Introduction: Navigating the Global Market for sheet steel cutting tools

In the rapidly evolving sphere of global manufacturing, infrastructure, and engineering, securing a dependable supply of sheet steel cutting tools is more pivotal than ever for international business buyers. The precision, durability, and reliability of these tools directly impact operational efficiency, production quality, and project timelines—whether you’re overseeing expanding automotive lines in Colombia, driving energy projects across the Middle East, managing infrastructure developments in Nigeria, or powering advanced fabrication facilities in Vietnam. Choosing the right sheet steel cutting solutions is not just a matter of procurement; it’s a strategic investment that determines your business’s competitive edge and ability to deliver to both local and international standards.

As material technologies and product demands advance, today’s sheet steel cutting tools must navigate a landscape shaped by stringent quality requirements, diverse regulatory environments, and complex supplier ecosystems. From manual shears and CNC plasma systems to high-precision laser cutters, understanding the full spectrum of tool types, their material compositions, manufacturing intricacies, and compliance checkpoints is essential for minimizing project risk and ensuring consistent performance.

This guide serves as a practical and comprehensive resource for B2B procurement teams and purchasing leaders from Africa, South America, the Middle East, and Europe. You will find:

- In-depth overviews of sheet steel cutting tool types and primary industrial applications

- Insights into tool materials, manufacturing processes, and robust quality control measures

- Best practices for supplier evaluation, from due diligence to global certification requirements

- Clear analysis of cost structures, logistics, and emerging market trends

- Actionable FAQs that address common challenges and scenarios faced by international buyers

With this knowledge, procurement professionals can make well-informed decisions that ensure optimal tool selection, streamline their sourcing processes, and foster secure partnerships—ultimately supporting business growth, minimizing supply chain disruptions, and safeguarding compliance across diverse and dynamic markets.

Understanding sheet steel cutting tools Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Mechanical Shear | Large blades, manual or powered; straight clean cuts | Sheet metal fabrication, mass production | Fast for straight cuts, low waste; limited to simple geometries |

| Nibblers | Punching action, small dies for curves/angles | HVAC, automotive bodywork, panel cutting | Ideal for complex shapes, minimal distortion; slow for thick steel |

| Plasma Cutter | High-velocity jet of ionized gas slices steel | Heavy fabrication, shipbuilding | Versatile, cuts thick steel; requires tech support, safety risks |

| Laser Cutter | Focused laser beam, high-precision, CNC integration | High-precision, electronics, prototypes | Precise, clean edges, automation-ready; high setup cost |

| Angle Grinder | Hand-held, abrasive rotating disc | Maintenance, site repairs, small batch | Highly portable, cost-effective; less precise, skill dependent |

Mechanical Shear

Mechanical shears are indispensable in high-throughput environments requiring uniform, straight cuts—such as construction and appliance manufacturing. Available in both manual and powered variants, these machines maximize efficiency, particularly for repetitive jobs involving standard sized sheets. For procurement teams, it’s crucial to assess blade quality, maintenance requirements, and local technical support, as downtime can affect large production runs. Buyers in regions with limited service infrastructure should prioritize vendors with robust after-sales assistance.

Nibblers

Nibblers use a rapid punching motion to create intricate curves, cutouts, and angles, making them a go-to tool for HVAC ducting, automotive panels, and custom metalwork. Their minimal distortion of the base material ensures accuracy in projects where fit and finish are critical. When sourcing nibblers, consider the thickness and grade of steel typically handled, die availability, and ergonomic designs, as operator fatigue can affect productivity. Access to consumables and quick-change dies can also drive operational flexibility.

Plasma Cutter

Plasma cutters offer unmatched versatility, processing both thin and thick sheet steel with speed and minimal heat distortion. They are integral to sectors with varying cut profiles and materials, such as shipyards and infrastructure. However, their efficient operation depends on technical expertise and safety protocols, particularly in emerging markets with varying workforce skill levels. Procurement decisions should factor in machine power ratings, local energy standards, after-sales training, and compliance with workplace safety regulations.

Laser Cutter

Laser cutters guarantee superior cut accuracy and minimal post-processing, excelling in applications demanding precision, such as electronics and prototype manufacturing. These systems are compatible with automation and can reduce long-term operational costs by minimizing waste and rework. For B2B buyers, while initial capital investment is significant, evaluating a supplier’s ability to provide remote diagnostics, integration support, and operator training is essential. Maintenance agreements and readily available spare parts also weigh heavily in total ownership costs.

Angle Grinder

Angle grinders are a staple for fieldwork, maintenance tasks, and low-volume steel cutting due to their portability and adaptability to various environments. They support a range of disc types for cutting, grinding, and surface preparation, offering flexibility for unplanned tasks or repairs. Buyers should scrutinize product durability, safety certifications, and availability of compatible consumables, especially in markets with challenging field conditions. Investing in reliable brands with strong local distribution networks can help minimize operational interruptions.

Related Video: Eastwood Metal Cutting Tools – How to Cut Sheet Metal to Thick Plate!

Key Industrial Applications of sheet steel cutting tools

| Industry/Sector | Specific Application of sheet steel cutting tools | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Construction & Infrastructure | Fabrication of structural steel beams and panels | Enables scalable, accurate assembly; reduces rework | Local service/parts, tool throughput, cut precision |

| Automotive Manufacturing | Shaping chassis components & body panels | Ensures high fit/finish, reduces material waste | Tolerance consistency, supplier quality certifications |

| Energy & Utilities | Cutting panels for enclosures, ductwork, wind/solar rigs | Supports custom projects, fast installation | Corrosion resistance, tool versatility, delivery reliability |

| HVAC & Appliance Production | Mass cutting of sheet steel for casings/ducts | Boosts production throughput, ensures repeatability | High-volume capability, maintenance, automation options |

| Shipbuilding & Heavy Engineering | Precision cutting for hulls, frames, reinforcements | Handles thick sections, minimizes manual rework | Cut accuracy, thickness capacity, after-sale technical support |

Construction & Infrastructure

Sheet steel cutting tools are pivotal in the construction and infrastructure sector for preparing structural beams, frameworks, cladding panels, and reinforcement elements. Precision is critical—accurate cuts drive efficient assembly on-site, minimize welding/adjustment, and ensure compliance with design standards. Buyers in regions like Africa and the Middle East should prioritize robust tools that handle variable steel grades found in local markets and work in diverse field conditions. Access to localized maintenance and timely spare parts is essential to prevent costly project delays.

Automotive Manufacturing

Automotive manufacturers utilize sheet steel cutting tools to shape chassis components, door panels, and intricate bodywork parts. These tools must deliver repeatable accuracy in high-volume environments to reduce scrap rates and support tight dimensional tolerances vital for fit and safety. For buyers in South America and Europe, sourcing from suppliers with proven quality control (ISO/TS certifications) and reliable post-sale training is crucial to maintaining competitive production lines and meeting automaker specifications.

Energy & Utilities

The energy sector requires sheet steel cutting tools for fabricating electrical enclosures, ducting, control cabinet panels, and structure mounts for renewable installations. Flexibility in producing customized shapes and quick turnaround are key, particularly for fast-moving energy projects in regions such as the Middle East and emerging African markets. Tools must withstand exposure to corrosive environments—so buyers should ensure selected solutions offer material compatibility, are easy to reconfigure, and come with solid warranty support for mission-critical projects.

HVAC & Appliance Production

Manufacturers in the HVAC and home appliance sectors depend on fast, consistent sheet steel cutting for creating casings, vents, and ductwork. High throughput, reliability, and low tool wear directly impact margins, especially where batch production is common. Buyers in Europe and Vietnam should look for solutions that integrate well with automation lines, offer customizable die/tooling options, and include clear schedules for preventive maintenance to sustain uptime and production quality.

Shipbuilding & Heavy Engineering

Shipyards and heavy engineering firms deploy industrial cutting tools for processing thick steel plates for ship hulls, load-bearing frames, and reinforcement structures. These applications demand substantial tool durability, accuracy over large sections, and the flexibility to cut varying profiles. International buyers, particularly in port regions of South America and Africa, should evaluate suppliers based on machine capacity, the availability of technical support/training, and ability to provide specialized tooling or upgrades to meet evolving project requirements.

Related Video: Cutting Sheet Metal or Roofing – 4 Different Tools You Should Use

Strategic Material Selection Guide for sheet steel cutting tools

Common Materials Used in Sheet Steel Cutting Tools: B2B Analysis

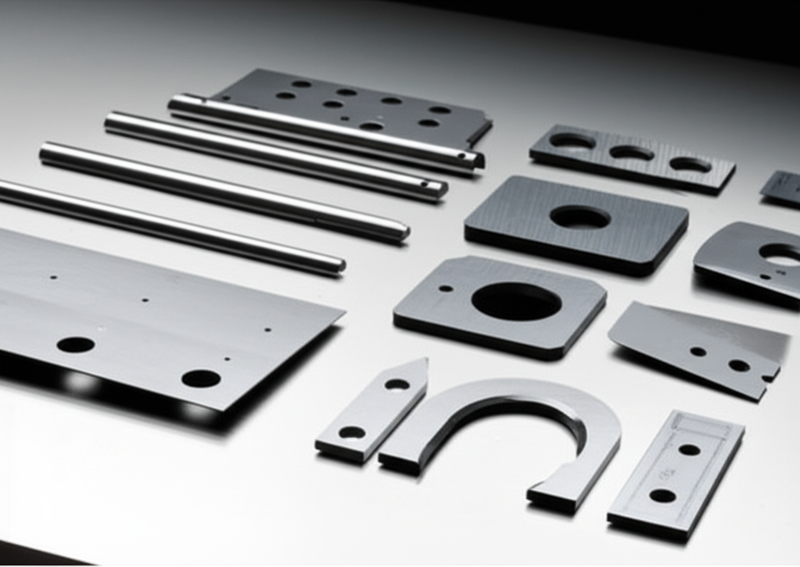

Selecting the appropriate material for sheet steel cutting tools is crucial for ensuring optimal performance, longevity, and return on investment for international buyers. The most prevalent materials—High-Speed Steel (HSS), Carbide (Tungsten Carbide), Tool Steel (Alloy Tool Steel), and Ceramic—each present distinct properties, advantages, and challenges. The following analysis highlights critical factors B2B procurement teams in Africa, South America, the Middle East, and Europe should consider, including application suitability, cost-effectiveness, and international compliance.

High-Speed Steel (HSS)

Key Properties:

HSS combines hardness, toughness, and heat resistance, enabling tools to retain cutting edges at elevated temperatures (up to ~600°C). It exhibits moderate corrosion resistance and is less brittle than carbide.

Pros & Cons:

Pros include reliable durability, cost-effectiveness, and ease of manufacture/sharpening. HSS can be formed into various complex geometries, supporting a wide range of cutting profiles. However, it wears faster than carbide in high-speed or high-abrasion environments and is less suitable for ultra-hard materials or mass production where tool change-out frequency is a critical cost driver.

Application Impact:

HSS tools are ideal for small to medium batch runs and manually operated or semi-automated equipment, especially in facilities where budgets are limited, and repair or regrinding is routine.

Regional Considerations:

HSS products are widely available and compliant with common standards (ASTM A600, DIN 17350, JIS G4403). This ubiquity simplifies sourcing and replacement in developing regions with less specialized supply chains. Buyers should confirm material certificates and compliance to prevent counterfeit or substandard imports.

Carbide (Tungsten Carbide)

Key Properties:

Noted for extreme hardness, high wear resistance, and the ability to maintain cutting edges at temperatures exceeding 800°C. Carbide tools are inherently brittle but offer unmatched performance in high-speed and high-precision applications.

Pros & Cons:

The primary benefit is significant increases in cutting speed and tool life, reducing downtime and improving throughput. However, carbide’s brittleness makes it vulnerable to chipping if misapplied, and the initial cost is substantially higher than HSS. Manufacturing and repair require advanced techniques and equipment.

Application Impact:

Carbide cutting tools excel in high-volume, automated operations where precision and repeatability are critical, such as automotive, aerospace, and electronics manufacturing.

Regional Considerations:

Sourcing from reputable suppliers is essential, particularly in markets where quality control standards vary. Requesting certificates to international norms (ISO 513, DIN V ISO 513) and sample testing are advisable. For buyers in regions with limited access to skilled labor or advanced machining infrastructure, weigh increased productivity against maintenance complexity and support.

Tool Steel (Alloy Tool Steel)

Key Properties:

Alloyed tool steels (such as D2, O1, and A2 grades) are tailored for toughness, wear resistance, and stability during repeated heating/cooling cycles. They offer moderate to high hardness and resist distortion during heavy-duty applications.

Pros & Cons:

Tool steels balance reasonable cost with robust durability and are more resistant to shock and impact than carbide. They can be customized through heat treatment, although this increases manufacturing complexity and requires robust quality controls. Tool steels do not match HSS or carbide for continuous high-speed use and can suffer from corrosion in aggressive environments if not coated.

Application Impact:

Particularly effective for shearing and punching operations that demand resistance to mechanical stress and intermittent loads. Used in guillotine blades, dies, and heavy-duty hand tools.

Regional Considerations:

Specify grades per local or project standards (ASTM A681, DIN 17350, JIS G4404) to avoid mismatches in toughness/hardness. For buyers dealing with variable-quality steel supply chains, insist on batch traceability and final inspection reports.

Ceramic

Key Properties:

Ceramic materials bring extreme hardness, resistance to heat, and complete immunity to corrosion. They can tolerate cutting temperatures above 1,000°C but are significantly less tough than steel-based tools.

Pros & Cons:

Ceramics last longer than metal-based tools at very high speeds and can cut particularly difficult or abrasive steels. Their extreme brittleness, however, restricts use to highly controlled environments and precise, low-impact applications. Repair and regrinding are impractical, and initial costs are high.

Application Impact:

Ceramic tools are best suited for specialized, precision-required applications—such as fine blanking, electronics, or certain high-volume shearing processes—where tool breakage risk is mitigated by automated handling.

Regional Considerations:

Due to high price, sourcing complexity, and specific application restrictions, ceramics are rarely used outside highly industrialized or niche sectors. Confirm technical compatibility and ensure supplier adherence to standards (ISO 513) before procurement.

Comparative Summary Table

| Material | Typical Use Case for sheet steel cutting tools | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| High-Speed Steel (HSS) | General-purpose blades, saws, drills for small/medium batch cutting | Versatile, easy to manufacture/repair | Wears faster at high speeds; not optimal for ultra-hard steels | Low |

| Carbide (Tungsten Carbide) | High-speed production, precision CNC, and automated sheet cutting | Superior hardness and cutting speed | Brittle, costly, requires specialized maintenance | High |

| Tool Steel (Alloy Tool Steel) | Heavy-duty shears, guillotine blades, punches/dies | Excellent toughness and wear resistance | Susceptible to corrosion if uncoated; manufacturing is complex | Medium |

| Ceramic | Fine blanking, high-precision cutting in automated lines | Extreme hardness/heat resistance; no rust | Very brittle, high price, niche applicability | High |

In-depth Look: Manufacturing Processes and Quality Assurance for sheet steel cutting tools

Overview of Sheet Steel Cutting Tool Production

For international B2B buyers, especially from Africa, South America, the Middle East, and Europe, understanding the manufacturing lifecycle and quality assurance protocols for sheet steel cutting tools—such as shears, snips, and industrial cutters—is indispensable to risk mitigation, cost optimization, and compliance. The following sections offer a comprehensive breakdown of the key manufacturing phases, essential quality control (QC) milestones, applicable standards, verification strategies, and actionable insights for effective global procurement.

Key Manufacturing Stages

The production of sheet steel cutting tools is a complex, multi-phase process, engineered to achieve high performance, longevity, and safety. While manufacturers may employ localized variants, the major stages typically include:

1. Material Preparation

- Steel Selection: The choice of steel (often high-carbon or alloy variants) is foundational. Raw material batches are tested for composition, hardness, and consistency according to grade specifications (e.g., DIN, JIS, ASTM), which directly impacts tool performance.

- Material Conditioning: Cutting tools demand excellent homogeneity. Processes such as annealing, de-scaling, and leveling are applied to ensure the steel is stress-free and uniformly workable.

2. Forming and Shaping

- Blanking & Punching: CNC-controlled blanking or power presses shape steel sheets into blanks—the rough form of tool parts, ensuring dimensional precision and efficient material use.

- Forging or Stamping: For increased strength, many high-grade tools undergo hot-drop forging—a process where steel blanks are shaped under pressure and heat, realigning grain structure to maximize toughness.

- Machining: Cutting edges and intricate profiles are achieved through CNC milling, grinding, and wire EDM. Machining tolerances are tightly controlled for optimal sharpness and fit.

3. Assembly and Joining

- Component Fitting: Multi-part tools require precision assembly, often using interference fitting, riveting, or advanced welding (such as laser or robotic TIG/MIG).

- Heat Treatment: Hardening and tempering cycles are carefully calibrated to balance wear resistance with elasticity, preventing brittleness that could cause tool failure.

4. Surface Finishing

- Grinding & Polishing: Final edge geometry and smoothness are achieved via precision grinding and polishing. Surface finishing also includes deburring, sandblasting, or tumbling to ensure operator safety and reduce contamination risks.

- Protective Coating: Corrosion resistance is enhanced with coatings such as black oxide, nickel, or special anti-corrosive treatments, especially vital for humid climates (relevant for African and Southeast Asian buyers).

- Marking & Packaging: Laser or mechanical marking ensures traceability (batch, model, compliance codes), while industrial packaging protects during transit.

Quality Assurance: Standards, Checkpoints, and Methods

Investing in rigorous QC is vital for both compliance and buyer confidence. Below are the critical facets of quality assurance in this sector:

International & Industry-Specific Quality Standards

- ISO 9001: Most reputable manufacturers operate certified Quality Management Systems (QMS) compliant with ISO 9001, underpinning consistent process control from raw materials through to dispatch.

- ISO 13485, CE Mark, and FDA: In sectors such as medical or food-grade applications, ISO 13485 (medical devices), CE Mark (European market), or FDA (US market) demonstrate adherence to elevated safety and traceability norms.

- API, ANSI, DIN: For certain industrial clients (e.g., oil & gas, automotive), adherence to sectoral norms—such as American Petroleum Institute (API), American National Standards Institute (ANSI), or Deutsches Institut für Normung (DIN)—may be key to project approvals and long-term reliability.

Core QC Checkpoints

- Incoming Quality Control (IQC): Rigorous inspection of incoming steel ensures material certification, chemical composition, and hardness meet contractual specs. Traceability at this stage preempts downstream failures.

- In-Process Quality Control (IPQC): During forming, machining, and assembly, operators and automated systems check critical dimensions, tolerances, edge angles, and hardness. Statistical process control (SPC) and real-time inspection reduce defective batches.

- Final Quality Control (FQC): Post-finishing, each batch undergoes comprehensive evaluation—visual inspection, dimensional verification, and functional tests ensure tools operate as specified.

Common Testing and Validation Methods

- Hardness Testing: Tools are routinely checked with Rockwell or Vickers testers to confirm correct heat treatment and durability.

- Microstructure Analysis: Sampling with metallography validates grain structure integrity, especially after forging and heat treatment.

- Edge Sharpness & Impact Testing: Practical tests measure cutting efficiency and resistance to chipping or deformation.

- Corrosion Resistance Tests: Salt spray or humidity chamber testing ensures suitability in environments with varied moisture/humidity—particularly relevant for buyers in Africa, Southeast Asia, and coastal regions of Europe and Latin America.

- Dimensional Inspection: CMM (Coordinate Measuring Machines) and optical profilers verify adherence to CAD blueprints for high-precision tools.

Verifying Supplier Quality as an International B2B Buyer

For buyers outside the manufacturing region, robust QC verification is central to supply risk management. Recommended tactics include:

1. Supplier Audits

- On-site Visits: Schedule periodic or pre-shipment audits to observe live production, review documentation (QMS, traceability logs), and interview staff.

- Remote Audits: Increasingly, virtual audits using video walkthroughs and real-time data access are viable, particularly in initial supplier selection or for ongoing compliance reviews.

2. Third-Party Inspection

- Pre-shipment Inspection (PSI): Engage independent agencies (SGS, TÜV, Intertek) to inspect tool batches, validate test results, and verify packaging before shipment—critical in cross-border transactions.

- Sample Testing: Request representative tool samples for lab testing at buyer’s facility or by a third-party, confirming specs before full payment or approval.

3. Documentation Review

- Quality Certificates: Require up-to-date ISO/CE/FDA certificates, detailed QC reports, and Batch Test Certificates with each shipment.

- Traceability Records: Ensure the supplier provides full documentation enabling batch traceability—a must for regulated sectors or in the event of product recalls.

Regional Considerations and Nuances for Global B2B Buyers

Africa & South America:

Buyers often face issues related to supply chain stability, customs clearance, and climate-induced corrosion or wear. Prioritize suppliers able to customize tool coatings for local climates, offer multi-language QC reports, and support after-sales technical training to maximize ROI and operational uptime.

Middle East:

Severe temperatures and dust require tools with high tolerance for thermal and abrasive stress. Insist on suppliers with proven experience in desert or heavy-industrial deployments, and verify that tools meet both international and regional industry norms.

Europe (including Vietnam as a production base):

Stringent environmental and safety regs (REACH, CE, EN standards) mean supplier compliance must be bulletproof. European buyers and those sourcing from Vietnam should request REACH-compliance documentation, eco-friendly packaging, and full CAD/CAM records for precision-critical orders.

All Regions:

Language barriers and varying business practices can complicate communication and QC expectations. Standardize requirement documents, use Incoterms, and require dual-language labeling and documentation where possible.

Actionable Takeaways for B2B Procurement Teams

- Insist on clear QMS documentation (ISO 9001/13485) and full traceability for each order.

- Mandate third-party PSI and comprehensive batch QC records prior to shipment or payment release.

- Customize tool specs and finishing for local environmental challenges (humidity, dust, temperature).

- Prioritize suppliers with robust after-sales support, multi-language documentation, and regional references.

- Negotiate periodic audits or site visits in initial and renewal contracts to maintain long-term quality consistency.

By mastering both the intricacies of manufacturing and QC, B2B buyers can dramatically reduce operational risk, drive down total cost of ownership, and ensure reliable, long-term partnerships with sheet steel cutting tool suppliers worldwide.

Related Video: The World’s Largest Bevel Gear CNC Machine- Modern Gear Production Line. Steel Wheel Manufacturing

Comprehensive Cost and Pricing Analysis for sheet steel cutting tools Sourcing

Key Cost Drivers in Sheet Steel Cutting Tools Sourcing

Understanding the full cost structure behind sheet steel cutting tools is critical for international B2B procurement teams. Buyers should evaluate not just unit price but the cumulative effect of various cost contributors throughout the production and supply chain process.

1. Materials:

The quality and composition of the steel or alloy used in the cutting tool significantly impact base costs. High-speed steel (HSS), carbide, and specialty coatings for enhanced performance command premium prices, especially for tools subject to intense wear.

2. Labor:

Manufacturing labor forms a substantial portion of cost, especially where hand-finishing or specialized craftsmanship is required. Regional wage differences, skills shortages, and labor regulations (particularly within the EU or Middle East) will further influence labor-related expense.

3. Manufacturing Overhead:

This captures costs for facility operation, machine amortization, energy, safety measures, and environmental compliance. Automation can reduce per-unit overhead, which large Asian or Eastern European suppliers may leverage effectively.

4. Tooling & Set-Up:

For custom or low-volume orders, tooling and setup fees may apply. Initial mold fees or CNC programming charges can be amortized over production runs, so higher volumes typically reduce these per-unit costs.

5. Quality Control & Certification:

Investment in quality assurance—including ISO 9001, CE marking, or other regional and sector-specific certifications—adds to direct costs. Buyers targeting regulated markets must budget for supplier certification and potentially third-party inspections.

6. Logistics & Freight:

Transportation, insurance, import duties, and in-market distribution strongly influence landed cost. Lead time, shipment size, and chosen Incoterms (e.g., FOB, CIF, DDP) all play a crucial role.

7. Supplier Margin:

Final pricing incorporates supplier margin, which can reflect risk factors, currency volatility, and negotiation dynamics. Long-term partnerships and guaranteed reorder agreements can sometimes secure preferential rates.

Influential Factors Affecting Pricing

Beyond core costs, the final price quoted to B2B buyers will depend on several operational and commercial variables:

-

Order Volume and MOQ:

Larger orders improve economies of scale, driving per-unit pricing down. Be mindful of high MOQs, as smaller batch orders may encounter surcharges. -

Degree of Customization:

Non-standard dimensions, coatings, or branding increase engineering time and setup, raising costs, especially for unique industrial requirements in emerging markets. -

Raw Material Sourcing:

Fluctuations in global steel prices or supply chain disruptions (such as tariffs or export controls common in China and the EU) can lead to price volatility. -

Quality Requirements and Certifications:

Adherence to stringent industry standards or third-party certifications (such as FDA, ISO 13485 for medical use) can be mandatory in sectors like European manufacturing or Middle Eastern energy, increasing both direct and indirect costs. -

Supplier Location and Reliability:

Suppliers with established logistics and aftersales infrastructure in Africa, South America, or the Middle East may charge higher rates but deliver greater reliability, which reduces hidden costs from downtime. -

Incoterms:

Pricing can shift considerably depending on whether your purchase terms are EXW (Ex Works), FOB (Free on Board), CIF (Cost, Insurance, and Freight), or DDP (Delivered Duty Paid). These distinctions will determine who bears shipping, customs, insurance, and risk responsibilities.

Strategic Sourcing Tips for International B2B Buyers

-

Request Detailed Quotations:

Ensure all cost elements (materials, labor, setup, inspection, logistics, warranty) are itemized. This increases transparency and strengthens negotiation leverage. -

Leverage Volume and Long-Term Agreements:

Where feasible, consolidate orders or enter into framework agreements to secure bulk discounts, favorable payment terms, and priority production slots. -

Balance Price Against Total Cost of Ownership (TCO):

Consider not only upfront pricing but also lifecycle costs—such as tool longevity, maintenance, and local support availability. A marginally higher purchase price for a tool with longer service intervals can deliver significant savings. -

Prioritize Certified and Reputable Suppliers:

Especially for buyers in Africa and South America, working with ISO-certified or internationally recognized suppliers reduces quality risks and ensures easier cross-border customs clearance. -

Clarify Incoterms and Logistics:

Inquire whether quotes are all-inclusive (e.g., DDP) or if you need to budget for additional inland transportation, customs fees, or warehousing. -

Negotiate Payment and Currency Terms:

Engage suppliers on payment terms and consider currency fluctuation clauses, particularly when dealing with suppliers in high-volatility regions.

Disclaimer:

All price ranges and examples provided here are for reference only. Actual costs will vary by region, supplier, market conditions, and order specifics. Request real-time quotations from multiple vendors to confirm current rates.

By systematically analyzing each cost element and key influencer, international B2B buyers can build a competitive, resilient sourcing strategy that delivers both immediate value and long-term cost efficiency.

Spotlight on Potential sheet steel cutting tools Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘sheet steel cutting tools’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Cutting Tool Manufacturers: The Most Comprehensive List (ronixtools.com)

Cutting Tool Manufacturers: The Most Comprehensive List, as profiled by RONIX Tools, functions as an extensive industry aggregator, presenting a diverse portfolio of global cutting tool companies with a focus on sheet steel cutting tools. The platform curates a rigorously selected list of over 70 manufacturers, highlighting the leading producers renowned for high-quality, industrial-grade solutions. With a sharp emphasis on meeting bulk procurement needs, it streamlines the supplier selection process for international B2B buyers by summarizing technical strengths, manufacturing capabilities, and market presence.

While specific certifications and proprietary technologies are not exhaustively detailed, the list serves as a trustworthy reference point for buyers across Africa, South America, the Middle East, and Europe seeking reliable partners for sheet steel cutting applications. Their accessible approach to bulk inquiries, combined with up-to-date market data, provides significant value for purchasing managers aiming to optimize supplier relationships and stay abreast of industry trends.

5 Metal Cutting Tools Companies in the World (www.expertmarketresearch.com)

Recognized globally, the companies listed among the “5 Metal Cutting Tools Companies in the World” reflect the industry’s leading edge in technological innovation and manufacturing scale for sheet steel cutting tools. These firms—such as Amada Co., Ltd., Sandvik AB, Ceratizit Group, Fanuc UK Ltd, and Nachi-Fujikoshi Corp.—are known for robust R&D capabilities, integration of IoT and AI for predictive maintenance, and advanced automation solutions, making them valuable suppliers for diversified industrial operations. Their product portfolios often encompass high-precision tools including shears, saws, and CNC-driven systems, meeting diverse client needs from high-volume fabrication to custom engineering. Many are ISO-certified and have a strong presence in international markets, with proven logistics and aftersales support, making them accessible and reliable for buyers in Africa, South America, the Middle East, and Europe.

Metal Cutting Tools Companies (www.marketresearchfuture.com)

Metal Cutting Tools Companies operates within the global market as a prominent supplier of sheet steel cutting tools, catering to diverse sectors such as construction, automotive, and heavy industry. The company is recognized for leveraging cutting-edge manufacturing technologies and innovative tool designs that emphasize precision, efficiency, and durability, supporting complex sheet steel applications. While detailed product portfolios or certifications are not widely published, their presence is notable in competitive markets across Europe, the Middle East, Africa, and South America, indicating substantial export and international project experience. For B2B buyers, especially those navigating complex supply chains or requiring versatile solutions, the company’s industry expertise and responsiveness to emerging trends position them as a reliable partner for scaling manufacturing or infrastructure projects.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Cutting Tool Manufacturers: The Most Comprehensive List | Comprehensive list for global bulk buyers | ronixtools.com |

| 5 Metal Cutting Tools Companies in the World | Leading global providers, tech-driven, strong certifications | www.expertmarketresearch.com |

| Metal Cutting Tools Companies | Global supplier, advanced sheet steel tool solutions | www.marketresearchfuture.com |

Essential Technical Properties and Trade Terminology for sheet steel cutting tools

Key Technical Specifications in Sheet Steel Cutting Tools

Selecting high-performing sheet steel cutting tools for international projects hinges on understanding the core technical properties that impact quality, efficiency, and long-term value. Below are the critical specifications to assess during procurement:

-

Material Grade of Cutting Edge

The composition of the tool’s cutting edge (e.g., high-speed steel (HSS), carbide, hardened alloy) directly determines wear resistance, toughness, and the ability to withstand intensive use. For buyers in infrastructure and manufacturing, specifying the right grade ensures consistent performance even when working with hard or coated steels, reduces replacement cycles, and minimizes unexpected downtime. -

Hardness (Measured in HRC or Vickers)

Hardness indicates a tool’s resistance to deformation and wear—typically measured on scales such as Rockwell (HRC) or Vickers (HV). Tools with higher hardness maintain sharpness longer, critical for large-scale or repetitive cutting tasks. However, there’s a balance: extremely hard tools may be brittle, so it’s important to match hardness to the cutting application and steel thickness. -

Dimensional Tolerance

Tolerance defines the permissible variation in tool dimensions, crucial for precision work and interchangeability. Tight tolerances (smaller deviations from nominal measurements) ensure consistent, clean cuts, especially for components destined for assembly or critical structural roles. This property reflects manufacturing quality and directly impacts the fit, finish, and performance of end products. -

Coating Type

Advanced surface coatings (e.g., Titanium Nitride (TiN), Titanium Carbonitride (TiCN), Black Oxide) enhance tool life by reducing friction, resisting corrosion, and minimizing heat buildup. Coated tools maintain sharpness and performance longer, especially in high-tempo or abrasive environments. Requesting specification sheets on coating type is advisable for buyers aiming for durability and process optimization. -

Cutting Capacity (Thickness Range)

This defines the maximum sheet thickness and steel types a tool can cut safely and efficiently. Overestimating a tool’s capability leads to rapid wear or tool failure. Manufacturers should declare, and buyers should confirm, certified cutting capacities based on actual testing—this is especially important when sourcing for diverse application ranges across sectors. -

Compliance and Certification

Compliance with international or regional standards (e.g., ISO 9001, CE marking, local safety directives) guarantees a minimum threshold of manufacturing quality and operator safety. For cross-border procurement, documented certifications reduce legal and operational risk, aligning with import regulations in the Middle East, Africa, South America, and Europe.

Common Industry and Trade Terminology

A strong grasp of trade terms ensures smoother supplier communications, efficient negotiations, and successful fulfillment. Some of the most prevalent terms include:

-

OEM (Original Equipment Manufacturer)

Refers to a supplier producing tools either under its brand or “white-label” for resellers. Knowing if a partner is an OEM can influence support, pricing structure, and aftersales service levels. -

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to sell per order. International buyers should clarify MOQs early in negotiations to balance pricing with inventory management and supply chain costs, especially for trial or diversified orders. -

RFQ (Request for Quotation)

A formal document sent by buyers to solicit precise pricing, specifications, lead-time, and terms from potential suppliers. Well-constructed RFQs improve cost comparisons, reduce ambiguity, and accelerate procurement cycles. -

Incoterms (International Commercial Terms)

Standardized shipping and delivery terms (such as FOB, CIF, DAP) defined by the International Chamber of Commerce; they allocate costs, risks, and responsibilities between buyers and sellers. Mastery of Incoterms is essential to manage total landed cost and resolve customs challenges in global trade. -

Lead Time

The duration from order placement to delivery at the buyer’s facility. Understanding lead times—including production and transit—helps buyers in regions with fluctuating shipping routes or customs procedures forecast inventory and avoid project delays. -

Certificate of Conformity (CoC)

An official document supplied by manufacturers confirming compliance with designated standards or specifications. CoCs are particularly relevant for importers in regulated markets, ensuring tools meet the minimum criteria for quality and safety.

Adopting these technical and trading standards in your sourcing processes will not only ensure optimal tool performance but also boost procurement transparency, compliance, and long-term supplier relationships—critical success factors in the global B2B marketplace.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the sheet steel cutting tools Sector

Market Overview & Key Trends

Global demand for sheet steel cutting tools is surging, propelled by a diverse array of industries—from construction and infrastructure to automotive and energy. Rapid urbanization in Africa and Southeast Asia, ambitious manufacturing growth in South America, large-scale infrastructure projects in the Middle East, and Europe’s push for advanced engineering solutions all contribute to a robust, evolving marketplace. International B2B buyers face both opportunities and complexities as the sector responds to shifting input costs, volatile logistics, and rising expectations for precision and performance.

Technology-driven product differentiation is now a keystone trend. Equipment featuring automation, CNC integration, and smart diagnostics is increasingly favored for its ability to reduce operator dependency and increase throughput. Buyers from emerging industrial economies—such as Nigeria, Vietnam, and Colombia—are particularly interested in hybrid tools that balance cost-effectiveness with flexibility and durability. There is a growing appetite for customizable solutions that minimize waste and adapt to evolving production needs, especially for projects requiring frequent specification changes.

Supplier diversification and nearshoring are becoming chief strategies to hedge geopolitical risks and supply chain disruptions. Partnerships are shifting beyond traditional hubs in East Asia, with renewed scrutiny on regional capabilities in Turkey, Eastern Europe, and South Asia. B2B procurement teams are prioritizing suppliers with robust quality management certifications (ISO, CE, etc.), strong post-sale support, and the capacity to scale quickly. At the same time, transparent traceability—from raw material to finished tool—is now a non-negotiable expectation, as regulatory compliance and end-user demands escalate.

Finally, digitalization of the sourcing process—including online B2B platforms, e-auctions, and virtual factory audits—is enabling wider supplier discovery and more granular vetting, crucial for buyers operating across vast geographies with varying legal frameworks and industrial standards. This digital shift also aids in collecting data for continuous process and supply chain optimization.

Sustainability & Ethical Sourcing in B2B

Sustainability has transitioned from a “nice-to-have” to a core decision factor for B2B buyers of sheet steel cutting tools. Manufacturers are increasingly expected to demonstrate environmentally responsible practices, from material selection through end-of-life recyclability. The use of high-efficiency alloys, recycled steels, and non-toxic coatings is on the rise, reducing the overall environmental footprint of both the tools and the manufacturers themselves.

Ethical sourcing is tightly intertwined with corporate responsibility and global supply chain integrity. International buyers, especially those supplying regulated markets in Europe and parts of the Middle East, are now required to verify that steel cutting tools are produced under fair labor conditions and with minimal environmental impact. Certifications like ISO 14001 (for environmental management), RoHS (Restriction of Hazardous Substances), and compliance with local labor laws are becoming default procurement prerequisites.

Green certifications and product declarations—for example, Environmental Product Declarations (EPDs) or carbon footprint reports—are increasingly requested in tenders and framework agreements. Progressive suppliers are also offering full traceability of materials, enabling B2B buyers to confidently communicate their sustainability and ethical commitments downstream.

Procurement teams are encouraged to conduct structured supplier audits or partner with third-party verification agencies to ensure conformity. By prioritizing environmental stewardship, buyers not only mitigate regulatory risk but can also unlock competitive advantages through enhanced brand reputation and alignment with client sustainability targets.

Brief Evolution of the Sheet Steel Cutting Tools Sector

The sheet steel cutting tools sector has evolved dramatically from simple hand-operated shears to today’s integration of advanced robotics and precision-controlled machinery. Early innovations focused on increasing mechanical advantage and operator efficiency, with milestones such as hydraulic-powered shears and the introduction of motorized cutting saws marking key developments in industrial history.

The late 20th and early 21st centuries ushered in a wave of innovation, with the adoption of automation, laser, and plasma-based technologies that dramatically improved productivity and cut quality. This progress has been accompanied by a parallel shift toward sustainable material usage and digital process management. The result: a globalized, innovation-driven sector where B2B buyers can choose from a wide spectrum of solutions finely tuned to meet the rigors of modern industrial demands, regulatory requirements, and sustainability expectations.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of sheet steel cutting tools

-

How can I reliably evaluate international sheet steel cutting tool suppliers before placing a large order?

Start by verifying a supplier’s business licenses, export experience, and manufacturing capacity. Request references from previous international clients, ideally in similar markets or regions. Conduct video audits, request quality certifications (such as ISO 9001 or CE), and ask for recent inspection or factory audit reports. Third-party inspection agencies can provide on-site verifications if travel is impractical. A phased approach—starting with small test orders or trial runs—minimizes exposure to risk while building trust. -

Can sheet steel cutting tools be customized for specific local standards or applications?

Most reputable manufacturers offer customization options, including sizing, cutting capabilities, compatible materials, and safety features. Clearly communicate your required specifications; provide diagrams or use-case details where possible. For buyers in regions with strict regulatory standards (e.g., EU safety norms, GCC Conformity Mark), confirm that the supplier can design or certify products to meet those requirements. Obtain and verify prototypes or product samples before committing to full production, ensuring fit for purpose in your market. -

What are typical minimum order quantities (MOQs), lead times, and recommended payment terms when sourcing internationally?

MOQs vary by tool type and manufacturer, but for industrial-grade tools, expect a range from 50–500 units per model. Lead times can span from 4–12 weeks, factoring in production, quality checks, and shipping. Negotiate partial advance payments (e.g., 30% deposit, 70% at shipment) and consider letters of credit (LCs) for added security. For first-time orders, some suppliers may consider lower MOQs—especially if you’re willing to pay slightly higher unit costs or sign longer-term contracts. -

Which quality assurance processes and certifications should I look for in sheet steel cutting tool suppliers?

Prioritize suppliers adhering to international standards, such as ISO 9001 (quality management) and, where relevant, CE marking or equivalent. Request documentation of QC processes—material traceability, dimensional inspection, and hardness testing are minimum requirements. For specialized applications, demand batch-level or third-party inspection certificates. A strong supplier will welcome factory audits and provide full traceability of materials, processes, and end products to ensure consistent quality. -

How should I arrange logistics and shipping for large orders, especially to Africa, South America, or the Middle East?

Work with suppliers experienced in international shipping and familiar with your region’s import regulations. Clarify Incoterms (e.g., FOB, CIF) in contracts to define responsibilities for freight, insurance, and clearance. If possible, partner with reputable freight forwarders specializing in industrial equipment to ensure cost-effective, timely delivery. Request detailed packing lists, customs documentation, and tracking information upfront. Proactive communication with logistics partners can help avoid delays at ports and border crossings. -

What steps help minimize risks of supply disruption or delivery delays?

Maintain clear communication and establish mutually agreed timelines with built-in buffers for production and transit. Consider dual sourcing or keeping a buffer stock for urgent needs. Vet the supplier’s supply chain resilience—ask about their sources of raw materials and historical on-time delivery performance. Implement penalties or incentives in contracts to enforce adherence to deadlines. Regularly monitor global trade disruptions (strikes, customs changes, etc.) and work with logistics partners to adjust plans proactively. -

What is the best way to handle disputes or quality issues with international suppliers?

Document all requirements and quality standards clearly in purchase agreements. Upon receipt, inspect incoming goods and report any discrepancies immediately with photographic or video evidence. Professional suppliers should offer prompt resolutions—replacement, refund, or repair. Include arbitration clauses stipulating neutral jurisdictions or third-party mediation in contracts. Where possible, retain a portion of the payment until acceptance inspections are completed, incentivizing timely resolution of any disputes or defects. -

How can I ensure compliance with local and international standards when importing sheet steel cutting tools?

Identify and communicate all applicable standards (e.g., EN, ISO, or local safety directives) to the supplier before ordering. Request certification documents and conformity declarations with each shipment. Engage local regulatory consultants or inspection agencies for pre-shipment or arrival inspections, especially if importing into regions with evolving or complex compliance requirements (e.g., EU, Brazil, Saudi Arabia). Monitor regulatory changes regularly and update supplier requirements accordingly to avoid import delays or compliance penalties.

Strategic Sourcing Conclusion and Outlook for sheet steel cutting tools

As international markets for sheet steel cutting tools continue to evolve, several actionable insights stand out for procurement professionals. Prioritizing quality, supplier credibility, and regulatory compliance is crucial—especially given the diversity in standards and logistical complexities across Africa, South America, the Middle East, and Europe. B2B buyers should leverage thorough supplier audits, demand robust after-sales support, and pay close attention to certifications such as ISO and CE to ensure product reliability and suitability for regional requirements.

Strategic sourcing is not simply about cost savings; it is a catalyst for risk reduction, operational efficiency, and long-term business resilience. Developing strong, transparent partnerships with global suppliers, staying updated on advancements in cutting technologies, and integrating digital procurement tools all contribute to higher value creation throughout the supply chain.

Looking ahead, ongoing technological innovation, rising emphasis on sustainability, and shifting trade dynamics will reshape the sourcing landscape. Forward-thinking B2B buyers are encouraged to continually re-evaluate their sourcing strategies—benchmarking supplier performance and proactively exploring new markets. Now is the time to secure strategic partnerships and invest in next-generation tools and processes to strengthen your competitive edge and ensure uninterrupted business growth in the global sheet steel cutting tools sector.