliance for corrosion (e.g., drinking water, food processing) is strict

– Ensure local availability of preferred grades (304, 316, duplex, etc.)

– Evaluate end-to-end supply chain for consistent quality, especially in regions with sparse advanced alloy foundries

4. Bronze

Key Properties:

Bronze, a copper-tin alloy, is valued for its outstanding corrosion resistance (especially to seawater and wastewater), excellent machinability, and naturally low friction properties. It handles moderate mechanical and pressure loads with good wear resistance.

Pros:

– Excellent for marine and waterworks applications

– Self-lubricating, ideal for bearings and bushings

– Stable pricing in mature copper markets

– Recognized global standards (ASTM B62, EN 1982)

Cons:

– Significantly higher cost versus cast iron or carbon steel

– Mechanical strength is lower—less suitable for high-pressure or highly loaded environments

– Sensitive to theft/loss due to copper value

Global Buyer Considerations:

– Common in Europe and Middle East for water and sanitation infrastructure

– Niche suppliers in Africa/South America may require importation, impacting lead times

– Verify compliance with potable water and safety standards (WRAS, NSF in Europe/Africa, ANSI/NSF in Americas)

Material Selection Summary Table

| Material | Typical Use Case for cast iron vs | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Cast Iron | Municipal valves, engine blocks, machinery bases | Affordable, excellent castability, good vibration damping | Brittle, limited ductility, moderate corrosion resistance | Low |

| Carbon Steel (e.g., A216 WCB) | Valve bodies, structural parts, piping | Higher strength, robust under pressure | Susceptible to corrosion if unprotected | Low-Med |

| Stainless Steel | Food processing, marine, and chemical equipment | Superior corrosion and chemical resistance | Expensive, complex manufacturing, slower lead times | High |

| Bronze | Marine components, waterworks fittings, bushings | Outstanding corrosion resistance (especially seawater), self-lubricating | Lower mechanical strength, higher theft risk, costlier | High |

In-depth Look: Manufacturing Processes and Quality Assurance for cast iron vs

Cast iron’s continued dominance in global infrastructure and manufacturing owes much to its flexible production processes and ever-evolving quality assurance methodologies. For international B2B buyers, especially those operating in Africa, South America, the Middle East, and Europe, understanding manufacturing and QC processes is essential for securing reliable cast iron components that meet both technical specifications and regulatory expectations. Below, we detail the end-to-end manufacturing stages, critical quality assurance checkpoints, and actionable methods to ensure robust quality compliance throughout the procurement lifecycle.

Key Stages in Cast Iron Manufacturing

A thorough grasp of the cast iron production pipeline not only enhances supplier selection but also positions buyers to anticipate lead times, potential risks, and value-added opportunities.

1. Material Preparation and Alloy Selection

- Raw Material Sourcing

- Core inputs include pig iron (predominantly 70–80%), supplemented by scrap iron, steel (10–20%), and carefully proportioned alloying elements (carbon, silicon, and sometimes nickel, chromium, or molybdenum for alloyed grades).

-

Reliable suppliers maintain rigorous incoming material checks to validate elemental composition and screen for contaminants, a key determinant of consistent casting quality.

-

Alloy Customization

- Depending on end-use—such as gray iron for vibration damping, ductile iron for impact resistance, or white iron for wear applications—suppliers regulate alloy content. This step is increasingly critical for B2B buyers requiring application-specific mechanical properties.

2. Melting and Composition Control

- Melting Technologies

- Three main furnace types are commonly used:

- Cupola Furnaces for high-volume, cost-sensitive production

- Induction Furnaces where compositional precision and environmental controls are priorities

- Rotary Furnaces for specialized, uniform heating requirements

- During melting, real-time spectroscopy and other metallurgical testing ensure target chemical composition and reduce off-spec batches.

3. Forming and Molding

- Mold Design

- Molds may be sand-based (most common), resin-bonded, or metal—the choice impacts surface finish, dimensional accuracy, and cost.

-

Complex or mission-critical castings may utilize digital simulations for mold filling and solidification analysis, minimizing porosity, inclusions, or misruns.

-

Pouring and Solidification

- Controlled pouring temperature and mold pre-conditioning are vital to prevent cold shuts and ensure uniform grain structure.

4. Cooling and Extraction

- Natural vs. Forced Cooling

- The rate of cooling impacts microstructure. For ductile and malleable iron, precise cooling profiles are enforced to achieve required nodularity or malleability.

- Automation in mold handling and extraction minimizes labor variation and production delays.

5. Cleaning, Fettling, and Finishing

- De-gating and Sand Removal

- Once solidified and extracted, castings undergo mechanical or manual cleaning to remove runners, gates, and residual mold material.

- Additional Processing

- Grinding, shot blasting, machining, and often heat treatment (for malleable or alloyed cast irons) finalize the component. The extent of these processes is typically determined by the buyer’s technical drawing or international standard.

Industry-Leading Quality Assurance Practices

Maintaining, and verifying, cast iron quality requires a layered approach—balancing global standards, local regulations, and buyer-specific benchmarks.

International and Industry Standards

- Global Certifications

- ISO 9001: Universal for quality management systems, ensuring consistent production and complaint handling.

- ISO 14001: Increasingly important for environmental compliance, particularly in Europe and markets with sustainability mandates.

- Sector-Specific Compliance

- CE Marking (Europe): For products entering the EU, particularly where safety or pressure containment is involved.

- API (American Petroleum Institute): Predominant in oil/gas sector equipment.

- EN, ASTM, GOST: Material and test standardization as required by geography or project.

Quality Control Checkpoints

- Incoming Quality Control (IQC)

- Inspection and chemical testing of all incoming raw materials and additives.

-

Traceability systems to link batches from furnace to final product—a critical factor for minimizing recalls and liability.

-

In-Process Quality Control (IPQC)

- Continuous monitoring during melting (spectrometry), molding, pouring, and cooling.

-

Visual and mechanical inspection for surface defects, dimensional accuracy, and microstructure (metallographic analysis).

-

Final Quality Control (FQC)

- Finished products subjected to non-destructive testing (NDT) techniques: ultrasonic, radiographic (X-ray), and magnetic particle inspections.

- Mechanical property tests include hardness (Brinell, Rockwell), tensile strength, and impact resistance.

- Pressure/leak tests for piping or pressure-rated components.

Post-Production: Packaging and Logistics

- Secure, materials-compatible packaging is critical to prevent corrosion, chipping, or non-conformity during international transit. Clear marking and robust documentation (including batch numbers and test certificates) help streamline customs clearance and traceability upon delivery.

Ensuring Supplier Quality: Due Diligence for Global Buyers

International B2B buyers, particularly those operating in diverse markets (e.g., Kenya, Colombia, Saudi Arabia, Turkey, Poland), face nuanced challenges due to variations in infrastructure, regulations, and supply chain risks. Below are actionable strategies to mitigate quality and compliance risks:

1. Supplier Pre-qualification and Audits

- On-site Audits

- Schedule pre-contract audits to inspect manufacturing capabilities, certifications, and quality system implementation. In-person visits are invaluable, but virtual/third-party audits can serve as an alternative.

- Assessment Criteria

- Verify up-to-date ISO and sectoral certifications.

- Evaluate laboratory and testing equipment (spectrometers, CMMs, NDT facilities).

- Review production records, previous inspection reports, and scrap/rework rates.

2. Third-Party Inspection and Testing

- Independent Inspection Agencies

- Use internationally recognized agencies (SGS, Bureau Veritas, TÜV) for pre-shipment inspection and random batch testing, especially when entering unfamiliar or high-consequence markets.

- Sample Retention and Witness Testing

- Request pre-production samples or first-article inspections, with results shared through comprehensive reports.

3. Traceable Documentation

- Require full traceability:

- Mill test certificates (MTCs) detailing chemical and mechanical properties

- Dimensional and weight reports

- NDT and pressure test certificates (where relevant)

- Declaration of conformity for standardized grades (EN, ASTM, ISO, or local equivalents)

4. Adapting to Regional Nuances

- Africa & South America

- Infrastructure can affect logistics and handling; prioritize suppliers experienced with export procedures (incoterms, packaging, documentation) for your target port.

- Collaborate with partners who understand local regulatory requirements—for example, SONCAP (Nigeria), INVIMA (Colombia) for sector-specific castings.

- Middle East & Europe

- Ensure alignment with market-specific standards (BS, DIN for Europe; SASO in Saudi Arabia).

- For public projects, check for additional governmental or tender-driven requirements (traceability, local certification marks).

Practical Recommendations for B2B Buyers

- Insist on Full Supply Chain Transparency: Choose manufacturers who provide batch traceability from raw material to finished product.

- Define Acceptance Criteria Upfront: Clearly specify material grades, inspection methods, and allowable tolerances in RFQs and purchase orders.

- Engage in Collaborative Quality Planning: Involve your supplier’s technical team in discussing critical control points and potential cost-saving opportunities without compromising compliance.

- Prioritize Proactive Communication: Maintain open channels—for example, joint quality review calls and timely sharing of quality reports—to resolve issues early and ensure mutual understanding across time zones and languages.

- Leverage Technical Partnerships: Suppliers who offer technical support during product development and troubleshooting often deliver higher long-term value and fewer costly failures in the field.

With robust knowledge of the cast iron manufacturing process and a codes-based, audit-driven approach to quality assurance, international B2B buyers can source competitively, reduce operational risks, and deliver reliable products to their markets—regardless of geography or industry sector.

Related Video: How Things Are Made | An Animated Introduction to Manufacturing Processes

Comprehensive Cost and Pricing Analysis for cast iron vs Sourcing

Key Cost Components in Cast Iron Sourcing

When evaluating the cost structure of cast iron sourcing, international B2B buyers must consider several interrelated components:

- Raw Materials: The majority of cast iron’s cost derives from pig iron, scrap steel, and alloying elements (such as silicon, nickel, or chromium, for specialty grades). Price fluctuations in global iron ore and scrap markets can have a significant impact, especially in import-reliant regions like Africa and South America.

- Labor: Labor costs vary by sourcing region. Countries with advanced foundry automation in Europe may have higher direct labor costs but yield consistent quality, while emerging markets may offer lower labor costs, albeit with careful attention to skill levels and training.

- Manufacturing Overheads: Facility maintenance, energy costs (notably high in melting and molding operations), and environmental compliance fees all contribute to overhead. Energy-efficient processes (e.g., induction furnaces) can moderate long-term costs.

- Tooling and Pattern Costs: Initial setup for custom or complex castings may require investment in molds or patterns. This one-time cost is amortized over production volume, making large orders more cost-effective.

- Quality Control and Certification: Rigorous inspection, testing (mechanical, chemical), and compliance with international standards (ISO, ASTM, EN) add layers of assurance but also increase the unit cost.

- Logistics and Packaging: Transportation—especially cross-continental—can account for a notable share of total cost. Freight rates, insurance, and appropriate packaging (to prevent corrosion or breakage) are essential cost factors, particularly for buyers in remote or landlocked regions.

- Supplier Margin: Each supplier builds in a margin to cover risk, currency fluctuation, and profit. Understanding typical markups in your chosen sourcing region aids in more effective negotiation.

Major Price Influencers to Consider

B2B cast iron prices are seldom one-size-fits-all. Key influencing factors include:

- Volume and Minimum Order Quantities (MOQ): Higher quantities almost always secure more favorable unit pricing due to economies of scale and amortization of setup costs. Buyers from smaller markets (e.g., Kenya, Colombia) may face higher per-unit prices if consolidation is not possible.

- Product Specifications and Customization: Non-standard shapes, tighter tolerances, specialized alloys, or extra machining increase material consumption, tooling complexity, and scrap rates. Custom certifications or testing also add incremental cost.

- Material Grade and Alloy Content: Premium or alloyed cast irons (with nickel, chromium, etc.) for demanding applications will carry higher raw material costs compared to standard gray or ductile iron.

- Quality Requirements and Certifications: Demands for third-party inspection, compliance with stringent international standards, or advanced NDT (non-destructive testing) reflect directly on pricing.

- Supplier Factors: The foundry’s scale, location, technology adoption, expertise, and reputation influence baseline pricing and reliability.

- Incoterms and Delivery Terms: FOB, CIF, DDP, and other delivery arrangements determine whether shipping, insurance, tariffs, and customs handling fall on the buyer or seller, affecting landed costs.

Actionable Tips for International B2B Buyers

- Benchmark Total Cost of Ownership: Don’t focus solely on ex-factory price. Account for tooling amortization, logistics to your region, import duties, local taxes, and costs related to quality control, delays, or product failures.

- Negotiate Based on Volume and Commitment: Push for price concessions with higher-volume orders or long-term agreements. If you can aggregate orders across branches or partner with others in your region, leverage this for bulk pricing.

- Scrutinize Supplier Capabilities: Visit or audit suppliers when possible. Assess furnace technology, process control, quality assurance, and export track record—especially for compliant and timely deliveries into Africa, South America, or the Middle East.

- Clarify All Specs Upfront: Provide detailed drawings, tolerances, and performance expectations at the RFQ stage to avoid scope creep and post-order surcharges.

- Understand and Confirm Incoterms: Factor in who bears shipping and insurance responsibilities. In regions with infrastructure or customs bottlenecks, CIF or DDP may provide more cost predictability, albeit at a slightly higher upfront price.

- Monitor Raw Material Indexes: For market-driven contracts, tie pricing to well-known iron/steel commodity indices to share risk and gain pricing transparency.

Regional Pricing Nuances

- Africa & South America: Expect higher landed costs due to logistics, customs, and sometimes lack of direct supplier presence. Identify consolidation options to optimize shipping and reduce per-unit costs.

- Middle East: Infrastructure favors large projects and high-volume procurement. Use tendering processes and leverage region-specific trade agreements.

- Europe: Stringent regulations ensure quality but increase compliance costs. However, shorter lead times and established logistics networks can offset some price premiums for European buyers.

Indicative Pricing Disclaimer: Cast iron prices fluctuate based on market volatility, regional logistics, and supplier-specific factors. All numbers or pricing ranges provided in this guide should be treated as estimates. Engage suppliers directly for formal, binding quotations tailored to your precise requirements and delivery terms.

Spotlight on Potential cast iron vs Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘cast iron vs’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Cast Iron Foundry: A Review of Global Cast Iron Foundries (dawangmetals.com)

As a globally recognized cast iron foundry, Dawang Metals stands at the forefront of industry innovation by leveraging advanced automation and industrial intelligence in their manufacturing operations. Their focus on fully automatic production lines enables high-volume, consistent fabrication of a wide range of cast iron grades—including custom-engineered solutions tailored to diverse application needs. Their facilities emphasize precision engineering and robust quality management, reportedly meeting strict international standards, though details on specific certifications may be limited publicly. Dawang Metals caters to an international clientele, including buyers from Africa, South America, the Middle East, and Europe, ensuring supply chain reliability and responsive logistics. Their adoption of cutting-edge production technology positions them as a strong partner for B2B buyers seeking scalable capacity, modern casting techniques, and competitive pricing in the “cast iron vs” sector.

Highlighting 25 Superior Iron Casting Organizations (www.inven.ai)

Highlighting 25 Superior Iron Casting Organizations showcases leading global manufacturers in the dynamic cast iron sector, known for supplying a diverse range of high-performance components across automotive, construction, and heavy industry. These firms leverage advanced casting technologies and automated processes to deliver custom iron solutions that meet stringent strength, durability, and dimensional accuracy requirements. Catering to international B2B buyers, they demonstrate robust export capabilities and market reach across Africa, South America, the Middle East, and Europe, often aligning with recognized global quality standards. With continuous investments in innovation and sustainability—such as energy-efficient foundries and modern patternmaking—these companies are positioned as trusted partners for complex, large-volume, and customized cast iron sourcing initiatives.

The 15 Best Cast Iron Brands, Ranked (www.tastingtable.com)

Lancaster Cast Iron, featured prominently among the industry’s best by “The 15 Best Cast Iron Brands, Ranked,” focuses on premium, small-batch cast iron cookware. Based in Pennsylvania, the company is recognized for its handcrafted, Amish-made skillets, emphasizing both traditional manufacturing techniques and exceptional material quality. The lineup includes 10.5-inch and 11.6-inch skillets—ideal for culinary professionals, hospitality suppliers, and specialty retail distributors seeking authentic, durable cookware suited for global markets.

Key strengths include artisanal production with strict quality oversight, delivering products that balance weight, heat retention, and classic design. While detailed certifications or industrial-scale manufacturing capabilities are not publicized, Lancaster’s reputation for craftsmanship distinguishes it for buyers targeting premium kitchenware segments. International resellers, particularly those catering to the upscale culinary or boutique retail sectors in Africa, South America, the Middle East, and Europe, can leverage Lancaster’s strong brand positioning and consumer appeal as a mark of quality and tradition.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Cast Iron Foundry: A Review of Global Cast Iron Foundries | Automated, global supplier; modern casting capabilities | dawangmetals.com |

| Highlighting 25 Superior Iron Casting Organizations | Global leaders, advanced tech, export-ready castings | www.inven.ai |

| The 15 Best Cast Iron Brands, Ranked | Premium artisanal kitchen cast iron cookware | www.tastingtable.com |

Essential Technical Properties and Trade Terminology for cast iron vs

Key Technical Specifications in the Cast Iron Trade

When sourcing or comparing cast iron products internationally, B2B buyers should focus on a core set of technical properties to ensure product suitability for their application, minimize procurement risks, and drive better supplier negotiations. The following specifications are especially important for buyers in Africa, South America, the Middle East, and Europe seeking to optimize both value and long-term reliability.

1. Material Grade

Material grade refers to the precise alloy composition and classification (e.g., Gray Iron ASTM A48 Class 35, or Ductile Iron EN-GJS-400-15). Each grade is tailored for specific mechanical characteristics—such as tensile strength, ductility, and hardness—which directly impact the component’s performance. For B2B buyers, demanding the correct grade is essential to meet application standards and regulatory requirements, and to ensure interchangeability or warranty compliance across markets.

2. Mechanical Properties (Tensile Strength, Hardness, Ductility)

Mechanical properties define how the cast iron will behave under load and in service.

– Tensile Strength: Indicates resistance to pulling forces; higher values are preferable for load-bearing or dynamic parts.

– Hardness: Measures resistance to wear and abrasion; critical for parts exposed to friction or impact.

– Ductility: The ability to deform without breaking; essential for applications subject to vibration or shock.

Clear documentation and independent testing of these properties help buyers prevent premature failures and costly warranty claims.

3. Dimensional Tolerance

Tolerance specifies allowable deviation in the cast part’s dimensions from the nominal design. Tight tolerances ensure compatibility with other components, reduce rework costs, and streamline assembly. Buyers operating in markets with advanced manufacturing or strict product regulations should always clarify tolerance requirements upfront with suppliers to avoid disputes or supply chain delays.

4. Surface Finish Quality

The surface finish affects fit, assembly, corrosion resistance, and appearance. A superior finish is often achieved through post-casting processes like grinding or machining. Accurately specifying finish requirements is important for parts that need leak-tightness (e.g., valve bodies) or smooth mating surfaces (e.g., hydraulic equipment), directly impacting final product quality.

5. Heat Treatment Status

Some cast irons (notably malleable and alloyed types) may undergo post-casting heat treatment to adjust their microstructure for targeted performance—such as improving ductility or fatigue resistance. Buyers need to confirm whether heat treatment is included, as this can influence lead times, costs, and mechanical properties.

6. Certification and Compliance Standards

Specifications should reference globally recognized standards such as ASTM, EN, ISO, or country-specific certifications. Insisting on certified products assures consistent quality, legal compliance, and easier cross-border trade, which is especially valuable in regulated sectors or export-oriented projects.

Common B2B Trade Terminology in Cast Iron Procurement

A clear understanding of industry-specific jargon is essential for smooth, confident negotiations and effective supplier management. Below are key terms B2B buyers regularly encounter:

-

OEM (Original Equipment Manufacturer):

The company that originally designs and manufactures a product, as opposed to aftermarket or third-party suppliers. For cast iron, dealing with OEMs can ensure access to proprietary engineering and superior technical support. -

MOQ (Minimum Order Quantity):

The smallest batch a supplier is willing to produce or ship. Knowing the MOQ is crucial for managing inventory, optimizing shipping costs, and evaluating supplier flexibility—especially important for buyers in emerging markets or running low-volume projects. -

RFQ (Request For Quotation):

A formal inquiry sent to suppliers soliciting prices, lead times, and technical details for specified products. A well-prepared RFQ outlines grades, tolerances, standards, and desired delivery terms, accelerating the quote process and reducing miscommunication. -

Incoterms (International Commercial Terms):

Globally standardized rules (such as FOB, CIF, DDP) that define buyers’ and sellers’ responsibilities for shipping, insurance, customs clearance, and risk transfer. Understanding Incoterms helps buyers compare offers accurately and manage landed costs in cross-border trade. -

Casting Method:

Refers to the process used to manufacture the part, such as sand casting, lost foam casting, or centrifugal casting. Each method offers different cost, finish, and dimensional accuracy trade-offs. Buyers should specify or ask about casting method to suit the application’s technical and economic requirements. -

Lead Time:

The total time from order placement to delivery. Accurate lead time assessments allow buyers to coordinate production, manage project schedules, and respond to demand shifts—critical when importing across continents or dealing with time-sensitive infrastructure projects.

By mastering these technical properties and trade terms, international B2B buyers can greatly enhance their sourcing strategies, avoid costly misunderstandings, and ensure they receive the most suitable cast iron products for their unique market needs and applications.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the cast iron vs Sector

Global Market Landscape and Strategic Sourcing Trends

The global cast iron sector continues to play a vital role across industries such as automotive, construction, utilities, and manufacturing, driven by its cost efficiency, durability, and versatile application profiles. In 2024, international B2B buyers—especially those in Africa, South America, the Middle East, and Europe—are navigating a mix of opportunities and challenges shaped by shifts in raw material supply, cost volatility, and emerging technological advancements. For markets like Kenya or Colombia, recent infrastructure investments and increased industrialization have spurred demand for cast iron components, making local sourcing strategies and regional partnerships increasingly critical.

Key trends shaping the cast iron procurement landscape include:

- Regionalization of Supply Chains: Amid ongoing disruptions and geopolitical uncertainty, buyers are prioritizing suppliers with flexible logistics, local presence, or diversified sourcing footprints, particularly in regions affected by fluctuating freight rates and port congestion.

- Digital Procurement Platforms: The adoption of digital sourcing tools and B2B marketplaces is accelerating, enabling buyers to benchmark prices, verify certifications, and access supplier performance data in real time. This shift benefits buyers across emerging and developed economies by increasing transparency and improving risk management.

- Specialization and Customization: With the evolution of end-use requirements—such as higher strength components for electric vehicles or corrosion-resistant alloys for water infrastructure—OEMs are seeking more specialized, custom-cast solutions. Supplier selection now heavily weighs on technical collaboration capabilities and flexible production lines.

- Compliance and Quality Control: Stringent standards for pressure castings, environmental compliance, and performance durability are influencing procurement decisions, urging buyers to request detailed certification (e.g., ISO 9001, EN 1563) and enhanced quality traceability across the supplier network.

- Sustainability and Circularity Demands: More buyers are factoring in recycled content, waste minimization processes, and supplier adherence to ‘green’ certifications as procurement essentials, not mere differentiators.

Proactive buyers leverage these trends by conducting thorough due diligence, maintaining robust supplier audits, and investing in long-term partnerships with manufacturers committed to innovation and sustainability. Adaptability, data-driven decision making, and cross-regional relationship-building remain fundamental to maintaining supply resilience and cost optimization.

Sustainability and Ethical Sourcing Imperatives in Cast Iron Procurement

Sustainability has evolved from a regulatory checkbox to a core procurement priority for B2B buyers worldwide. Cast iron production is energy intensive and involves significant environmental considerations, from CO₂ emissions in smelting processes to the responsible management of foundry waste and scrap. Forward-thinking buyers are increasingly aligning sourcing strategies with broader environmental, social, and governance (ESG) mandates.

Best practices and actionable considerations for buyers:

- Material Traceability: Ensure your suppliers source pig iron, scrap, and alloying elements from mines and recyclers that adhere to international standards for labor practices and environmental stewardship.

- Recycled Content Utilization: Increasing the proportion of recycled scrap in cast iron production slashes energy usage and carbon footprint. Many leading foundries now market products with guaranteed recycled content—query your suppliers for this data during RFQ (request for quotation) processes.

- Green Certifications: Prioritize manufacturers certified under environmental management systems such as ISO 14001, or participating in circular economy initiatives. For export markets in the EU, compliance with REACH, RoHS, or specific eco-labels may be mandatory.

- Process Innovation: Support suppliers investing in energy-efficient furnaces (such as electric induction), waste heat recovery, and advanced dust/slag collection systems—which reduce resource usage and emissions—benefiting both the environment and your corporate social responsibility objectives.

- Ethical Supply Chains: Work with partners who conduct regular social compliance audits, from upstream mining operations to local foundry labor standards, to guard against unethical practices, such as unfair wages or unsafe working conditions.

- Sustainable Logistics: Consider suppliers with optimized, low-emission logistics solutions, especially for intercontinental shipping routes common to Africa, South America, and the Middle East.

Embedding these sustainability criteria into procurement policy not only ensures regulatory compliance but also acts as a differentiator in tenders, strengthens brand reputation, and meets growing end-customer expectations globally.

A Brief Evolution: Cast Iron’s B2B Journey

Cast iron’s industrial journey spans over two thousand years, from its early use in ancient weaponry and tools to its pivotal role in the modern age of mechanization. The Industrial Revolution transformed cast iron into a strategic material, underpinning bridges, machinery, railways, and municipal infrastructure across Europe and beyond. During the twentieth century, advancements in alloying, molding, and quality control technologies extended its applicability to automotive, energy, and heavy machinery sectors.

Today, cast iron remains a foundational component of global infrastructure and manufacturing. Its enduring appeal stems from continuous innovations—ranging from precision casting techniques to the adoption of waste-reducing, energy-efficient processes—ensuring it evolves in step with the world’s changing industrial and sustainability demands. For B2B buyers, this legacy translates into a mature, globally interconnected supply base equipped to meet both classic and emerging technical requirements.

Related Video: What Is The Future Of The Mortgage-Backed Securities Market? – Learn About Economics

Frequently Asked Questions (FAQs) for B2B Buyers of cast iron vs

-

How can B2B buyers effectively vet international cast iron suppliers for reliability and quality?

Begin by requesting detailed company profiles, references, and case studies of previous exports, especially to markets similar to yours. Insist on reviewing relevant certifications such as ISO 9001 or industry-specific marks. Perform virtual or in-person factory audits and ask for third-party inspection reports on recent shipments. Shortlist suppliers with transparent supply chains, traceable raw material sourcing, and demonstrable experience in your sector. For added assurance, consider small trial orders and assess responsiveness, documentation, and after-sales support before entering into larger contracts. -

What level of customization is typical when sourcing cast iron products, and how should international buyers specify requirements?

Most manufacturers offer a range of customization including alloy composition, part geometry, surface finish, and packaging. To ensure precise outcomes, provide detailed technical drawings (ideally in internationally recognized formats), material grade specifications, tolerance requirements, and end-use details. Engaging in early technical discussions with the supplier’s engineering team minimizes misunderstandings. Clarify any necessary compliance with international or local standards (e.g., ASTM, EN, DIN) upfront to prevent rework, and request a prototype or sample before mass production whenever possible. -

What are the common minimum order quantities (MOQ), lead times, and payment terms in global cast iron trade?

MOQs typically range from 1-5 metric tons or are based on mold setup costs. Lead times can vary widely: standard castings may ship in 4-8 weeks, while complex or customized parts may require 10-16 weeks, especially if tool fabrication is involved. Payment terms often follow international norms—30% advance and 70% on bill of lading, or through letters of credit for added security. Discuss flexibility, especially when establishing new partnerships or during volatile demand periods, as reputable suppliers may negotiate MOQs and payment arrangements for long-term clients. -

How do B2B buyers ensure rigorous quality assurance and certification compliance in cross-border cast iron sourcing?

Obtain and verify certificates for material grades, mechanical properties, and relevant international standards compliance. Mandate third-party inspection at key production stages—pre-shipment and upon loading. Request detailed quality assurance plans, non-destructive testing results, and production process controls specific to your order. In regions where counterfeiting is a risk, only proceed with established suppliers audited by international agencies. Documentation should be complete and include heat numbers and traceability records for every batch. -

What logistics considerations are crucial when importing cast iron from overseas, particularly to Africa, South America, or the Middle East?

Cast iron’s weight and bulk demand careful route and carrier selection. Collaborate with suppliers experienced in international shipping to secure optimal containerization and protective packaging. Understand local port infrastructure limitations, customs documentation requirements, and duties or VAT obligations that will affect total landed cost. Factor in local transport from port to facility—delays or mismanagement here can erode any upstream cost savings. Work only with suppliers who provide real-time tracking and robust export documentation, and predefine Incoterms (e.g., CIF, DDP) to clarify responsibilities. -

How can international buyers manage supply chain risks such as non-performance, quality disputes, or delayed shipments?

Mitigate risks through legally sound contracts outlining quality benchmarks, inspection rights, and penalty clauses for delays or non-conformance. Secure adequate insurance for cargo in transit. Make use of escrow services or letters of credit for payment security. In recurring trade, establish a clear escalation path for disputes—ideally naming a mutually acceptable arbitration body. Maintain ongoing communication and periodic site visits (or video audits) to preempt issues, and diversify suppliers where possible to reduce dependency on a single source or region. -

Are there specific certifications or standards to prioritize when sourcing cast iron for critical applications internationally?

Prioritize suppliers with certifications relevant to your sector and destination market. Common standards include ISO 9001 for quality management, ISO/TS 16949 for automotive, or API for oil and gas. Material certifications should align with standards like ASTM A48 (gray iron), ASTM A536 (ductile iron), or EN-GJL/EN-GJS grades. For municipal or infrastructure projects, demand compliance with local codes and third-party attestations. Evaluate whether the supplier can furnish test certificates (mill test reports) and pass audits by global inspection agencies. -

What best practices can help build strong, long-term relationships with international cast iron suppliers?

Consistent, transparent communication is key—regularly share forecasts, new requirements, and quality feedback. Recognize and accommodate regional business customs, holidays, and cultural expectations. Visit supplier facilities periodically and invite them to your site if feasible, strengthening trust. Review performance quarterly, discussing mutually beneficial improvements. Consider establishing vendor-managed inventory or consignment arrangements for high-volume ongoing needs and prioritize collaborative problem-solving over punitive measures during challenges. Long-term, reliable partnerships often unlock better pricing, priority production slots, and proactive problem resolution.

Strategic Sourcing Conclusion and Outlook for cast iron vs

As global industries continue to evolve, the strategic sourcing of cast iron stands as a crucial lever for B2B buyers seeking resilience and competitive advantage. By thoroughly understanding the diverse types of cast iron—gray, ductile, white, malleable, and alloyed—and their optimal applications, buyers can make informed decisions that balance operational performance with cost efficiency. Evaluating supplier capabilities, regional expertise, and quality control processes remains paramount, especially as supply chains span continents from Africa and South America to the Middle East and Europe.

Key takeaways for international procurement teams include the necessity of robust material specification, rigorous quality inspections, and proactive planning for logistics and lead times. Partnering with certified, reliable manufacturers can not only mitigate sourcing risks but also unlock tailored solutions for specialized sectors such as infrastructure, energy, and manufacturing. Additionally, staying attuned to evolving market trends and regulatory standards can help buyers anticipate challenges and capitalize on emerging opportunities in the global cast iron market.

Looking ahead, B2B buyers who prioritize strategic partnerships and continuous supplier evaluation will be best positioned to harness the full value of cast iron, regardless of shifting economic or geopolitical landscapes. Now is the time to reinforce your sourcing strategies, strengthen supply chain agility, and explore new partnerships to secure your organization’s success in the years to come.