Introduction: Navigating the Global Market for bronze or brass

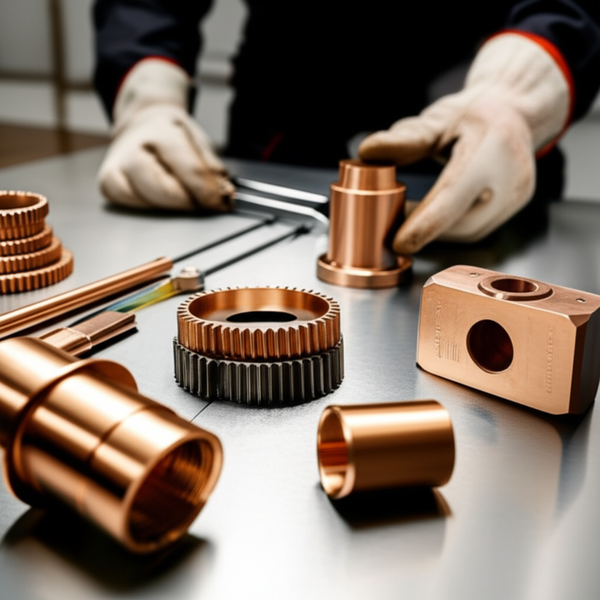

Navigating the global marketplace for bronze and brass components is a strategic imperative for international B2B buyers seeking to optimize quality, cost-efficiency, and supply stability. These copper alloys are vital across diverse sectors—from marine and energy to construction and automotive—making their correct selection crucial for operational success and long-term durability. Given the regional variations in material standards, environmental conditions, and regulatory frameworks, sourcing decisions must be informed by a comprehensive understanding of alloy types, manufacturing practices, and market dynamics.

This guide offers a thorough exploration of bronze and brass, covering essential material compositions, manufacturing best practices, quality control standards, and regional supplier landscapes. It also provides critical insights into cost analysis, market trends, and regional considerations—particularly tailored for buyers from Africa, South America, the Middle East, and Europe (including the UK and Spain). Whether you are evaluating supplier reliability, negotiating prices, or ensuring compliance with local standards, this resource empowers you to make confident, data-driven sourcing decisions.

By understanding the nuanced differences between these alloys and the regional market factors influencing their availability, buyers can reduce procurement risks, enhance product performance, and achieve a competitive edge. Ultimately, this guide equips international B2B buyers with the knowledge to navigate complex global markets effectively, ensuring every sourcing decision is precise, compliant, and optimized for long-term success.

Understanding bronze or brass Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Cartridge Brass | High copper (~70%), high zinc (~30%), bright yellow color, excellent ductility | Plumbing fittings, electrical connectors, decorative hardware | Easy to machine, good formability; moderate corrosion resistance, susceptible to dezincification in water environments |

| Free-Cutting Brass | Contains lead (for machinability), high zinc content (~35%), golden appearance | Precision machined parts, fasteners, instrumentation components | Superior machinability reduces tooling costs; unsuitable for potable water or food contact due to lead content |

| Tin Bronze | Copper-tin alloy (~88% Cu, 12% Sn), reddish-brown hue | Marine hardware, bearings, bushings, casting applications | Excellent wear and corrosion resistance; higher cost and more challenging to machine |

| Aluminum Bronze | Copper-aluminum alloy (up to 12% Al), gold-like color | Valves, marine hardware, oil & gas components | Exceptional seawater corrosion resistance; more expensive and less ductile, requiring careful forming |

| Phosphor Bronze | Copper-tin-phosphorus alloy, increased hardness (~5% P) | Springs, electrical contacts, gears, bearings | High fatigue and wear resistance; higher price, more difficult to machine, needs precise processing |

Cartridge Brass

Cartridge brass is characterized by its high copper and zinc content, offering excellent ductility and ease of machining. Its bright yellow appearance makes it popular in decorative applications, but its moderate corrosion resistance and vulnerability to dezincification in water environments require careful consideration, especially in plumbing or outdoor settings. B2B buyers should evaluate water quality and operational conditions to determine suitability, as untreated or aggressive water can accelerate corrosion. Its cost-effectiveness and workability make it ideal for high-volume manufacturing of electrical fittings and architectural hardware, but long-term performance in corrosive environments may demand additional protective coatings or material alternatives.

Free-Cutting Brass

Designed specifically for machining, free-cutting brass contains added lead, which dramatically enhances its machinability. This alloy is favored in industries producing precision components such as fasteners, instrumentation parts, and small mechanical assemblies. Its high zinc content and lead addition allow for faster production cycles and lower tooling costs. However, lead content raises regulatory and health concerns, restricting its use in potable water and food-related applications. B2B buyers in sectors like automotive or electronics should verify compliance with local safety standards and consider alternative alloys if health or environmental regulations are strict. Its cost efficiency and superior machinability provide a competitive edge in high-volume manufacturing.

Tin Bronze

Tin bronze is distinguished by its high corrosion and wear resistance, especially in marine and heavy-duty environments. Its copper-tin composition imparts strength and durability, making it suitable for bearings, bushings, and marine hardware exposed to harsh conditions. While its superior performance justifies a higher purchase price, it presents challenges in machining and forming, often requiring specialized tooling and processes. B2B buyers should consider long-term operational savings through reduced maintenance and replacements when sourcing tin bronze. Its application in critical environments demands careful supplier evaluation to ensure consistent alloy quality and adherence to marine or industrial standards.

Aluminum Bronze

Aluminum bronze combines copper with up to 12% aluminum, resulting in a highly corrosion-resistant alloy suitable for aggressive environments like seawater, chemicals, and oil extraction. Its high strength and wear resistance make it a preferred choice for valves, pumps, and structural components in the oil & gas, marine, and chemical industries. The alloy’s higher cost and lower ductility necessitate precise forming and manufacturing techniques, often requiring specialized equipment. B2B buyers should prioritize suppliers with proven certifications and experience in producing complex, high-performance aluminum bronze components. Its durability can lead to significant lifecycle cost savings despite initial higher procurement costs.

Phosphor Bronze

Phosphor bronze is known for its high fatigue strength, elasticity, and wear resistance, making it ideal for springs, electrical contacts, gears, and bearings. The addition of phosphorus enhances hardness and reduces friction, enabling reliable performance in dynamic mechanical applications. Its higher price reflects its specialized properties, and machining requires careful process control to avoid material degradation. B2B buyers should focus on sourcing from reputable suppliers with strict quality control to ensure consistency, especially for critical electrical or mechanical components. Its superior performance in demanding environments can justify premium pricing, especially in sectors like aerospace, electrical engineering, and precision machinery.

Related Video: What is Data Modelling? Beginner’s Guide to Data Models and Data Modelling

Key Industrial Applications of bronze or brass

| Industry/Sector | Specific Application of bronze or brass | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Marine & Offshore | Marine propellers, shaft bearings, seawater pumps | Superior corrosion resistance ensures longer lifespan and reliability in harsh marine environments | Material certification, resistance to seawater corrosion, consistent alloy quality |

| Oil & Gas | Valves, pumps, offshore platform components | High durability and chemical resistance reduce maintenance costs and prevent failures | Resistance to aggressive chemicals, compliance with industry standards, supply stability |

| Electrical & Electronics | Electrical connectors, switches, circuit components | Excellent electrical conductivity and machinability optimize performance and manufacturing efficiency | Conductivity standards, machinability, traceability, lead content regulations |

| Construction & Infrastructure | Architectural hardware, decorative fixtures, structural fittings | Aesthetic appeal combined with corrosion resistance enhances durability and visual quality | Finish quality, corrosion resistance, regional certifications, environmental standards |

| Automotive & Transportation | Fasteners, gears, cooling system components | Good machinability and wear resistance improve manufacturing efficiency and component lifespan | Material consistency, compliance with safety standards, supply reliability |

Marine & Offshore Applications

Bronze is extensively used in marine environments due to its exceptional resistance to seawater corrosion. Components such as propellers, shaft bearings, and seawater pumps rely on bronze alloys like aluminum bronze and tin bronze to withstand harsh, corrosive conditions. For international buyers from regions like Africa, South America, or the Middle East, sourcing high-quality marine-grade bronze ensures long-term operational reliability, reducing costly downtime and maintenance. Suppliers must provide certifications confirming alloy composition and seawater resistance, especially vital for projects in remote or environmentally sensitive areas.

Oil & Gas Industry

In the oil and gas sector, bronze components such as valves, pumps, and offshore platform fittings are critical for safe and efficient operations. These applications demand materials with high mechanical strength, excellent corrosion resistance, and chemical stability under extreme conditions. Buyers from Europe and the Middle East should prioritize suppliers offering alloys like aluminum bronze and phosphor bronze that meet industry standards like API or NACE. Securing reliable supply chains with traceable quality and certifications minimizes risks of failure and ensures compliance with stringent safety regulations.

Electrical & Electronics Sector

Brass alloys, notably cartridge brass and free-cutting brass, are preferred for electrical connectors, switches, and circuit components. These materials offer excellent electrical conductivity, ease of machining, and consistent quality, which are essential for high-performance electronic assemblies. International buyers from South America and Europe should focus on sourcing suppliers that provide certified materials compliant with international standards such as RoHS or REACH, especially considering environmental regulations on lead content. Reliable sourcing ensures product performance and regulatory compliance across diverse markets.

Construction & Infrastructure

Brass and bronze are widely used in architectural hardware, decorative fixtures, and structural fittings due to their aesthetic appeal and resistance to corrosion. These alloys are suitable for outdoor installations, bridges, and decorative facades, especially in regions with high humidity or pollution. For European and Middle Eastern markets, sourcing high-quality finishes and corrosion-resistant alloys is vital to ensure longevity and maintain visual appeal. Buyers should consider regional certifications, environmental standards, and supplier reputation to mitigate risks of substandard materials affecting project durability and aesthetics.

Automotive & Transportation

In automotive manufacturing, brass and bronze components such as fasteners, gears, and cooling system parts benefit from their machinability, wear resistance, and thermal stability. These alloys contribute to longer-lasting parts that withstand operational stresses. International buyers in Africa and South America should prioritize suppliers offering consistent alloy compositions, compliance with safety standards, and reliable delivery timelines. Ensuring material traceability and quality control is crucial for integrating bronze or brass parts into complex, safety-critical systems, reducing warranty costs and operational failures.

Related Video: BRASS VS BRONZE – COMPOSITION, DIFFERENCE , ALLOY & USES – TECHTALK WITH KAPTAN

Strategic Material Selection Guide for bronze or brass

Analysis of Common Bronze and Brass Materials for B2B Sourcing

When selecting materials for industrial applications, B2B buyers must consider the specific properties, cost implications, manufacturing complexities, and regional standards that influence performance and compliance. Below are detailed insights into four prevalent alloys—each with distinct advantages and limitations—tailored to meet the needs of international markets, especially in Africa, South America, the Middle East, and Europe.

Cartridge Brass (C26000)

Key Properties:

Cartridge brass, composed of approximately 70% copper and 30% zinc, is renowned for its excellent ductility, ease of machining, and bright yellow appearance. It offers moderate corrosion resistance, especially suitable for dry or mildly humid environments, but is vulnerable to dezincification in aggressive water conditions. Its thermal and electrical conductivity are also notable, making it ideal for electrical fittings and plumbing.

Pros & Cons:

Its primary advantage is ease of fabrication, enabling cost-effective mass production of fittings, electrical connectors, and architectural hardware. However, its susceptibility to dezincification can compromise longevity in water systems with variable water quality, requiring protective coatings or specific alloy grades for critical applications.

Impact on Application:

Cartridge brass performs well in dry, indoor, or controlled environments. For outdoor or marine applications, additional corrosion protection or alternative alloys are advisable. Its machinability makes it suitable for precision components in electrical and plumbing sectors.

International B2B Considerations:

Buyers in Europe and the Middle East should verify compliance with standards like ASTM B124 or EN 12164. In Africa and South America, sourcing from certified suppliers that meet local standards ensures product reliability. Lead content in some grades may pose regulatory concerns, especially in markets with strict health and safety regulations.

Free-Cutting Brass (C36000)

Key Properties:

This alloy contains added lead (typically around 2%) to enhance machinability, with zinc as the primary alloying element. It maintains good ductility and electrical conductivity but is optimized for high-speed machining and intricate manufacturing processes. Its corrosion resistance is similar to other brasses but varies depending on environmental exposure.

Pros & Cons:

The key benefit is significantly reduced tooling wear and faster production cycles, translating into lower manufacturing costs. However, the lead additive makes it unsuitable for potable water or food contact applications, and some markets restrict its use due to environmental and health concerns.

Impact on Application:

Ideal for fasteners, gears, electrical components, and precision-machined parts. Its suitability diminishes in applications requiring high corrosion resistance or compliance with strict health standards.

International B2B Considerations:

Buyers should confirm compliance with local regulations regarding lead content, such as RoHS directives in Europe. Suppliers should provide certifications confirming lead content and adherence to environmental standards, especially for export to markets with strict environmental controls.

Tin Bronze (C93200)

Key Properties:

Tin bronze, typically comprising around 88% copper and 12% tin, offers excellent wear resistance, high fatigue strength, and outstanding corrosion resistance, particularly in seawater and chemically aggressive environments. Its reddish-brown hue and high hardness make it suitable for bearing surfaces, marine hardware, and casting applications.

Pros & Cons:

Its durability and corrosion resistance justify a higher cost, especially in demanding environments. The alloy’s hardness can complicate machining, often requiring specialized equipment or processes. It is less ductile than brass, limiting forming options.

Impact on Application:

Commonly used in marine, hydraulic, and industrial applications where longevity and resistance to corrosion are critical. Its performance in saltwater environments makes it a preferred choice for offshore projects and coastal infrastructure.

International B2B Considerations:

European and American standards such as ASTM B505 or DIN 1705 are prevalent. Buyers should ensure suppliers provide traceability and certifications for marine and offshore standards. In regions like Africa and South America, sourcing from reputable suppliers with proven compliance reduces risks of counterfeit or substandard materials.

Aluminum Bronze (C95400)

Key Properties:

Aluminum bronze, containing up to 12% aluminum, exhibits exceptional corrosion resistance, especially in seawater and chemically aggressive media. It also offers high strength, good wear resistance, and excellent fatigue life. Its golden hue and high alloy content make it suitable for high-performance applications.

Pros & Cons:

While its corrosion resistance and strength are superior, aluminum bronze is more expensive and less ductile, which can complicate complex forming or machining. Its high alloy content demands precise control during manufacturing.

Impact on Application:

Ideal for valves, marine hardware, and oil & gas equipment exposed to harsh environments. Its resistance to chemical attack makes it suitable for chemical processing equipment and structural components in corrosive settings.

International B2B Considerations:

Standards such as ASTM B148 or DIN 1705 are common. Buyers should prioritize suppliers with certifications for offshore and marine standards. In markets like the Middle East and Europe, compliance with environmental directives (e.g., REACH) and corrosion testing reports are essential for procurement decisions.

Summary Table

| Material | Typical Use Case for bronze or brass | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Cartridge Brass | Plumbing fittings, electrical connectors, architectural hardware | Excellent ductility, easy to machine | Moderate corrosion resistance, vulnerable to dezincification | Med |

| Free-Cutting Brass | Precision machined parts, fasteners, gears | Superior machinability, reduces manufacturing costs | Not suitable for potable water or food contact | Low |

| Tin Bronze | Marine hardware, bearings, casting | High wear and corrosion resistance | Higher cost, harder to machine | High |

| Aluminum Bronze | Valves, marine hardware, offshore equipment | Outstanding corrosion resistance, high strength | Most expensive, less ductile | High |

This detailed analysis equips B2B buyers with the insights needed to select the optimal bronze or brass alloy, balancing performance, cost, and regional standards to ensure successful procurement and long-term asset performance across diverse markets.

In-depth Look: Manufacturing Processes and Quality Assurance for bronze or brass

Manufacturing Processes for Bronze and Brass: Key Stages and Techniques

Material Preparation

The manufacturing process begins with sourcing high-quality raw materials, primarily copper alloys such as brass (copper-zinc) or bronze (copper-tin), often supplemented with alloying elements to meet specific application requirements. Suppliers perform initial material verification through chemical composition analysis to ensure conformity with industry standards and client specifications. In regions like Europe and the Middle East, strict adherence to certifications like ISO 9001 and industry-specific standards (e.g., CE marking, API specifications) is common to guarantee quality consistency.

Casting and Forming

Casting is a prevalent method for producing complex bronze or brass components, especially for intricate shapes such as marine hardware or decorative sculptures. Investment casting, sand casting, and die casting are widely used, with die casting preferred for high-volume, precision parts due to its dimensional accuracy and surface finish quality.

For simpler or high-precision parts, forging and extrusion are common, offering enhanced mechanical properties through work hardening. Cold and hot forging techniques are employed depending on the alloy’s temperature stability and desired final properties. Rolling and pressing may follow to achieve specific thicknesses or profiles, especially in sheet or plate production.

Machining and Assembly

Post-forming, components often undergo machining to achieve tight tolerances, smooth surface finishes, and precise dimensions. CNC machining is the industry standard, especially for critical parts like electrical connectors or precision gears, providing repeatability and high-quality finishes.

Assembly processes vary based on product complexity but often include welding, brazing, or mechanical fastening. For instance, in valve manufacturing, components are assembled with high-precision welding, followed by thorough inspection to ensure leak-proof and structural integrity. Surface treatments such as plating, anodizing, or polishing enhance corrosion resistance and aesthetic appeal, critical for marine or architectural applications.

Finishing Processes

Finishing techniques are crucial for both functional and aesthetic qualities. Common methods include polishing, electroplating, passivation, and coating. For bronze and brass components exposed to corrosive environments—such as marine settings—additional protective coatings or anodizing are applied to extend service life.

Quality Control (QC): Standards, Checks, and Testing Methods

International and Industry Standards

Manufacturers and suppliers typically align their quality management systems with ISO 9001, which specifies requirements for a quality management system (QMS) to ensure consistent product quality and process efficiency. For sectors like oil and gas, aerospace, or medical devices, compliance with industry-specific standards such as API (American Petroleum Institute), CE (European Conformity), or ASTM (American Society for Testing and Materials) is mandatory.

QC Inspection Levels and Checkpoints

-

Incoming Quality Control (IQC): Raw material verification is critical. Suppliers perform chemical analysis, mechanical testing, and visual inspections upon receipt to confirm alloy composition and surface condition before production begins.

-

In-Process Quality Control (IPQC): During manufacturing, key checkpoints include dimensional verification, surface finish inspections, and process parameter monitoring. For example, during casting, non-destructive testing (NDT) methods like ultrasonic or radiographic testing may be employed to detect internal flaws.

-

Final Quality Control (FQC): Before shipment, components undergo comprehensive testing—dimensional accuracy via coordinate measuring machines (CMM), surface roughness assessments, and corrosion resistance tests like salt spray testing or electrochemical analysis.

Common Testing Methods

- Mechanical Testing: Tensile, hardness, and fatigue tests evaluate material strength and durability.

- Corrosion Testing: Salt spray (ISO 9227), electrochemical impedance spectroscopy, and immersion tests assess corrosion resistance, especially vital for marine applications.

- Dimensional and Surface Inspection: CMM and optical comparators ensure parts meet specified tolerances and surface quality standards.

- Non-Destructive Testing (NDT): Ultrasonic, magnetic particle, or dye penetrant testing identify internal or surface flaws without damaging the component.

Verification for International Buyers

B2B buyers from Africa, South America, the Middle East, and Europe should request detailed QC reports, test certificates (e.g., Material Test Reports, or MTRs), and third-party inspection certificates. Engaging independent inspection agencies (e.g., SGS, Bureau Veritas) for audits or pre-shipment inspections adds an extra layer of assurance, especially when dealing with suppliers in regions where quality standards may vary.

Supplier Audits and Quality Verification

Proactive verification involves onsite audits, review of manufacturing processes, and assessment of quality management systems. Buyers should evaluate supplier certifications, review inspection records, and verify compliance with relevant standards. Digital documentation—such as real-time inspection reports and test data—facilitates transparency and traceability.

QC Nuances for Different Regions

In Europe and the UK, adherence to strict environmental and safety standards (e.g., REACH, RoHS) influences QC processes, requiring detailed chemical and emissions testing. In regions like Africa and South America, buyers should prioritize suppliers with robust certification and inspection records, considering potential variability in local manufacturing practices. Middle Eastern buyers often focus on corrosion resistance and material durability due to harsh environmental conditions, necessitating rigorous testing for salt spray and chemical resistance.

Conclusion

For international B2B buyers, establishing clear quality assurance protocols and understanding regional nuances are vital for sourcing bronze and brass components. Engaging with reputable suppliers who operate under internationally recognized standards and actively participate in third-party inspections minimizes risks and ensures product reliability. Moreover, integrating supplier audits, detailed testing, and comprehensive documentation into procurement strategies can significantly enhance confidence and streamline cross-border transactions, regardless of geographic location.

Related Video: Amazing factories | Manufacturing method and top 4 processes | Mass production process

Comprehensive Cost and Pricing Analysis for bronze or brass Sourcing

Cost Structure Breakdown for Bronze and Brass

Understanding the detailed cost components involved in sourcing bronze and brass is essential for optimizing procurement strategies. The primary expenses include raw materials, manufacturing labor, overhead, tooling, quality control, logistics, and profit margins.

Materials:

– Brass typically benefits from lower raw material costs, owing to zinc’s affordability and the alloy’s simpler composition. Raw material prices generally range between $1.50–$3.50 per pound.

– Bronze, containing more expensive copper and tin, incurs higher raw material costs—approximately $2.00–$5.00 per pound—reflecting the cost of high-purity copper and tin.

Labor and Manufacturing Overheads:

– Brass’s ease of machining and forming reduces production time and labor costs, making it suitable for high-volume, cost-sensitive projects.

– Bronze’s complex alloying process and specialized handling increase manufacturing overheads, especially for high-performance variants like phosphor or aluminum bronze.

Tooling & Quality Control:

– Tooling costs are generally comparable but can escalate for bronze when producing intricate or high-precision components, due to its hardness and wear resistance.

– Stringent quality control, especially for certified or specialized alloys, adds to costs but is crucial for applications in marine, aerospace, or safety-critical sectors.

Logistics:

– Both alloys are often sourced internationally; freight costs depend on volume, weight, and destination. For regions like Africa or South America, freight can constitute 10–20% of total costs, influenced heavily by incoterms and shipping mode.

Margins:

– Suppliers typically add a markup of 10–30%, depending on complexity, volume, and regional market competitiveness.

Price Influencers and Regional Considerations

Volume & MOQ:

– Larger orders usually attract discounts; minimum order quantities (MOQs) can range from small samples to several tons. Buyers should negotiate volume-based discounts, especially for ongoing projects.

Specifications & Customization:

– Custom alloy compositions, certifications (ISO, ASTM, etc.), or specialized finishes increase costs. Buyers in Europe or Middle East often require stringent certifications, impacting pricing.

Material Quality & Certifications:

– Higher purity materials or those meeting environmental standards (e.g., RoHS, REACH) tend to cost more but can reduce downstream compliance risks and warranty issues.

Supplier Factors:

– Established, ISO-certified suppliers with reliable supply chains generally command higher prices but offer better consistency and risk mitigation. Emerging suppliers may offer competitive rates but with increased supply chain risk.

Incoterms & Logistics:

– FOB (Free on Board) or CIF (Cost, Insurance, Freight) terms significantly influence landed costs. Buyers from Africa or South America should prioritize incoterms that mitigate import risks, like CIF, and negotiate freight and insurance costs upfront.

Buyer Tips for Cost Optimization

- Negotiate for Volume Discounts: Larger, consistent orders reduce unit costs and improve supply stability.

- Leverage Long-term Relationships: Building trust with suppliers can unlock better pricing, priority production, and customized terms.

- Prioritize Total Cost of Ownership (TCO): Consider lifecycle costs—durability, maintenance, corrosion resistance—when evaluating initial price differences. For example, bronze’s superior corrosion resistance in marine environments may justify a higher upfront cost.

- Understand Pricing Nuances: Prices fluctuate with global copper, zinc, and tin markets. Buyers should monitor commodity indices and consider futures contracts for bulk purchases.

- Regional Sourcing Strategies: For buyers in Africa, South America, or the Middle East, local or regional suppliers might reduce logistics costs but verify quality standards and certifications. European buyers often face stricter regulations but benefit from robust supplier networks.

Price Disclaimer

Indicative prices provided are approximate and can vary based on market conditions, alloy specifications, order quantities, and supplier relationships. It’s crucial to obtain multiple quotes and conduct due diligence to ensure competitive and reliable sourcing.

By understanding these components and influences, international B2B buyers can strategically negotiate, optimize costs, and make informed decisions that align with their project requirements and regional market dynamics.

本节着眼于活跃在“bronze or brass”市场中的几家制造商。这是一个用于说明目的的代表性样本;B2B买家在进行任何交易前都必须进行广泛的尽职调查。信息综合自公共资源和一般行业知识。

Essential Technical Properties and Trade Terminology for bronze or brass

Critical Technical Properties for Bronze and Brass

1. Material Grade and Composition

Material grade defines the specific alloy composition, such as Cartridge Brass (70% Cu, 30% Zn) or Tin Bronze (88% Cu, 12% Sn). Understanding these grades ensures compatibility with application requirements like corrosion resistance, machinability, or strength. For B2B buyers, selecting the correct grade impacts product performance, longevity, and compliance with industry standards.

2. Tolerance and Dimensional Accuracy

Tolerance specifies the permissible deviation from specified dimensions, typically measured in millimeters or thousandths of an inch. Tight tolerances are vital for precision applications like electrical connectors or mechanical components, reducing the need for extensive machining or rework. Suppliers should provide clear tolerance standards aligned with international or regional norms to ensure quality consistency.

3. Mechanical Properties (Hardness, Tensile Strength, Ductility)

These properties indicate how the alloy responds under load. Hardness (measured in HB or HR) reflects wear resistance; tensile strength shows maximum stress before failure; ductility indicates material flexibility. For example, phosphor bronze offers high fatigue resistance, ideal for springs, while aluminum bronze provides excellent corrosion resistance for marine parts. Buyers must match these properties to their operational demands for durability and safety.

4. Corrosion Resistance and Environmental Suitability

Corrosion resistance varies among alloys; tin bronze and aluminum bronze excel in seawater or chemically aggressive environments. This property directly influences maintenance costs, lifespan, and safety. Ensuring the alloy’s suitability for specific environmental conditions—such as saltwater, acidic atmospheres, or high humidity—is essential for long-term asset performance.

5. Machinability and Formability

Machinability refers to ease of cutting, shaping, or threading, often expressed through machinability ratings or lead content (in the case of free-cutting brass). Formability indicates how well the alloy can be shaped without cracking, which affects manufacturing efficiency. High machinability alloys reduce production costs and lead times, especially in high-volume or complex parts.

6. Certification and Compliance Standards

Many industries require materials to meet specific certifications (e.g., ASTM, ISO, EN standards) or regulatory standards for safety, health, and environmental impact. Verifying compliance ensures legal adherence and quality assurance, which is crucial when importing into regions with strict standards such as Europe or the Middle East.

Common Trade and Industry Terms

1. OEM (Original Equipment Manufacturer)

Refers to companies that produce parts or products branded and sold by other firms. Understanding OEM relationships helps B2B buyers identify reliable suppliers with specialized expertise, especially for custom alloy compositions or complex assemblies.

2. MOQ (Minimum Order Quantity)

The smallest quantity a supplier will accept for a given order. Recognizing MOQ constraints allows buyers to plan procurement budgets and production schedules effectively, particularly important in regions with fluctuating demand or limited storage capacity.

3. RFQ (Request for Quotation)

A formal process where buyers solicit price and lead time estimates from multiple suppliers. Properly prepared RFQs ensure competitive pricing, transparency, and clarity on technical specifications, reducing procurement risks.

4. Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce (ICC), defining responsibilities for shipping, insurance, and customs duties. Familiarity with Incoterms (like FOB, CIF, DDP) helps buyers clarify costs, ownership, and liability during cross-border transactions, vital in regions with complex customs procedures.

5. Specification Sheets and Certification Documents

Detailed documents outlining alloy composition, mechanical properties, testing standards, and compliance certificates. These are essential for verifying material quality and ensuring adherence to regional standards, especially when importing into Africa, South America, or Europe.

6. Lead Time and Delivery Schedule

The expected period from order placement to receipt. Understanding lead times allows for better production planning and inventory management, reducing downtime and ensuring timely project completion in dynamic markets.

By mastering these technical properties and trade terms, B2B buyers from diverse regions can make informed sourcing decisions, negotiate effectively, and ensure material suitability for their specific applications. Clear communication and thorough understanding of these parameters mitigate risks and optimize procurement outcomes across international markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the bronze or brass Sector

Market Overview & Key Trends

The global market for bronze and brass alloys is experiencing dynamic shifts driven by technological innovation, regional demand variations, and evolving regulatory landscapes. Key industries such as marine, energy, construction, automotive, and electrical sectors heavily influence market trends, with particular growth in infrastructure projects across Africa, South America, the Middle East, and Europe. For instance, the increasing demand for durable marine hardware in Middle Eastern oil and gas sectors, coupled with infrastructure modernization in African cities, amplifies the need for corrosion-resistant bronze alloys, especially aluminum bronze and tin bronze.

Emerging sourcing trends include a strong preference for supply chain transparency and traceability, driven by heightened environmental and ethical standards. Digital platforms, such as global metals exchanges and online B2B marketplaces, facilitate access to real-time market data, enabling buyers from diverse regions to compare prices, verify supplier credentials, and assess alloy quality more efficiently. Additionally, regional sourcing strategies are increasingly influenced by geopolitical factors, tariffs, and trade agreements, prompting buyers to diversify suppliers across multiple geographies to mitigate risks.

Technological advancements, such as additive manufacturing (3D printing) and precision machining, are reshaping production capabilities for bronze and brass components, making it feasible to produce complex, high-performance parts with reduced waste and lead times. Sustainability considerations are also impacting sourcing decisions; buyers are prioritizing suppliers who adopt eco-friendly practices, utilize recycled materials, and adhere to international environmental standards, ensuring that procurement aligns with both operational needs and corporate responsibility goals.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a central pillar in sourcing bronze and brass, especially as industries face increasing pressure to reduce environmental footprints. Both alloys rely heavily on copper, whose extraction and processing can be resource-intensive, involving significant energy consumption and ecological disruption. To address these concerns, B2B buyers are prioritizing suppliers who incorporate recycled metals—particularly scrap copper, zinc, and tin—into their production processes, significantly lowering the environmental impact.

Certifications such as ISO 14001 (Environmental Management), RJC (Responsible Jewelry Council), and chain-of-custody standards for recycled materials are becoming critical in supplier evaluations. These certifications assure buyers that their supply chains adhere to responsible mining, fair labor practices, and environmentally sound extraction methods. For regions like Europe and Spain, strict adherence to EU regulations on conflict minerals and due diligence is mandatory, influencing sourcing strategies significantly.

In Africa, South America, and the Middle East, ethical sourcing also involves addressing issues related to artisanal mining and potential human rights violations. Buyers are increasingly engaging with suppliers who can demonstrate transparent supply chains, ethical labor practices, and compliance with international standards. Additionally, “green” alloys—materials produced with minimal environmental impact—are gaining traction, driven by consumer and regulatory demands for sustainable products. Incorporating eco-friendly practices not only enhances brand reputation but can also lead to long-term cost savings through energy efficiency and waste reduction.

Brief Evolution/History (Optional)

Historically, bronze and brass have been integral to human civilization, used in tools, sculptures, and currency for thousands of years. In the context of modern B2B markets, their evolution reflects advances in metallurgy and manufacturing techniques. The industrial revolution accelerated the development of high-performance alloys tailored for specific applications, such as marine hardware and electrical connectors. Today, the focus has shifted toward sustainability and traceability, driven by global environmental policies and the increasing demand for ethically sourced materials. This evolution underscores the importance for international buyers to stay informed about technological innovations and regulatory changes to optimize procurement strategies effectively.

Related Video: International Trade 101 | Economics Explained

Frequently Asked Questions (FAQs) for B2B Buyers of bronze or brass

1. How can I effectively vet suppliers of bronze and brass for international trade?

Vetting suppliers requires a multi-step approach: start with verifying their business credentials, such as business licenses, certifications (ISO, ASTM, RoHS), and compliance with regional standards. Request references from previous clients, especially those in similar markets or industries. Conduct virtual or in-person audits if possible, focusing on production facilities, quality control processes, and supply chain practices. Utilize third-party verification services or trade platforms with supplier ratings. Establish clear communication channels to assess responsiveness and transparency. A reliable supplier should provide detailed technical data sheets, quality certificates, and samples before large orders.

2. What customization options are typically available for bronze and brass components, and how do they impact lead times?

Manufacturers can customize bronze and brass through various processes—such as specific alloy compositions, surface finishes (polished, anodized, coated), machining tolerances, and specialized shapes or sizes. Customization often extends to certifications for compliance or unique markings. Lead times depend on the complexity of the customization; simple modifications like surface finishes can be quick, while bespoke alloy formulations or complex shapes may require additional processing and testing, extending lead times by several weeks. Early planning and clear specifications help ensure faster turnaround and reduce risks of delays.

3. What are typical minimum order quantities (MOQs) and lead times for bulk bronze or brass orders?

MOQs vary based on supplier and product complexity but generally range from 500 to 10,000 units or kilograms. For standard stock materials, MOQs tend to be lower, around 500 kg or units; for custom alloys or intricate components, MOQs increase. Lead times typically span 4 to 12 weeks, depending on order size, alloy customization, and current production schedules. Establishing clear communication on your requirements early helps negotiate better terms and plan your procurement schedule accordingly, especially when managing inventory across different regions.

4. What quality assurance measures and certifications should I look for in international bronze and brass suppliers?

Ensure suppliers adhere to internationally recognized standards such as ISO 9001 for quality management, ASTM B16 for plumbing fittings, or EN standards for European markets. Request comprehensive test reports including chemical composition, mechanical properties, and corrosion resistance. Certifications like RoHS or REACH indicate compliance with environmental regulations. Suppliers should also provide non-destructive testing (NDT) reports, impact tests, and traceability documentation. Verifying these certifications ensures product consistency, reduces compliance risks, and aligns with your quality benchmarks for critical industrial or marine applications.

5. How can I manage logistics and shipping when importing bronze or brass from overseas suppliers?

Coordinate with suppliers to select reliable freight forwarders experienced in handling metal shipments, especially for delicate or heavy components. Consider shipping methods—sea freight for large volumes offers cost efficiency but longer transit times; air freight for urgent needs. Confirm Incoterms (e.g., FOB, CIF) to clarify responsibilities and costs. Proper packaging, including moisture barriers and protective cushioning, is vital to prevent damage. Maintain clear documentation—commercial invoices, certificates of origin, bills of lading—and ensure customs clearance procedures are understood to avoid delays, especially in regions with strict import regulations.

6. What common disputes arise in international bronze and brass procurement, and how can they be mitigated?

Disputes often stem from quality inconsistencies, delayed shipments, or payment issues. To mitigate these, establish detailed contracts with clear specifications, inspection rights, and penalty clauses for non-compliance or delays. Use independent third-party inspection agencies at origin and destination to verify quality before shipment. Maintain transparent communication and keep comprehensive records of all correspondence, samples, and test reports. Payment disputes can be reduced by using secure methods like letter of credit or escrow accounts. Building strong, trust-based relationships with suppliers also minimizes misunderstandings and fosters long-term cooperation.

7. How do regional regulations and environmental standards affect sourcing bronze and brass internationally?

Different regions enforce varying standards—Europe emphasizes REACH, RoHS, and WEEE directives; North America follows ASTM and ANSI standards; Middle Eastern and African markets may have local compliance requirements. Ensure suppliers provide certificates confirming materials are free from restricted substances and meet environmental standards. For projects in environmentally sensitive sectors, sourcing from suppliers with ISO 14001 certification or those practicing sustainable mining and manufacturing reduces regulatory risks and aligns with corporate responsibility goals. Staying updated on regional trade agreements and import restrictions helps prevent compliance issues and facilitates smoother customs clearance.

8. What should I do if I encounter quality disputes or delivery issues with my supplier?

Immediately document the issue with detailed photos, inspection reports, and correspondence records. Communicate directly with the supplier to clarify the problem and seek a resolution—this could involve rework, replacement, or financial compensation. If negotiations stall, escalate the matter through formal channels or involve third-party mediators or arbitration, especially if contracts specify dispute resolution processes. Prevent future issues by implementing rigorous incoming inspection protocols, establishing quality benchmarks, and including clear penalties in contracts. Building ongoing relationships based on transparency and mutual accountability helps resolve disputes efficiently and maintains supply chain stability.

⚠️ Important Disclaimer & Terms of Use

本指南中提供的信息,包括有关制造商、技术规格和市场分析的内容,仅供参考和教育目的。它不构成专业的采购建议、财务建议或法律建议。

我们已尽力确保信息的准确性和及时性,但不对任何错误、遗漏或过时的信息负责。市场状况、公司详情和技术标准可能会发生变化。

B2B买家在做出任何采购决策之前,必须进行自己独立的、彻底的尽职调查,包括直接联系供应商、验证认证、索取样品和寻求专业咨询。依赖本指南中的任何信息所产生的风险完全由读者自行承担。

Strategic Sourcing Conclusion and Outlook for bronze or brass

Strategic Sourcing Outlook for Bronze and Brass

Effective procurement of bronze and brass hinges on strategic sourcing that balances quality, cost, and supply stability. Understanding regional market dynamics, supplier reliability, and compliance standards is essential—particularly for buyers in Africa, South America, the Middle East, and Europe. Prioritizing reputable suppliers with transparent quality controls can mitigate risks associated with material variability and logistical disruptions.

As global markets evolve, so do the standards and environmental regulations impacting alloy selection. Staying informed about emerging trends, certifications, and regional preferences will enhance procurement resilience and ensure compliance. Leveraging market intelligence and fostering long-term supplier relationships will be critical for securing consistent supply at competitive prices.

Looking ahead, international B2B buyers should view sourcing as a strategic partnership rather than a transactional activity. By adopting a proactive approach—integrating regional insights, sustainable practices, and technological advancements—buyers can optimize their supply chains for durability and cost-efficiency. Now is the time to refine sourcing strategies, capitalize on regional opportunities, and position your organization for sustainable growth in the global bronze and brass markets.