Introduction: Navigating the Global Market for cost of sheet metal

Sheet metal stands at the heart of countless industries—from fast-growing construction sites in Nairobi and infrastructure projects in Dubai, to high-tech manufacturing hubs in São Paulo and established European factories. For international B2B buyers, the cost of sheet metal is a critical factor that determines not only your upfront spend, but the long-term competitiveness and reliability of your operations. However, with raw material prices fluctuating, supply chains stretching across continents, and local labor rates evolving rapidly, navigating the global sheet metal market demands both insight and agility.

Making informed sourcing decisions now goes well beyond price comparisons. Buyers must weigh material types and grades, production processes, finishing techniques, supplier track records, and regional market dynamics—each with a direct impact on cost, quality, and lead times. The wrong choice can lead to unnecessary expenses, missed deadlines, or compliance issues; the right one unlocks cost savings, consistency, and market advantage.

This guide brings together actionable expertise tailored for global buyers in Africa, South America, the Middle East, and Europe. Here’s what you’ll discover to sharpen your procurement strategy:

- Comprehensive breakdown of sheet metal types, formats, and grades—so you match application with exact materials.

- Deep dives into material properties and selection factors, focusing on durability, cost behavior, and regional supply.

- Clear overviews of fabrication, quality control, and finishing methods, helping you optimize project costs without risking quality.

- Supplier evaluation checklists and negotiation tips, ensuring reliable partnerships and transparency on pricing.

- Current market trends and risk factors shaping availability and cost across supply chains, including actionable mitigation strategies.

- Curated FAQs addressing common challenges unique to international sheet metal sourcing.

With this guide, you’re equipped to manage risk, maximize value, and build lasting supply relationships—no matter where your project, plant, or procurement office is located.

Understanding cost of sheet metal Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Stainless Steel Sheet | High corrosion resistance, durable, hygienic | Food processing, pharmaceuticals, construction, OEMs | + Excellent lifespan, low maintenance; – Higher upfront material cost, heavier than alternatives |

| Aluminum Sheet | Lightweight, good corrosion resistance, flexible | Automotive, aerospace, electronics, packaging | + Easy fabrication, reduced shipping costs; – Lower strength, price volatility |

| Carbon Steel Sheet | Robust, cost-effective, widely available | Machinery, structural works, industrial equipment | + Economical for volume, strong; – Prone to rust without coating, limited outdoor durability |

| Galvanized Steel Sheet | Zinc-coated for rust protection, durable | HVAC, roofing, agriculture, outdoor infrastructure | + Enhanced corrosion resistance, affordable; – Surface zinc can wear, not ideal for welding-intensive applications |

| Copper Sheet | Excellent conductivity, premium aesthetic | Electrical parts, decorative architecture, busbars | + High electrical/thermal performance, appealing finish; – Expensive, softer—may deform under mechanical loads |

Stainless Steel Sheet

Stainless steel sheet offers superior performance in environments demanding durability, hygiene, and corrosion resistance. This makes it ideal for sectors like food processing, pharmaceuticals, and high-end architectural projects. When sourcing globally, buyers in humid or coastal regions (e.g., West Africa, Mediterranean) should prioritize stainless steel for its ability to withstand aggressive environments with minimal maintenance. Key commercial considerations include precise specification of alloy grade (such as 304 or 316), thickness, and finish—all of which heavily influence cost and function. Bulk procurement can offset the initial higher costs with reduced unit pricing.

Aluminum Sheet

Aluminum sheet stands out for its lightweight composition and resistance to corrosion, making it vital in transport, packaging, and electronics. Its malleability allows for complex forms, crucial for automotive and aerospace parts manufacturers. For B2B buyers in markets where shipping costs and import duties are considerable barriers (like Sub-Saharan Africa), aluminum’s low weight reduces logistics expenses. However, rapid price swings—often tied to commodity markets—require buyers to monitor trends and lock in contracts when possible. Assessing the required alloy and formability against end-use stress is essential to achieving a balance between cost and performance.

Carbon Steel Sheet

Carbon steel remains a mainstay for buyers needing strength and economy. Widely used in construction, machinery, and industrial fabrication, it is frequently sourced for its ready availability and compatibility with mass-production. Buyers operating in emerging markets (such as Africa and South America) benefit from its low price point and robust properties, making it suitable for everything from structural frames to agricultural implements. The key drawbacks—susceptibility to corrosion and maintenance requirements—can be mitigated with coatings or by specifying weathering grades. When large quantities are needed, carbon steel sheet provides unmatched budget control, especially for internal and covered applications.

Galvanized Steel Sheet

Galvanized steel sheet features a zinc coating, granting reliable rust protection and an extended service life, particularly in outdoor or high-moisture applications. HVAC, roofing, and farm equipment manufacturers favor this type for its affordable, maintenance-friendly coverage. B2B buyers must scrutinize the thickness of both the steel core and zinc layer, as these factors dictate lifespan and price. Galvanized sheet is an optimal middle ground for buyers needing corrosion resistance but facing cost limits—though it’s less suited for intensive welding or decorative finishes.

Copper Sheet

Copper sheet is prized for unmatched electrical and thermal conductivity, along with an attractive, upscale finish. It’s a strategic choice for manufacturers of electrical components, power distribution systems, and premium architectural elements. Although copper commands a high price, its technical benefits—such as reduced resistive losses—can justify the investment for critical applications. Buyers in Europe and the Middle East should rigorously assess quality (purity, surface finish) and factor in fluctuations in global copper prices within their procurement strategies. Batch sizes tend to be smaller, but ensuring a reliable, reputable supplier is essential for consistent quality.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of cost of sheet metal

| Industry/Sector | Specific Application of cost of sheet metal | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Construction & Infrastructure | Cladding, roofing, support structures | Durability, cost efficiency, weather resistance | Material grade, corrosion resistance, compliance with standards |

| Automotive & Transportation | Body panels, chassis, engine enclosures | Lightweighting, safety, scalability | Thickness accuracy, forming capability, OEM certification |

| Manufacturing & Industrial Equipment | Machinery enclosures, processing lines | Customization, operational safety, hygiene | Fabrication precision, surface finish, batch volume |

| Agriculture & Agritech | Storage silos, irrigation systems, equipment frames | Longevity, corrosion resistance, easy repair | Environmental adaptability, maintenance cost, lead time |

| Renewable Energy & Utilities | Solar panel frames, wind turbine housings, ductwork | Performance, lifecycle cost control | Material lifespan, weather resistance, installation logistics |

Construction & Infrastructure

In construction, managing the cost of sheet metal is critical for cladding, roofing, and structural supports, particularly in regions facing harsh weather or corrosion risks. Buyers in Africa and the Middle East, for instance, require sheet metal that resists rust in humid or coastal environments while remaining cost-effective for large-scale projects. The solution involves balancing upfront material costs with long-term durability, and ensuring compliance with local building codes. Assessing supplier reliability and material traceability is also essential to prevent project delays or failures.

Automotive & Transportation

Sheet metal costs directly impact the production of automotive body panels, chassis, and enclosures. OEMs and suppliers in South America and Europe focus on sourcing sheets that allow precise forming for aerodynamic designs and meet safety standards. Cost control is achieved via material selection (e.g., aluminum for lightweighting, steel for strength) and negotiation for bulk pricing. Key requirements include consistent thickness, surface quality, and certifications due to strict regulatory environments.

Manufacturing & Industrial Equipment

Manufacturers across sectors such as food processing or electronics depend on custom sheet metal enclosures for machinery and production lines. Here, the cost of sheet metal influences project budgets and the ability to meet unique design specifications. African and Middle Eastern buyers often seek local fabrication partners to reduce logistics costs but must verify whether they can meet demanding tolerances and surface finish requirements. Efficient quoting and batch optimization help ensure projects stay profitable.

Agriculture & Agritech

Modern agritech applications—including silos, irrigation, and equipment frames—demand sheet metal that withstands long-term exposure to chemicals and environmental extremes. In regions like Kenya and Brazil, B2B buyers weigh the upfront cost of higher-grade metals (galvanized, stainless) against maintenance savings over time. Sourcing strategies focus on lead time, adaptability to local environmental conditions, and supplier responsiveness, as harvest cycles require rigorous uptime and minimal equipment failure.

Renewable Energy & Utilities

In the renewable energy sector, cost-effective sheet metal is fundamental for the assembly of solar panel frames, wind turbine housings, and utility ductwork. Energy projects in Europe and the Middle East prioritize lifecycle cost control, weather resistance, and installation efficiency. Sheet metal selection must consider local climate, expected operational lifespan, and logistics for remote or large-scale deployments. Partnering with experienced suppliers and specifying materials proven to withstand UV exposure or chemical corrosion drives long-term value.

Related Video: Forming Sheet Metal & Metal Forming Tools – Uses Explained By Gene Winfield at SEMA

Strategic Material Selection Guide for cost of sheet metal

Choosing the optimal sheet metal material is a critical strategic decision for international B2B buyers seeking the right balance between cost efficiency, technical performance, and market-specific compliance. The following analysis covers four widely used sheet metal materials—carbon steel, stainless steel, aluminum, and galvanized steel—focusing on their key properties, advantages, limitations, and region-specific considerations that can have a direct impact on total project costs and long-term value.

Carbon Steel

Key Properties:

Carbon steel offers robust tensile strength and high load-bearing capacity, making it suitable for structural and general fabrication work. With moderate corrosion resistance (unless treated), it remains workable under moderate temperatures and pressures.

Pros & Cons:

* Pros: Highly cost-effective, easily sourced worldwide, and simple to fabricate, weld, or machine.

* Cons: Prone to corrosion if not adequately coated, which can introduce ongoing maintenance costs, especially in humid or coastal regions. It also tends to be heavier compared to alternatives.

Application Impact:

Best for general-purpose applications in non-corrosive environments—including frameworks, construction, and machinery—where cost sensitivity prevails over corrosion resistance.

Regional Considerations:

Carbon steel adheres to international standards like ASTM A36 (US), DIN EN 10025 (Europe), JIS G3101 (Asia). Consider local climatic conditions: for Africa and the Middle East, anti-corrosion measures are crucial due to humidity and salinity. Carbon steel’s global availability ensures consistent supply.

Stainless Steel

Key Properties:

Stainless steel distinguishes itself with superior corrosion resistance, exceptional hygienic properties, and reliable performance at both high and low temperatures. Grades like 304 and 316 are common, with 316 providing increased chloride resistance for aggressive environments.

Pros & Cons:

* Pros: Durability, low maintenance, aesthetic appeal, and suitability for sanitary applications.

* Cons: High material and processing costs (often 2-3x carbon steel), potentially heavier, and more challenging to machine.

Application Impact:

Ideal for sectors requiring durability and hygiene, such as food processing, chemical/pharmaceutical equipment, and architectural facades—particularly in damp, coastal, or industrial settings.

Regional Considerations:

Widely preferred in Europe and parts of the Middle East for compliance with EU standards (e.g., EN 10088). Buyers in Africa and South America should check for compatibility with local standards (e.g., SABS, IRAM). Anticipate potential supply fluctuations due to global nickel and chromium market volatility.

Aluminum

Key Properties:

Aluminum is valued for its lightweight profile, natural corrosion resistance, and high thermal and electrical conductivity. Suitable for fabrication where weight reduction is a priority.

Pros & Cons:

* Pros: Easy to form, reduces shipping and handling costs, and supports complex geometries.

* Cons: Lower structural strength compared to steel variants, surface abrasion risk, and subject to price volatility.

Application Impact:

Preferred in automotive, aerospace, electrical enclosures, and transport infrastructure—especially where reduced weight equates to higher efficiency (e.g., vehicle panels, HVAC ductwork).

Regional Considerations:

Aluminum is globally available, with standards like ASTM B209 and EN 485. African and South American buyers must consider the impact of potentially higher logistics costs and seasonal price surges driven by international demand. European buyers often require REACH and RoHS compliance.

Galvanized Steel

Key Properties:

Galvanized steel features a carbon steel base with a protective zinc coating to enhance corrosion resistance, especially in exposed or humid environments.

Pros & Cons:

* Pros: More affordable than stainless steel yet offers reliable protection against rust for outdoor or exposed service. Widely used, quick to source, and compatible with standard fabrication.

* Cons: Zinc layer can degrade over time, especially if scratched; limited suitability for aggressive acidic/alkaline exposures; weldability and paint adhesion can be challenging.

Application Impact:

Widely used for roofing, ducting, and agricultural equipment—anywhere a blend of durability and cost control is required for outside use.

Regional Considerations:

Adheres to international standards (e.g., ASTM A653, EN 10346, JIS G3302). In Africa and the Middle East, demand is high for infrastructure and agritech projects due to aggressive local climates. Proper certification ensures consistent zinc coating thickness.

Summary Table: Key Sheet Metal Material Options for Cost-Focused B2B Buyers

| Material | Typical Use Case for cost of sheet metal | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Carbon Steel | General construction frameworks, machine parts | Low cost, strong structural support | Corrosion risk if uncoated | Low |

| Stainless Steel | Food-grade equipment, medical, high-corrosion settings | Superior corrosion resistance, hygiene | High material and processing cost | High |

| Aluminum | Lightweight panels, transport, enclosures | Lightweight, naturally corrosion resistant | Lower strength, cost fluctuates | Medium |

| Galvanized Steel | Roofing, outdoor ducting, agriculture | Cost-effective corrosion protection | Zinc layer wears, limits high-acid/alkali use | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for cost of sheet metal

Key Stages in Sheet Metal Manufacturing

Efficient cost control and product consistency in sheet metal sourcing depend largely on understanding each phase of the manufacturing workflow. For international buyers, clarity in these stages facilitates informed procurement decisions and effective quality assessment.

1. Material Preparation

- Material selection is the cornerstone, with choices such as stainless steel, aluminum, and carbon steel driving not only performance but cost. Buyers should specify grade, thickness, and tolerances upfront, as these impact both price and downstream manufacturability.

- Cutting and sizing processes—using laser, plasma, or mechanical shears—ensure raw material is prepared to specification, minimizing wastage. Best practice involves precise nesting (arrangement of parts on a sheet) to optimize material usage, reducing scrap rates and overall costs.

2. Forming and Shaping

- Bending uses CNC press brakes to create angles or curves, key for chassis, panels, and casings; complexity here directly affects labor and setup cost.

- Stamping or punching involves high-speed presses or CNC turrets, suitable for mass production of uniform holes, slots, or embossments. Buyers should request details on stamping dies and their maintenance, especially for high-volume orders.

- Rolling is employed for cylindrical or curved shapes, often used in HVAC, marine, or architectural applications.

3. Assembly and Joining

- Welding (TIG, MIG, spot, or robotic) is critical for structural integrity—each weld type has cost, speed, and strength implications.

- Fastening methods like riveting or bolting are alternatives to welding and may reduce labor costs or avoid local skill shortages.

- For complex assemblies, precision and process controls (e.g., jigs and fixtures) ensure consistency, lowering defect rates and improving project timelines.

4. Surface Treatment and Finishing

- Degreasing and cleaning prepare parts for painting, plating, or powder coating, vital for appearance and corrosion resistance.

- Coating and finishing choices such as galvanizing, anodizing, or painting increase durability and affect overall lifecycle costs.

- Surface finish (e.g., matte, gloss, brushed) impacts aesthetics and maintenance needs, often governed by end-market requirements (e.g., architectural vs. industrial).

Core Sheet Metal Fabrication Techniques and Their Cost Impact

Different fabrication methods carry unique cost, speed, and quality trade-offs. International buyers benefit from understanding these to negotiate better and select the right supplier capability set.

- Laser cutting: High precision and speed for complex profiles; initial investment higher but offsets labor in volume jobs.

- CNC punching: Excellent for repetitive holes or features; cost-effective at scale, lower setup and quicker cycle times.

- Manual and robotic welding: Robotic systems yield consistency and faster cycle times, but manual welding supports complex, low-volume builds.

- Finishing lines (automated vs. manual): Automation increases throughput and repeatability but requires volume to justify setup costs.

Opting for standard processes where possible, rather than custom setups, can significantly reduce both machine time and tooling expenses.

Quality Control: Ensuring Consistent and Compliant Output

For B2B buyers, particularly those sourcing internationally, quality control is non-negotiable. Thorough QC ensures compliance with technical specifications, reduces costly rework or recalls, and protects brand reputation across diverse regulatory environments.

International and Industry-Specific Standards

- ISO 9001 is the foundation for quality management across global suppliers, ensuring traceability, documented processes, and continuous improvement cycles.

- ISO 2768 and ISO 13920 cover general tolerances for sheet metal fabrication and welding, respectively—requesting suppliers’ adherence to these mitigates risk of dimensional or assembly issues.

- CE Marking (Europe), API (American Petroleum Institute), and other sector-specific badges denote compliance with strict regulatory or industry benchmarks. When sourcing for highly regulated industries (e.g., automotive, construction, energy), these marks are critical.

Critical Quality Control Checkpoints

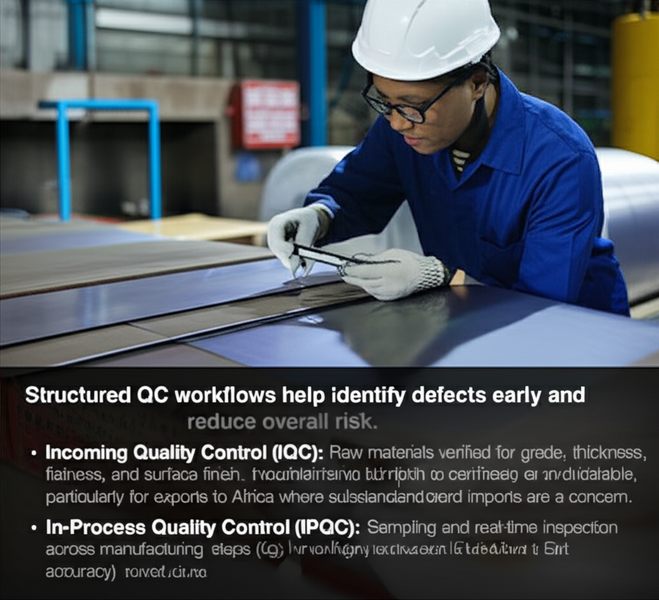

Structured QC workflows help identify defects early and reduce overall risk:

– Incoming Quality Control (IQC): Raw materials verified for grade, thickness, flatness, and surface finish. Independent mill certificates are advisable, particularly for exports to Africa or the Middle East where substandard imports are a concern.

– In-Process Quality Control (IPQC): Sampling and real-time inspection across manufacturing steps (e.g., bend angles, weld seams, punch location accuracy) prevent costly downstream errors.

– Final Quality Control (FQC): Comprehensive inspection before shipment, including dimensional verification (using calipers, gauges), visual surface checks, weld integrity (often via dye-penetrant or ultrasonic testing), and coating thickness tests.

Common Testing and Inspection Methods

Robust inspection underpins consistent performance and contractual peace of mind:

– Dimensional checks: Gauge tools and coordinate measuring machines (CMM) for high precision parts.

– Non-destructive testing (NDT): Ultrasonic, magnetic particle, and dye-penetrant methods are standard for welds and critical stress points.

– Salt spray and environmental testing: Validates corrosion resistance for export to humid or coastal regions (key for buyers from Kenya, Middle East coast, or Brazil).

– Surface adhesion or coating thickness (using XRF or micro-meter tools) confirm finishing standards.

Best Practices for International Buyer Verification

Proactive supplier validation avoids missteps, especially when navigating long-distance sourcing or new markets.

- On-site audits: Either by your team or accredited third-party inspectors. Evaluate process controls, equipment calibration, and operator training. Instruct auditors to review recent QC records, non-conformity logs, and traceability flows.

- Documented QC reports: Insist on receiving material certificates, process checksheets, inspection records, and compliance documents (ISO, CE, etc.) with every batch. These facilitate smooth customs clearance in regions like the EU or Gulf Cooperation Council (GCC).

- Third-party inspection: Global services (e.g., SGS, TÜV, BV) can independently verify batch quality, sample testing, and container loading, offering reassurance for buyers in Africa or South America with emerging local standards.

- Sample approval and first article inspection: Request pre-shipment samples or pilot batches. Evaluate against drawings/specifications before authorizing mass production.

Regional Considerations and Certification Nuances

Regulation, climate, and operational expectations vary by region, affecting both QC requirements and certification pathways:

- Africa: Anti-dumping initiatives in nations like Kenya and Nigeria heighten scrutiny on imports. Documentation of grade/certificates is essential. Consider buffer stock or local warehousing to manage customs or QC delays.

- South America: Regulatory acceptance of North American and European standards is strong, but port inspection protocols may be stringent—especially for infrastructure or power sector sheet metal.

- Middle East: Projects may require compliance with GCC or country-level standards (e.g., SASO in Saudi Arabia). Environmental resistance (sand, salt, extreme heat) should be tested and documented.

- Europe: The CE mark and EN standards are mandatory for many applications. Failure to comply leads to costly project shutdowns or legal action.

Actionable Insights for B2B Sheet Metal Buyers

- Clearly define technical and quality requirements in contracts and RFQs, referencing relevant international standards and certifications.

- Demand documentation and third-party validation to confirm compliance and material traceability.

- Balance cost with total lifecycle value: lower upfront costs can be offset by higher defect rates or premature failure.

- Monitor regional supply chain risks: Stay updated on material price fluctuations, trade regulations, and logistics issues that may impact both manufacturing cost and QC timelines.

- Collaborate with suppliers early for design-for-manufacturing advice; simplified components reduce both fabrication costs and defect rates.

Savvy B2B buyers who internalize manufacturing and QC best practices will consistently secure high-quality sheet metal that meets budget, regulatory, and performance benchmarks—ensuring on-time, trouble-free project delivery across borders and industries.

Related Video: Sheet Metal Coil Processing

Comprehensive Cost and Pricing Analysis for cost of sheet metal Sourcing

Understanding Sheet Metal Cost Components in International B2B Sourcing

A clear grasp of cost breakdowns is essential for organizations sourcing sheet metal globally. Total cost is shaped by multiple variables—each influenced by regional factors, supplier capabilities, and end-use requirements. Below is a deep dive into the main contributors and price influencers relevant for international B2B buyers across Africa, South America, the Middle East, and Europe.

Key Cost Components

-

Material Costs

– Raw materials typically comprise 40-60% of the total cost. The price varies with material type (stainless steel, carbon steel, aluminum, etc.), grade, thickness, and global market trends. For example, stainless steel often commands a price premium, while aluminum is relatively lighter and may be more cost-effective depending on market demand.

– Buyers should account for potential waste (typically 10–25%) and edge allowances when budgeting. -

Labor Costs

– Labor expenses differ significantly by region. While automation can reduce labor needs, skilled tasks—like high-precision welding or forming—carry premium labor rates.

– For example, labor costs in Europe and the Middle East tend to be higher than in emerging African or South American markets. Projects with complex designs will drive up skilled labor and training costs. -

Manufacturing Overhead

– Includes equipment depreciation, energy consumption (e.g., laser cutting machines), and facility costs. Energy prices and the efficiency of installed machinery can vary by geography, impacting the final price.

– Modern fabrication tech increases cost efficiency but may incur higher upfront investment. -

Tooling and Setup

– Custom tooling (for stamping, forming, or punching) can represent a substantial initial expense, particularly for short runs or prototypes. These costs decrease as order volumes rise and can be minimized by using standard tooling. -

Quality Control (QC)

– Stringent quality and certification requirements (ISO, CE, etc.) increase QC costs but often reduce risk and long-term maintenance. Buyers should weigh upfront QC investment against lifecycle cost savings. -

Logistics and Shipping

– Freight, customs duties, insurance, and inland transport can represent a sizable share of total costs, especially for transcontinental shipments. Shipping rates fluctuate based on international trade dynamics and Incoterms. -

Supplier Margin

– Suppliers add a margin to cover business sustainability and profit. Transparent quotations and negotiation can help buyers clarify and manage margin expectations.

Core Pricing Influencers

- Order Volume / Minimum Order Quantity (MOQ): Higher volumes generally secure better per-unit rates due to economies of scale and amortized setup/tooling costs.

- Specifications & Customization: Tight tolerances, complex geometries, or customized finishes drive up costs. Standardization and design-for-manufacturing principles can counterbalance these premiums.

- Material Selection: The chosen sheet type, grade, and thickness directly impact not only raw material costs but also downstream manufacturing requirements.

- Required Quality & Certifications: Demanding higher international standards or certifications (e.g., for EU or Middle Eastern infrastructure projects) may increase both production and QC expenses.

- Supplier Location & Scale: Local market conditions, labor rates, proximity to ports, and supplier production capacity all factor into pricing differentials. Buyers in Africa or South America may find cost advantages when sourcing regionally or from Asia.

- Incoterms & Delivery Terms: Incoterms (FOB, CIF, DDP, etc.) dictate where liability, insurance, and transport costs are assumed, significantly affecting the landed cost in your region.

Actionable Tips for International Buyers

- Negotiate Based on Volume and Contract Length: Leverage multi-year or bulk contracts to secure tiered pricing. Discuss the potential for volume-based discounts, especially when ordering standard sizes or materials.

- Optimize Design Early: Simplify geometries and standardize materials or tolerances to reduce labor, waste, tooling, and QC costs. Engage with potential suppliers during the design phase to identify cost-saving opportunities.

- Request Detailed Quotes: Insist on transparent and itemized quotations that break down material, labor, tooling, overhead, QC, and margin. This clarity facilitates informed negotiations and benchmarking across suppliers.

- Assess Total Cost of Ownership (TCO): Factor in not only upfront material and fabrication costs, but also logistics, taxes/duties, long-term maintenance, and potential rework due to quality lapses.

- Consider Regional Strengths: Buyers in the Middle East or Africa may benefit from proximity to raw material sources; European buyers might prioritize suppliers with established quality certifications; South American buyers should evaluate local logistics networks.

- Clarify Incoterms and Lead Times: Ensure mutual understanding of Incoterms to avoid surprise costs at customs or delivery. Align production and shipping schedules with your project requirements.

Disclaimer: All cost figures and price ranges referenced are for indicative purposes only; actual prices fluctuate with raw material markets, regional labor rates, energy prices, and supplier policies. Always conduct up-to-date, project-specific market research and due diligence.

By dissecting the full sheet metal cost structure and leveraging strategic sourcing practices, B2B buyers can optimize both price and value—unlocking stable supply chains and competitive project outcomes across continents.

Spotlight on Potential cost of sheet metal Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘cost of sheet metal’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

sheet metal cost Manufacturers in the world (www.mfgpro.tech)

Founded as a consortium of industry-leading sheet metal fabrication specialists, “sheet metal cost Manufacturers in the world” brings together top global producers with a focus on delivering high-quality, cost-optimized sheet metal solutions. With members such as Genesee Global Group, RAS Systems, Boyan, Highland Machine, and Northstar Metal Products, the group emphasizes precision engineering, cost and time efficiency, and reliable global supply chains. Advanced technologies—including CNC machining, automated bending, and custom fabrication—enable these manufacturers to support diverse requirements, from standard enclosures to complex assemblies.

Several members hold ISO 9001:2015 certifications, underscoring their commitment to stringent quality standards. Their collective experience in servicing international markets—including Europe, Africa, the Middle East, and South America—positions them as strategic partners for B2B buyers seeking both value and consistency. Unique selling points include integrated powder coating, custom tooling, and rapid prototyping, ensuring adaptability for projects with demanding timelines or specifications.

Ultimate B2B Guide: Sourcing Industrial Sheet Metal Globally (www.customproc.com)

Ultimate B2B Guide: Sourcing Industrial Sheet Metal Globally serves as a leading knowledge resource and potential partner for international sheet metal procurement, with particular expertise in guiding buyers through the complexities of global industrial sourcing. The company excels in helping B2B buyers identify optimal materials—from stainless steel and aluminum to carbon and galvanized steel—ensuring alignment with specific technical, environmental, and regulatory needs in diverse markets such as Africa, South America, the Middle East, and Europe. Their guidance emphasizes not only product selection but also navigating supply chain risks, cost drivers, and quality standards critical to industrial projects. The organization is noted for its practical approach to global sourcing, leveraging in-depth market analysis and supplier evaluation insights tailored for multinational procurement requirements. While specific certifications or in-house manufacturing capabilities are not publicly detailed, their comprehensive, region-aware support makes them a go-to advisor in the industrial sheet metal cost and sourcing sector.

Global Giants: Top 10 Sheet Metal Manufacturers in 2024 (sheetmetalmasion.com)

Sheet Metal Masion, based in Ningbo, China, stands out as a leading contract manufacturer specializing in custom sheet metal components for global industrial applications. Operating from a sprawling 30,000 m² facility and employing over 400 staff, the company boasts a high-volume production capacity—exceeding 7 million parts annually—making it well-suited for large-scale B2B sourcing needs. Key strengths include precision fabrication, broad material expertise (including stainless steel, aluminum, and carbon steel), and flexibility across batch sizes. While specific certifications or quality assurances are not detailed publicly, Sheet Metal Masion’s scale, advanced manufacturing infrastructure, and established export operations position it as a reliable partner for international buyers, especially those prioritizing cost efficiency and responsive lead times in Africa, the Middle East, South America, and Europe.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| sheet metal cost Manufacturers in the world | Certified multinational group, efficient and customizable sheet metal. | www.mfgpro.tech |

| Ultimate B2B Guide: Sourcing Industrial Sheet Metal Globally | Expert B2B advice for global sheet metal sourcing. | www.customproc.com |

| Global Giants: Top 10 Sheet Metal Manufacturers in 2024 | High-volume, cost-efficient custom sheet metal. | sheetmetalmasion.com |

Essential Technical Properties and Trade Terminology for cost of sheet metal

Key Technical Properties Impacting Sheet Metal Cost

Understanding the most critical technical specifications is essential for B2B buyers who aim to manage costs, ensure performance, and negotiate effectively with international suppliers. Below are the primary properties that directly affect sheet metal pricing and suitability for specific applications:

-

Material Grade

Material grade defines the chemical composition and mechanical properties of the sheet metal, such as strength, corrosion resistance, and machinability. For example, 304 stainless steel is widely used for its balance of cost and performance, while higher grades like 316 offer greater corrosion resistance but at a premium price. Selecting the right grade ensures compliance with industry standards, reduces long-term maintenance, and avoids costly over-specification. -

Thickness (Gauge)

The thickness of the sheet, typically specified in millimeters or gauge, directly influences cost, structural performance, and weight. Thicker materials are more expensive both in terms of raw material and fabrication processes (e.g., cutting, bending). Accurately specifying the required thickness—without excessive safety margins—can result in substantial cost savings without sacrificing product integrity. -

Tolerance

Tolerance refers to the allowable variation in sheet metal dimensions (e.g., thickness, length, width). Tight tolerances are often required in high-precision industries like electronics or automotive but can increase machining time and production costs. For many industrial applications, specifying standard tolerances can reduce both price and lead times. -

Surface Finish

The type of surface finish—such as mill finish, powder coating, or galvanization—affects not only aesthetics but also corrosion resistance and subsequent fabrication steps. Enhanced finishes incur additional processing expenses. Buyers should align finish requirements with the intended application to avoid unnecessary costs while ensuring product durability. -

Quantity (Order Volume)

The number of units or total tonnage ordered has a major impact on per-unit pricing due to economies of scale. Large batch orders typically lower production and material costs per unit. Understanding your volume requirements allows for more favorable price negotiations and better long-term supplier relationships. -

Formability

This denotes how easily a material can be bent, cut, or shaped without cracking or losing strength. Materials with higher formability simplify fabrication, reducing rejection rates and labor costs. Carefully assess your application’s forming needs to avoid unanticipated expenses in production.

Essential Trade Terms and Jargon in Sheet Metal Procurement

Navigating international sheet metal markets necessitates familiarity with trade terminology. The following terms frequently appear in quotations, contracts, and supplier communications:

-

OEM (Original Equipment Manufacturer)

Refers to a company that produces sheet metal parts or assemblies to be used in another company’s end products. In B2B transactions, engaging with an OEM ensures components designed to precise specifications, often tailored for integration into larger assemblies. -

MOQ (Minimum Order Quantity)

This is the smallest batch size a supplier is willing to manufacture or sell. MOQ impacts price, lead time, and negotiation leverage. Buyers with lower volume needs should discuss MOQ flexibility to optimize costs or consolidate orders regionally. -

RFQ (Request for Quotation)

An RFQ is a formal document sent to potential suppliers to solicit pricing, lead times, and technical capability information based on a specific set of sheet metal requirements. Precise RFQs reduce misunderstandings and accelerate procurement cycles. -

Incoterms (International Commercial Terms)

Globally recognized trade terms that outline the division of responsibilities, risks, and costs for shipping and delivery between buyers and sellers. Common examples include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and EXW (Ex Works). Clear specification of Incoterms in contracts safeguards against unexpected transportation or customs expenses. -

Lead Time

Refers to the total time from order placement to delivery. Lead time is affected by material availability, manufacturing complexity, and transit distance. Accurate lead time projections help prevent costly project delays and optimize inventory. -

FOB/CIF/EXW

These Incoterms specifics are particularly critical in international transactions. - FOB (Free On Board): Seller delivers goods to the port of shipment, and risk transfers to the buyer at that point.

- CIF (Cost, Insurance, and Freight): Seller covers costs and insurance up to the destination port.

- EXW (Ex Works): Buyer assumes all transportation risks and costs from the seller’s premises.

Actionable Insights for B2B Buyers

- Clearly define technical specifications—over-specifying material quality, tolerance, or finish can lead to unnecessary expense.

- Always clarify trade terms and Incoterms in contracts to avoid unforeseen logistical or duty costs, especially for cross-border shipments.

- Leverage order volume and long-term supplier relationships to negotiate better pricing and more flexible MOQs.

- Use precise and detailed RFQs to enable accurate comparison and informed procurement decisions.

By mastering these critical technical properties and understanding essential industry terms, international buyers—whether sourcing from Paris, Nairobi, São Paulo, or Dubai—can make informed, cost-effective sheet metal purchasing decisions that align with business objectives and project requirements.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the cost of sheet metal Sector

Global Market Overview and Key Trends

The cost of sheet metal is highly dynamic, shaped by fluctuating commodity prices, shifting supply chain routes, and rapid advancements in manufacturing technology. International B2B buyers—whether sourcing for Kenyan construction projects or French automotive production—must navigate a sector influenced by macroeconomic drivers such as raw material availability, regional demand surges, and evolving geopolitical considerations. For example, disruptions in steel and aluminum supply from major producers can quickly impact availability and pricing across Africa, the Middle East, and Europe.

One key trend is the increasing adoption of digital sourcing tools, real-time price tracking, and e-procurement platforms, which enable buyers to negotiate more transparently and minimize the risk of price volatility. Strategic sourcing from diverse regions is also rising, as buyers seek to mitigate risk by balancing cost-effective suppliers in Asia or South America with closer-to-home providers that offer greater reliability and compliance with local standards. Automation and advanced manufacturing methods—like CNC machining, high-speed laser cutting, and AI-driven nesting software—are enabling suppliers to optimize production, cut waste, and offer more competitive pricing even as base material costs rise.

In emerging markets within Africa and South America, limited local sheet metal production capacity sometimes means importing semifinished or finished products. Here, buyers must pay close attention to international logistics, tariffs, and transport costs, which can represent a significant share of the overall price. Meanwhile, European and Middle Eastern companies face growing pressure to adhere to stricter quality certifications and environmental regulations, adding another layer of complexity to the sourcing equation.

Sustainability and Ethical Sourcing Considerations

Sustainability now plays a central role in sheet metal procurement decisions for global B2B buyers. Environmental impact is front-of-mind: mining and processing metals like steel and aluminum are energy-intensive and significant sources of carbon emissions. Therefore, many companies are re-evaluating supplier practices and increasingly prioritizing those who demonstrate robust environmental stewardship.

A primary driver in this shift is the growing demand for ‘green’ sheet metal—products made with recycled content, low-carbon energy, or certified under programs like ISO 14001 (Environmental Management) or ResponsibleSteel. European buyers, in particular, are mandating compliance with REACH regulations and exploring materials with Environmental Product Declarations (EPDs). African and South American firms, while often focused on cost control, are recognizing that sustainable sourcing can be a differentiator in winning international contracts or government tenders.

Ethical sourcing is also critical, especially in the mining and initial processing stages. B2B buyers should perform due diligence on supply chain transparency, ensuring that metals are not linked to illegal mining, labor abuses, or environmental destruction. Requesting supplier certifications such as the Responsible Minerals Initiative (RMI) or tracking through chain-of-custody documentation can help buyers align procurement with both regulatory requirements and corporate social responsibility (CSR) commitments.

Actionable insights:

- Prioritize suppliers with clear sustainability credentials and verifiable green certifications.

- Request evidence of recycled content and low-carbon manufacturing processes.

- Incorporate environmental and ethical criteria into RFQs and supplier evaluations.

- Monitor and adapt to evolving regional and international sustainability regulations.

Brief Evolution and Historical Context

The sheet metal industry has evolved from traditional manual rolling mills to modern, automated production lines capable of extraordinary precision and scale. In the early 20th century, most production was concentrated in industrialized economies, using energy-intensive methods with little environmental regulation. Spurred by globalization and technology, fabrication methods have dramatically improved, reducing costs and increasing customization.

Today, digital design tools, automated equipment, and integrated ERP systems enable global supply chains to deliver tailored sheet metal products faster and more consistently than ever. This evolution has democratized access for buyers in emerging markets like Africa and South America, while increasing competition and driving continuous quality and sustainability improvements worldwide.

Related Video: Incoterms® 2020 Explained for Import Export Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of cost of sheet metal

-

How can I effectively evaluate and select reliable international sheet metal suppliers?

Begin by reviewing the supplier’s certifications (such as ISO 9001), quality control processes, and client references. Request detailed documentation on material sourcing, production capacity, and previous export experience—especially to your region. Always verify the supplier’s reputation through third-party audits or reputable B2B platforms. For African, Middle Eastern, or South American buyers, ensure the supplier is familiar with your local regulatory requirements and shipping procedures. Establish clear SLAs and include inspection clauses in your contract to protect your interests. -

What factors most affect the cost of sheet metal for international orders?

Key elements include the type of metal (stainless steel, aluminum, etc.), thickness, grade, and finish. Design complexity, required fabrication processes, and order volume all influence price. Market-driven variables such as global commodity prices, currency fluctuations, and logistics costs also play major roles. For importers in Africa and South America, anticipate regional shipping and customs charges. Always request itemized quotes and analyze how each factor impacts your total landed cost. -

Can I request customized sheet metal products with specific finishes, dimensions, or tolerances?

Most established sheet metal suppliers offer extensive customization, including size, thickness, hole patterns, surface treatments (galvanization, powder coating), and precision tolerances. Submit detailed technical drawings and clear specifications to ensure feasibility and accurate cost estimation. For custom orders, expect longer lead times and potentially higher MOQs. Ask your supplier to share prior customization case studies and recommend cost-effective design changes to optimize manufacturability. -

What are typical minimum order quantities (MOQ), lead times, and payment terms for international sheet metal orders?

MOQs vary by material, process, and supplier—but often start from 100–500 units or a minimum weight/volume. Standard production lead times range between 3–8 weeks, with additional time for ocean or air freight. For payment, reputable suppliers usually require 30–50% upfront (with balance on shipment or delivery). For new buyers, using secure payment methods such as letters of credit or escrow can reduce risk. Discuss batch shipping, partial deliveries, and schedule flexibility if needed. -

How do I ensure material quality and compliance with international standards?

Always require documentation such as mill test certificates (MTCs), Certificates of Conformity (CoC), and batch traceability for every order. Specify compliance with relevant standards (ASTM, EN, ISO) in your purchase agreement. Arrange for pre-shipment inspections (either by your team or a third-party agent) to verify dimensional accuracy, surface quality, and packaging. For projects in regulated sectors (e.g., construction, automotive), ensure products meet both destination country and project-specific certifications. -

What should I consider when arranging shipping and logistics for cross-border sheet metal orders?

Work with suppliers experienced in exporting to your region—this ensures knowledge of customs paperwork, standard incoterms (FOB, CIF, DDP), and preferred freight modes. Confirm packaging specifications to prevent transit damage (especially with large or heavy sheets). For destinations like Kenya or Brazil, clarify port handling capacity and final-mile delivery options. Factor in customs duties, taxes, and possible clearance delays; partner with a reputable freight forwarder to streamline the process. -

How can I manage disputes, quality issues, or delivery delays with international suppliers?

Establish clear contract terms for dispute resolution, including procedures for claims, defective goods, or missed deadlines. Define penalties, return/replacement protocols, and timelines for corrective action within your purchase agreement. Maintain open communication and document all key correspondences. Consider sourcing from suppliers with established after-sales support in your region or using trade assurance programs to reduce risk. It’s advisable to retain a percentage of payment until satisfactory delivery and inspection. -

What are the current regional trends or challenges impacting sheet metal costs for buyers in Africa, South America, the Middle East, and Europe?

Global volatility in commodity prices, shipping disruptions, and variations in local demand can affect pricing and lead times. In Africa and South America, logistics infrastructure and strict import regulations often add cost and complexity. European buyers must watch labor and energy costs, while Middle Eastern buyers may see fluctuations based on infrastructural projects. Stay informed through market reports, leverage flexible sourcing strategies, and maintain communication with suppliers to adapt procurement plans as conditions shift.

Strategic Sourcing Conclusion and Outlook for cost of sheet metal

As global industries continue to evolve, the cost of sheet metal remains a critical factor shaping procurement strategies and operational competitiveness. International B2B buyers—whether sourcing for infrastructure projects in Kenya, automotive components in Brazil, or manufacturing in France—must navigate a landscape influenced by fluctuating material prices, regional labor rates, and rapidly advancing fabrication technologies. The most successful organizations are those that treat sheet metal sourcing not as a commodity transaction, but as a strategic lever for long-term value creation.

Key B2B takeaways include:

– Material Selection Matters: Choose sheet metal grades and suppliers that precisely match your application requirements to avoid overspending on unnecessary specifications or compromising performance.

– Balance Cost Drivers: Continuously monitor and negotiate on core cost factors—raw materials, labor, machine utilization, and tooling—to ensure optimal, sustainable pricing.

– Regional Insights: Leverage regional strengths, such as lower labor costs or proximity to raw materials, while staying vigilant to local compliance standards and logistical challenges.

– Supplier Partnerships: Prioritize supplier reliability and transparency; strong relationships facilitate cost predictability, consistent quality, and agile response to market changes.

– Embrace Innovation: Adopt modern digital procurement tools and advanced manufacturing processes to unlock efficiencies, reduce waste, and gain a competitive edge.

Looking ahead, the ability to strategically source sheet metal will separate leaders from laggards in the global supply chain. Proactive buyers who invest in market intelligence, flexible supplier networks, and continuous process optimization will be well-positioned to control costs, mitigate risks, and seize new opportunities in a dynamic marketplace. Now is the time to elevate your sourcing strategy and drive lasting impact across your operations.