Introduction: Navigating the Global Market for water jet cutter price

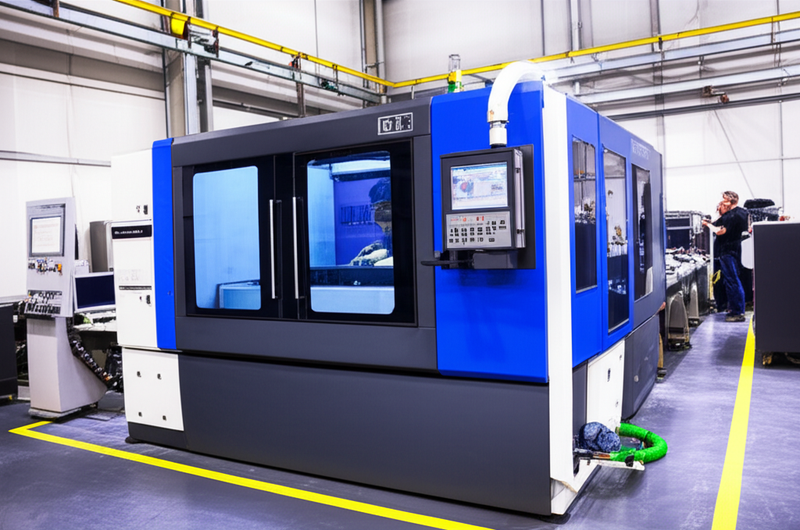

Water jet cutting technology has become a cornerstone for modern manufacturing, construction, and industrial fabrication, offering unrivaled versatility across a wide range of materials—from metals and stone to composites and ceramics. For international B2B buyers in dynamic markets like Africa, South America, the Middle East, and Europe, understanding the intricacies of water jet cutter pricing is not just an operational necessity—it can be a game-changer for competitiveness and long-term profitability.

Navigating the complexities of global water jet cutter pricing requires more than a simple cost comparison. Factors such as machine type, specifications, origin, manufacturer reputation, technological advancements, and local market conditions all play pivotal roles in determining the final investment. Moreover, additional considerations like after-sales support, quality control protocols, import duties, and logistics can dramatically impact the total cost of ownership—especially for businesses sourcing across borders from regions like the UAE, Indonesia, Brazil, or South Africa.

This guide is meticulously designed to help you decode the real costs and value propositions in the global water jet cutter market. Inside, you’ll find in-depth insights on:

- Types of water jet cutters: From entry-level machines to advanced CNC and custom-built systems.

- Material considerations: How capabilities align with your industry’s unique requirements.

- Manufacturing and quality control: Assessing supplier reliability and product lifespan.

- Supplier comparison: Evaluating offers from established and emerging global manufacturers.

- Detailed cost breakdowns: Upfront price, operational expenses, and total lifecycle cost.

- Regional market dynamics: How local factors affect pricing and sourcing strategies.

- FAQs and practical checklists: Key questions to ask and red flags to avoid.

Armed with this knowledge, international buyers gain the confidence to negotiate effectively, minimize risks, and secure water jet cutting solutions that drive operational efficiency and solid ROI—regardless of market challenges or geographic boundaries.

Understanding water jet cutter price Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Entry-Level Waterjet | Compact, basic cut capabilities, single cutting head, manual controls | Small workshops, prototyping, low-volume | Low upfront cost and simplifies training but limited speed, features, and material thickness handling |

| Standard Abrasive Waterjet | 2D cutting, incorporates abrasive media, moderate power, CNC controls | General metalworking, glass, stone shaping | Versatile for diverse materials and widely available but higher running costs due to abrasives |

| 3-Axis Advanced Waterjet | Enhanced precision, CNC, 3-axis operation, larger cutting beds | Aerospace, automotive, intricate parts | Achieves high accuracy and productivity, supports larger workpieces but increased purchase and maintenance costs |

| Multi-Head Waterjet | Multiple synchronized cutting heads, automation, advanced CNC integration | High-volume production, fabrication shops | Boosts throughput for repeated jobs, reduces labor cost, but requires skilled operators and higher capital outlay |

| Custom/High-Capacity Waterjet | Tailored configurations, extended cutting beds, IoT/remote monitoring | Specialized manufacturing, oversized parts | Maximum flexibility and integration; expandable for future needs but highest price range and complex procurement |

Entry-Level Waterjet

Characteristics: Entry-level waterjet cutters are compact machines designed for fundamental cutting tasks. Typically equipped with a single cutting head and basic manual or semi-automatic controls, they handle thinner materials and smaller workpieces.

Suitability: Best for small manufacturers, prototyping centers, or businesses starting waterjet operations with limited production requirements.

Key Purchasing Considerations: Evaluate the maximum supported material thickness, system reliability, local after-sales support, and the potential for upgrades. Ideal for buyers seeking low investment entry and basic versatility.

Standard Abrasive Waterjet

Characteristics: Standard abrasive waterjets incorporate an abrasive media with high-pressure water for 2D cutting of metal, stone, ceramics, and composites. Most include CNC controls, moderate worktable sizes, and are the workhorse for typical industrial jobs.

Suitability: Suits general-purpose manufacturing, fabrication shops, and sectors requiring flexible material processing.

Key Purchasing Considerations: Assess abrasive costs, machine throughput, ease of maintenance, and available training. Balance between acquisition cost and operational efficiency is crucial for ROI, especially where diverse cutting is needed.

3-Axis Advanced Waterjet

Characteristics: These machines offer higher degrees of precision, CNC automation, and 3-axis motion for complex contours. Larger cutting beds allow processing of substantial workpieces or batch runs.

Suitability: Essential in automotive, aerospace, and engineering fields where detailed, high-tolerance parts are required.

Key Purchasing Considerations: Focus on controller sophistication, precision specifications, size compatibility with client orders, and integration with existing digital workflows. Service contracts and technical support infrastructure are vital due to advanced components.

Multi-Head Waterjet

Characteristics: Multi-head systems use two or more synchronized cutting heads, often with automated material handling. They significantly boost productivity for repetitive or high-volume jobs.

Suitability: Tailored for medium to large manufacturers and contract fabricators aiming for mass production or simultaneous batch cuts.

Key Purchasing Considerations: Analyze system uptime, head-changing/mechanical downtime, programming complexity, and labor savings vs. capital expenditure. Ensure robust local technical support for minimal production interruptions.

Custom/High-Capacity Waterjet

Characteristics: Custom units cater to unique production requirements with tailored features—such as extra-long cutting beds, industry-specific configurations, or Internet of Things connectivity for remote diagnostics and predictive maintenance.

Suitability: Critical for enterprises scaling up, dealing with oversized parts, or needing industry-specific automation and integration.

Key Purchasing Considerations: Jointly develop technical specifications with the supplier, negotiate aftersales service SLAs, and factor in upfront engineering time. Attention to total cost of ownership and future expandability is essential for long-term investment confidence.

Related Video: Water Jet Cutting through 3″ inch thick Aluminum Metal 4′ x 6′

Key Industrial Applications of water jet cutter price

| Industry/Sector | Specific Application of water jet cutter price | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Metal Fabrication | Precision cutting of metals, alloys, and composites | Burr-free edges, minimal heat affected zones, versatility | Machine power, abrasive cost, after-sales service, compliance |

| Automotive & Aerospace | Complex part shaping and prototyping | High accuracy, supports various materials, rapid turnaround | CNC integration, part tolerances, maintenance contracts |

| Construction & Mining | Shaping stone, granite, ceramics, and hard materials | Reduction of material waste, clean cuts, adaptability | Machine robustness, water recycling capability, abrasive supply |

| Electronics | Cutting circuit boards, plastics, and enclosures | No thermal distortion, intricate designs, clean edges | Precision head, software control, safe handling for fine materials |

| Shipbuilding | Thick plate and specialty part fabrication | Fast processing, handles thick/hard materials, no distortion | Table size, corrosion resistance, local support availability |

Metal Fabrication

Water jet cutters are extensively used in metal fabrication for processing metals, alloys, and advanced composites. Their ability to deliver high-precision cuts without generating heat means there are no thermal distortions or burrs, crucial for sectors with stringent quality requirements. For buyers in regions like the Middle East and Africa, who may source steel or alloys locally or import specialized materials, investing in water jet equipment can reduce post-processing costs and expand the range of contract projects that can be accepted. Buyers should pay close attention to machine power, abrasive costs, alignment with local standards, and the availability of reliable after-sales service.

Automotive & Aerospace

In both automotive and aerospace manufacturing, water jet cutters are favored for complex part prototyping and production. They enable high-accuracy shaping of body components, engine parts, and custom assemblies, working efficiently with metals, composites, and layered materials. Rapid design changes and tight tolerances are common; thus, the right water jet cutter price reflects not only core machine capability but also CNC integration, part precision, and optional maintenance contracts. International buyers need machines designed for repetitive, high-precision tasks, with easy spare parts procurement and technical support.

Construction & Mining

Water jet cutters are increasingly applied for shaping and cutting hard materials such as granite, stone, and ceramics in construction and mining. Their cold-cutting capability significantly reduces microcracking and waste, essential for large infrastructure projects in regions like the UAE and South America. The adaptability of water jets on-site means diverse materials can be cut without frequent tool changes. Buyers should evaluate machine robustness, abrasive and water recycling systems (especially in regions with water scarcity), and ensure reliable abrasive supply channels.

Electronics

For electronics manufacturers, especially those producing PCBs and intricate enclosures, water jet cutting provides unmatched precision with no thermal or mechanical distortion, which is vital for sensitive assemblies. Clean cuts on composites and plastics support rapid prototyping and mass customization. Buyers from Europe or Africa should focus on equipment with high-precision heads, advanced software controls, and material handling suited for thin, delicate components—ensuring both yield and speed targets are met.

Shipbuilding

Shipbuilding operations require cutting of thick steel plates and specialty parts. Water jet cutters excel here, offering fast processing speeds and the ability to handle dense or layered materials without warping. No heat-affected zones ensure materials retain their properties, crucial for marine compliance. For B2B buyers in coastal countries, durability (corrosion resistance), table size for oversize works, and timely access to local technical support are primary considerations in equipment selection and negotiation.

Strategic Material Selection Guide for water jet cutter price

When evaluating water jet cutter price and performance, selecting the right material for key components—such as the body, cutting head, and plumbing—is essential. The material choice directly affects equipment durability, cutting precision, maintenance requirements, and compliance with international regulations. Below is an analysis of three commonly used materials in water jet cutter construction from a B2B buyer’s perspective, particularly for international markets in Africa, South America, the Middle East, and Europe.

Stainless Steel (e.g., 304, 316 Grades)

Key Properties:

Stainless steel, especially in 304 and 316 grades, is prized for its excellent corrosion resistance, tolerance to high pressures, and moderate-to-high temperature endurance. These qualities make it a top choice for components exposed to water and abrasive slurries, which are prevalent in water jet cutters.

Pros:

– High resistance to rust and chemical attack, ensuring long service life.

– Maintains structural integrity in both high-humidity and aggressive industrial environments.

– Widely available and supported by global standards like ASTM, DIN, and JIS.

Cons:

– Higher initial material cost compared to basic steels or alloys.

– More challenging to machine, which may increase component lead times.

– Some variants require specialized welders; local labor costs and expertise may be a consideration.

Application Impact:

Stainless steel is ideal where long-term reliability, hygiene, or exposure to saline/chemical water is critical. Its global standardization makes it a preferred material for international projects requiring compliance and traceability.

International B2B Considerations:

Frequent alignment with global certifications simplifies cross-border procurement and use. This is advantageous for buyers in regions with stringent import controls or for projects in harsh or coastal climates.

Hardened Tool Steel (e.g., AISI D2, H13)

Key Properties:

Hardened tool steels bring exceptional hardness, abrasion resistance, and toughness. Their properties are aided by specialized heat treatments, making them ideal for high-wear parts like nozzles and orifices within water jet systems.

Pros:

– Outstanding wear resistance extends the lifespan of precision components.

– Maintains dimensional accuracy in cutting applications.

– Can support very fine tolerances, key for intricate or repeated cuts.

Cons:

– Prone to corrosion if not properly treated (unlike stainless steel).

– Typically higher cost due to requisite heat treatment and precision machining.

– May not be readily available everywhere; supply chain constraints can affect delivery.

Application Impact:

Recommended where abrasive cutting is frequent, tool steel’s resilience maximizes uptime and reduces component replacement frequency.

International B2B Considerations:

Sourcing genuine, compliance-certified tool steel can be more complex in developing markets. Buyers should insist on certificates (e.g., ISO, ASTM compliance) and may need to account for longer lead times when importing to Africa or South America.

Aluminum Alloys (e.g., 6061, 7075)

Key Properties:

Aluminum alloys are known for their light weight, moderate strength, and excellent corrosion resistance when anodized. They are often used for frames, secondary structures, and sometimes low-pressure plumbing or electronic housings.

Pros:

– Significantly lighter than steels, easing transport and installation.

– Naturally resistant to oxidation, especially when anodized.

– Easy to machine, facilitating rapid prototyping and repair.

Cons:

– Lower pressure rating; can deform under high thermal/mechanical stress.

– Not suitable for critical, high-wear fluid path components.

– Surface protection needed in aggressively corrosive environments.

Application Impact:

Best suited for non-critical structural parts where weight savings reduce logistics cost, particularly in regions with complex or expensive inland freight.

International B2B Considerations:

Aluminum alloys follow a global standardization system (e.g., ASTM B221, EN 573), easing sourcing for European or Middle Eastern buyers. In Africa and South America, confirm supply availability and correct grade to avoid counterfeit material.

Engineering Plastics (e.g., PEEK, PTFE)

Key Properties:

Advanced engineering plastics like PEEK (polyether ether ketone) and PTFE (polytetrafluoroethylene) offer impressive chemical resistance, low weight, and self-lubrication, making them ideal for seals, bushings, and certain valve components.

Pros:

– High chemical and corrosion resistance even against aggressive fluids.

– Excellent performance at moderate temperatures.

– Non-conductive and low friction, reducing wear on moving parts.

Cons:

– Inferior mechanical strength and lower pressure tolerance than metals.

– Can deform under sustained high loads or temperatures.

– Premium grades can be expensive and difficult to source.

Application Impact:

Ideal for specialized seals, lining, or parts where corrosion or contamination control is paramount—however, limited to non-load bearing roles within the cutter.

International B2B Considerations:

There are strict export restrictions and variable national standards for advanced plastics. Buyers should verify compliance with local regulations (such as REACH in the EU) and consider logistics, especially when importing to remote or climate-sensitive regions.

Summary Table

| Material | Typical Use Case for water jet cutter price | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel (304/316) | Structural components, high-pressure plumbing, cutting heads | Corrosion resistance, global standardization | Higher initial cost, challenging machining | High |

| Hardened Tool Steel (AISI D2/H13) | Nozzles, wear parts exposed to abrasive media | Superior hardness and wear resistance | Susceptible to rust, higher supply complexity | High |

| Aluminum Alloys (6061/7075) | Frames, housings, non-critical supports | Lightweight and easy machining | Lower pressure/toughness limitations | Medium |

| Engineering Plastics (PEEK/PTFE) | Seals, bushings, lining, valves | Exceptional chemical resistance | Lower mechanical strength, higher price | High / Varies |

In-depth Look: Manufacturing Processes and Quality Assurance for water jet cutter price

Understanding how water jet cutters are manufactured and quality-assured is crucial for global B2B buyers assessing potential suppliers and justifying investment. Large capital machinery like water jet cutters involves precise engineering, multi-stage assembly, and stringent quality control to meet global performance standards. Buyers from Africa, South America, the Middle East, and Europe must pay particular attention to production processes and quality documentation to minimize operational and financial risks.

Core Stages of Water Jet Cutter Manufacturing

1. Material Preparation and Sourcing

The process begins with the selection of raw materials, primarily high-grade stainless steel and specialized alloys for critical components (e.g., high-pressure pumps, cutting heads). Precision in material selection impacts system durability, corrosion resistance, and ultimate cutting performance. For exporters, it’s important to confirm that suppliers maintain reliable sourcing and traceability—a practice enhanced by adherence to standards like ISO 9001.

2. Precision Machining and Forming

Key components undergo Computer Numerical Control (CNC) machining for exact tolerances. Parts such as the intensifier, nozzle, and abrasive feed systems are produced using advanced lathes, milling machines, and surface grinders. The forming process may include:

- Laser or plasma cutting for frame panels.

- CNC milling of pump assemblies.

- Heat treatment of wear parts to improve longevity.

Cutting head alignment and pressure vessel integrity are often checked using coordinate measuring machines (CMMs).

3. System Assembly and Integration

Main assemblies—pump units, drive motors, cutting gantry, and control panels—are installed in a staged sequence. Manufacturers may pre-assemble sub-units for reduced in-field installation time. Critical practices here include:

- Proper sealing of high-pressure plumbing.

- Electrical integrity checks.

- Integration of safety interlocks and emergency shut-off mechanisms.

For buyers, attention should be paid to whether modular subassembly is used, as it impacts serviceability and shipping logistics.

4. Software Configuration and Calibration

Modern water jet cutters include CNC controllers with proprietary or open-source software. Software is installed, and the system is calibrated to ensure motion accuracy and synchronization between heads and pumps. This stage often includes:

- Firmware installation.

- Test patterns to validate repeatability and precision.

- Connectivity checks for remote monitoring features (especially for IoT-enabled models).

5. Surface Finishing and Final Assembly

Final units are subjected to anti-corrosive coatings, powder painting, or anodizing (for aluminum parts). After cosmetic finishing, signage and safety decals are applied. The complete system is then prepared for packing according to export requirements, often with additional protections for marine or airfreight.

Quality Assurance: Standards, Checkpoints, and Methods

Key International Standards and Certifications

- ISO 9001: Indicates an overall quality management system, covering SOPs, documentation, and corrective action procedures.

- CE Marking: Mandatory for European Economic Area (EEA) imports, demonstrating compliance with EU safety and EMC standards.

- API or Industry-Specific Standards: Relevant for special-use water jet cutters (e.g., oil/gas, medical devices).

Buyers from the Middle East and Africa should confirm local regulatory acceptance of CE, RoHS, or equivalent international marks.

Core Quality Control Checkpoints in Production

- Incoming Quality Control (IQC): Review and testing of incoming materials—ensures alloy composition and mechanical properties meet specifications via spectrometry and hardness tests.

- In-Process Quality Control (IPQC): Conducted during machining and subassembly. Common checks include dimensional verification with gauges, pressure resistance evaluation, and electronics inspection. IPQC is vital for identifying issues before costly rework is required.

- Final Quality Control (FQC): Complete system testing under simulated operating conditions. This includes:

- Hydrostatic and dynamic pressure tests.

- Accuracy checks using test cuts in various materials (metal, ceramic, glass).

- Full safety system verification.

Common Component and System Testing Methods

- Ultrasonic and radiographic testing of high-pressure vessels.

- Leak and pressure cycling tests of plumbing and fittings.

- Cutting accuracy and repeatability trials (with digital measurement of kerf and tolerance).

- Software validation through cut simulation.

How B2B Buyers Can Verify Supplier Quality

Third-Party Factory Audits and Pre-Shipment Inspections

B2B buyers should routinely commission independent audits, especially for suppliers outside their domestic market. These audits should cover:

- Verification of ISO 9001 or equivalent certifications.

- Review of calibration records for key measurement tools.

- On-site checks for compliance with safety standards (CE, EMC).

Buyers can retain specialized quality control firms to conduct pre-shipment inspections—these include functional tests with buyer-specified parameters and checks for packing according to international standards (ISPM 15 for wooden crates, anti-moisture wrapping for sea transport).

Requesting and Evaluating Quality Documentation

Key supplier documents include:

- Material certificates (e.g., mill test reports for steel pressure parts)

- In-house QC logs and batch records.

- Factory Acceptance Test (FAT) reports, ideally with video/photo evidence of passage through each QC checkpoint.

- Certificates of Conformity for regulatory standards (CE, RoHS, etc.).

Best Practices for International Buyers

- Clarify regional certification requirements: For example, UAE importers may require civil defense approval; EU importers need CE marking.

- Confirm traceability: Ensure all critical parts are traceable to batch and production records, aiding warranty and servicing.

- Build “inspection windows” into contracts: Specify the right to audit during production and demand full pre-delivery test documentation.

Regional Considerations for Quality and Compliance

Buyers from Africa, South America, and the Middle East may face local infrastructure, power, and regulatory differences. When sourcing from Asia or Europe:

- Confirm voltage/frequency compatibility for electrical systems.

- Request spare part and service support assurances.

- Assess language/labeling compliance—ensure all safety labels, operating manuals, and software interfaces are supplied in accepted languages.

Some exporters may provide “international version” machines designed for enhanced durability and easier integration in varying environments.

Action Points for B2B Buyers

- Shortlist manufacturers with demonstrable ISO 9001, CE, or equivalent certifications.

- Insist on access to full QC records and factory test reports.

- Engage a local or international third-party inspection service prior to shipping.

- Build certification, inspection, and after-sales support obligations into purchasing contracts.

By rigorously evaluating manufacturing processes and QC systems, B2B buyers can secure reliable, high-performance water jet cutters that deliver consistent value and comply with regional requirements. This approach minimizes risk, reduces lifecycle costs, and supports long-term productivity for businesses across diverse international markets.

Related Video: Water Quality Testing

Comprehensive Cost and Pricing Analysis for water jet cutter price Sourcing

Understanding the True Cost Structure of Water Jet Cutter Procurement

International B2B buyers face a multi-layered cost structure when sourcing water jet cutting machines. Each price component—from raw materials to landed cost—demands careful scrutiny. Below is a breakdown of major cost contributors and actionable points for strategic water jet cutter sourcing.

Key Cost Components

-

Materials and Core Components

The foundation of pricing begins with core materials—high-grade stainless steel, precision pumps, CNC systems, and durable nozzles. Advanced machines require specialized electronics and reinforced cutting beds, increasing material and assembly costs. -

Labor and Manufacturing Overhead

Skilled labor for assembly, calibration, and testing is critical. Labor rates vary widely by manufacturing country; Chinese and Southeast Asian factories tend to offer competitive rates, while European brands reflect higher labor expenditures. Overhead includes factory maintenance, utilities, and compliance with manufacturing standards. -

Tooling, Calibration, and Initial Setup

New tooling for custom builds, specialized fixtures, and rigorous calibrations are significant for bespoke orders or high-precision models. This is especially relevant if your operation requires modifications beyond standard machine specifications. -

Quality Control and Certification

Internationally recognized standards (e.g., CE, ISO) necessitate strict testing and inspection processes—factored into the equipment’s production price. Third-party inspections may be advisable to ensure consistent machinery quality before shipment. -

Packaging and Logistics

Water jet cutters are heavy, sensitive capital goods. Secure export packaging, freight (sea/air), port handling, inland transportation, and insurance typically add 10–20% to the machine’s ex-factory price, with shipping costs varying markedly between regions such as Africa, South America, and the Middle East. -

Supplier Margins and Distribution Costs

For OEM or factory-direct purchases, margin rates are lower; working through local agents/distributors incurs higher mark-up, but may offer after-sales and local compliance support.

Major Price Influencers

-

Order Volume and Minimum Order Quantity (MOQ):

Larger, multi-unit orders usually unlock better per-unit pricing and reductions in shipping costs per unit. Conversely, buyers opting for a single machine or small batches may not access such economies of scale. -

Specifications and Customization:

The price escalates with greater bed sizes, advanced cutting speeds, abrasive functionality, multi-head systems, or IoT integration. Each non-standard specification adds engineering, production, and QA costs. -

Material Selection and Quality Levels:

Opting for higher-grade components or demanding specific imported parts will increase costs. Machines certified for certain industries (food-grade, aerospace, etc.) often command a premium. -

Supplier Reputation and Service:

Well-known brands with an established export track record charge more, reflecting both quality assurances and extended warranties. New entrants might price aggressively but pose higher operational and warranty risks. -

Incoterms, Duties, and Taxes:

Pricing can be quoted as EXW (Ex Works), FOB (Free on Board), CIF (Cost, Insurance and Freight), or DDP (Delivered Duty Paid). Buyers must factor in destination import duties, VAT/GST, local clearance fees, and storage at destination ports, all of which can materially affect the landed cost, especially in Africa or South America.

Actionable Buyer Tips

1. Always Compare Total Cost of Ownership (TCO):

Low upfront prices can be misleading. Consider consumables (abrasives, pump parts), maintenance cycles, local service availability, and power usage over the machine’s expected life.

2. Leverage Volume and Long-Term Partnerships:

Negotiate for volume incentives or ongoing partnership discounts—many suppliers offer price breaks for commitment beyond a single unit or after-sales package inclusions.

3. Clarify Specification Requirements:

Clearly define tolerance, precision, and automation needs. Over-specifying may inflate prices with features your operation doesn’t require.

4. Strategic Supplier Selection:

Assess export capabilities, references in target regions, after-sales support, and responsiveness. For regions like the Middle East or Africa, choose suppliers with a strong track record and local partnerships to overcome logistics and service hurdles.

5. Optimize Incoterms and Shipping:

Negotiate favorable Incoterms; in some markets, FOB or CIF agreements may provide better risk management. Understand local customs regulations to accurately estimate all ancillary import costs.

6. Seek Transparent Quotations:

Insist on detailed quotations breaking down machine price, optional modules, packaging, logistics, and aftersales support. This clarity prevents hidden surcharges and facilitates apples-to-apples comparisons.

Disclaimer:

All pricing ranges referenced are illustrative and subject to market fluctuations, model specifications, and supplier terms. Always secure up-to-date quotes with detailed breakdowns before committing to procurement.

Spotlight on Potential water jet cutter price Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘water jet cutter price’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

27 Waterjet Cutting Machine Manufacturers in The World (swaterjet.com)

As a comprehensive global buyer’s resource, “27 Waterjet Cutting Machine Manufacturers in The World” curates detailed insights on leading waterjet cutting machine producers, including top CNC and waterjet technology innovators. This guide is distinguished for its breadth, offering B2B buyers comparative overviews of market-leading suppliers, many with a proven track record in delivering over 6,000 cutting solutions worldwide. The companies profiled typically serve sectors requiring high precision and reliability—key criteria for international buyers in Africa, South America, the Middle East, and Europe. While individual manufacturer certifications (such as ISO 9001) and advanced capabilities (like multi-axis CNC machining) are frequently highlighted, the resource’s unique value lies in facilitating informed supplier selection and price benchmarking. It supports buyers through Q&A guidance, practical supplier contact details, and critical market context on pricing and specialization. Publicly available specifics for some manufacturers may be limited, but all are recognized as significant players in the water jet cutting segment.

38 Water Jet Cutter Manufacturers in 2025 (us.metoree.com)

38 Water Jet Cutter Manufacturers in 2025, as featured on Metoree, represent a curated selection of leading suppliers and OEMs active in the water jet cutting sector. This comprehensive group encompasses globally established brands such as OMNICNC, Hualong Machinery Co., Ltd, and Finepart, alongside international distributors and emerging specialist manufacturers. Their collective expertise covers a broad range of machine sizes, automation levels, and price points—enabling buyers to compare entry-level units to premium, custom solutions. Many manufacturers within this group are positioned for export, with visible supply chain and support networks extending across Africa, the Middle East, South America, Europe, and Southeast Asia. While detailed public information may be limited for some, the selection is evaluated for market reputation, diverse manufacturing standards, and the ability to support international B2B procurement needs, including bulk sourcing and tailored configurations.

Omax (www.omax.com)

OMAX, a Hypertherm Associates brand, is a globally recognized manufacturer specializing in advanced abrasive waterjet cutting systems. Renowned for precision, user-friendly operation, and reliability, OMAX serves a wide range of industries with machinery engineered for tight tolerances and efficient operation. Their direct-drive pump technology and proprietary INTELLI-MAX control software distinguish them in the market, enabling high-performance cutting across virtually any material.

Key strengths include:

– Comprehensive range of models, from compact solutions to large-scale industrial machines

– Robust R&D resulting in smart, intuitive interfaces and IoT-ready systems for modern manufacturing environments

– Strong international support network, with established experience supplying waterjet solutions to buyers in Africa, South America, the Middle East, and Europe

– Emphasis on quality and after-sales support, ensuring minimal downtime and maximum productivity

While specific certifications are not highlighted publicly, OMAX’s global reputation reflects consistent adherence to stringent quality standards and continual technological innovation.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 27 Waterjet Cutting Machine Manufacturers in The World | Comprehensive supplier comparison and price benchmarking. | swaterjet.com |

| 38 Water Jet Cutter Manufacturers in 2025 | Global group, wide range, export-focused suppliers. | us.metoree.com |

| Omax | Premium, precision-focused global waterjet solutions. | www.omax.com |

Essential Technical Properties and Trade Terminology for water jet cutter price

Key Technical Specifications to Evaluate in Water Jet Cutter Purchases

For international B2B buyers, especially those sourcing from Africa, South America, the Middle East, and Europe, a thorough understanding of technical properties is essential for making informed purchase decisions and accurate price comparisons. Below are critical technical specifications that directly influence both the price and utility of water jet cutters in industrial environments:

-

Cutting Pressure and Pump Power

The pressure rating (usually measured in bar or psi) and the pump’s output (kW or HP) are pivotal in determining cutting speed, material thickness capability, and overall efficiency. Higher-pressure systems (e.g., 4,000+ bar or 60,000+ psi) can process thicker and harder materials faster but typically command a higher investment and require robust maintenance infrastructure. -

Cutting Area (Table Size)

Specified in millimeters or inches (e.g., 1,500 x 3,000 mm), the table size dictates the maximum dimensions of materials that can be accommodated on the cutter bed. Buyers must match this to their typical workpiece size to avoid unnecessary expenditure or production constraints. -

Positional Accuracy and Tolerance

This reflects the precision of the cut, important for industries demanding tight tolerances (e.g., aerospace, automotive). Expressed as ±0.1 mm or similar, better accuracy is critical for high-value applications and justifies a premium price. -

Cutting Speed

Indicated in mm/min or in/min, cutting speed is especially relevant for high-volume production. Faster speeds can optimize production output but may vary depending on material type, thickness, and whether abrasive is used. -

Number and Type of Cutting Heads

Machines may come with single or multiple heads, and with either pure water or abrasive capabilities. Multiple heads can double throughput, reducing per-unit operational costs. Abrasive heads are necessary for hard materials like metal and stone; pure-water heads suit soft materials such as rubber or foam. -

CNC and Automation Features

Advanced water jet cutters integrate sophisticated Computer Numerical Control (CNC) systems, sometimes including software connectivity (IoT), remote diagnostics, and automatic tool changers. These features streamline workflow, enable complex geometries, and lower operator labor requirements, but also contribute to higher upfront and support costs.

Understanding and negotiating around these specifications enables B2B buyers to match machines to their production needs and budget constraints, while also ensuring scalability and after-sales support compatibility within their markets.

Common B2B Trade Terms and Industry Jargon

International buyers frequently encounter specialized trade terms throughout the procurement process. Mastery of this vocabulary streamlines negotiations, clarifies expectations, and reduces the risk of costly misinterpretation:

-

OEM (Original Equipment Manufacturer)

Refers to equipment produced according to the buyer’s specifications, often under their brand. OEM arrangements enable customization and potentially competitive pricing but may involve higher Minimum Order Quantities or longer lead times. -

MOQ (Minimum Order Quantity)

The lowest number of units a supplier is willing to accept per order. Understanding MOQ is critical for supply planning—especially for small to mid-sized buyers or when piloting new equipment in unfamiliar markets. -

RFQ (Request for Quotation)

A formal inquiry that buyers send to suppliers detailing technical requirements, quantities, delivery timelines, and terms, soliciting a detailed price offer. Well-prepared RFQs lead to more accurate, competitive pricing and help filter capable suppliers. -

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce (e.g., FOB, CIF, DDP) defining responsibilities for shipping, insurance, and tariffs. Selecting the right Incoterm impacts landed cost and risk allocation—essential for cross-border transactions. -

COC (Certificate of Conformity)

An official document attesting that the machinery complies with relevant standards and regulations (e.g., CE marking for Europe, SABER in Saudi Arabia). COCs are vital for smooth customs clearance and legal operation in the destination market. -

Lead Time

The total time from confirmation of order to delivery at the buyer’s location. For international buyers, factoring in manufacturing, quality checks, shipping, and customs is critical for accurate production scheduling and inventory management.

By familiarizing themselves with these pivotal technical properties and trade terms, international B2B buyers can ensure their water jet cutter investments maximize value, comply with regional standards, and provide a lasting competitive edge.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the water jet cutter price Sector

Market Overview & Key Trends

The global water jet cutter sector is experiencing rapid transformation, driven by the demand for versatility, precision, and sustainability in industrial manufacturing. B2B buyers—from large construction firms in the Middle East to custom fabrication shops in Africa and industrial suppliers in Europe—are finding water jet cutters essential for processing various materials, including metals, ceramics, and composites. The push for operational efficiency, minimal thermal impact on materials, and low tooling costs has positioned water jet cutting as an advantageous technology in multiple sectors such as aerospace, automotive, and metalworking.

Current sourcing trends reveal a pronounced shift toward digital procurement and supplier diversification. International buyers, especially in emerging markets like Indonesia and South America, are leveraging e-marketplaces and supplier comparison platforms to vet manufacturers in China, Europe, and increasingly, domestic providers where local support infrastructure is strengthening. Technology adoption is also on the rise, with CNC integration, IoT-enabled monitoring, and software-driven automation pushing buyers to prioritize advanced, data-driven models for both cost and quality management.

Market dynamics are nuanced by regional economic conditions, government incentives, and trade policies. Buyers in Africa and Latin America are particularly sensitive to import tariffs and currency fluctuations, making total cost of ownership—not just the sticker price—a critical consideration. European businesses, facing stricter labor and environmental regulations, are demanding equipment that complies with local directives and sustainability goals. Meanwhile, competitive pressure from low-cost suppliers in Asia motivates global players to bundle services such as training, aftersales support, and extended warranties to differentiate their offerings.

Notably, the ongoing evolution of value-added solutions—such as modular water jet systems and hybrid models—caters to buyers seeking scalability, flexibility, and shorter lead times. B2B procurement decisions are increasingly collaborative, involving technical, operational, and sustainability committees to ensure long-term investment value and regulatory compliance.

Sustainability & Ethical Sourcing in B2B

Environmental responsibility is becoming a key criterion for B2B buyers in the water jet cutter market, especially as global supply chains come under closer scrutiny. Water jet cutting itself is often lauded for its eco-friendliness compared to thermal methods; the absence of hazardous fumes and lower material waste are significant advantages. Nonetheless, responsible sourcing extends beyond machine operation—buyers are scrutinizing suppliers for their adoption of sustainable manufacturing practices, energy efficiency standards, and responsible water management.

In response, leading manufacturers are integrating closed-loop water recycling systems into their machines, which drastically reduce water and abrasive consumption and minimize discharge into local ecosystems. Buyers are encouraged to request documentation on environmental impact, such as ISO 14001 certification, RoHS compliance, or local equivalents in the region of manufacture. Additionally, the abrasive materials used (commonly garnet) are increasingly subject to traceability and ethical sourcing requirements, as extractive practices can have significant ecological footprints if mismanaged.

Ethical supply chain management is also rising on the B2B agenda, fueled by regulatory requirements—from the European Union’s Corporate Sustainability Due Diligence Directive (CSDDD) to national mandates across the Middle East. Buyers should conduct due diligence on labor standards, workplace safety, and anti-corruption policies within their suppliers’ operations. Collaboration with suppliers to achieve transparency—notably through regular audits and adherence to internationally recognized sustainability frameworks—can mitigate risk and enhance brand reputation in the long term.

The push for sustainable procurement is now influencing supplier selection and long-term vendor relationships, prompting buyers to prioritize partners with clear, demonstrable commitments to green manufacturing, lifecycle management, and ethical resource sourcing.

Brief Evolution/History

Water jet cutting technology originated in the mid-20th century for soft material processing and evolved rapidly with the introduction of abrasive water jets in the 1970s. This breakthrough enabled the precise cutting of hard metals, ceramics, and composites, catalyzing adoption across multiple industrial sectors. Over the last three decades, the integration of computer numerical control (CNC) and advanced pump technologies has transformed water jet cutters from niche tools to mainstream industrial assets.

Today’s water jet cutters feature sophisticated software, multi-axis cutting heads, and remote monitoring capabilities. Historically, the technology’s accessibility has been limited by high capital investments, but recent supply chain globalization and cost-efficient manufacturing (notably in Asia) have lowered barriers to entry. The sector’s emphasis has distinctly shifted toward smarter, greener, and more modular solutions, reflecting broader industry trends in digitalization and sustainable manufacturing—making water jet cutting an attractive investment for forward-thinking B2B buyers worldwide.

Related Video: The Inside Story of the Ship That Broke Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of water jet cutter price

-

How can I effectively vet and select reliable international water jet cutter suppliers?

Begin by researching suppliers’ backgrounds through third-party business directories, references from existing customers, and industry certifications (such as ISO 9001). Evaluate their manufacturing track record, export experience, and after-sales support. Request documentation of previous international shipments, quality inspection reports, and test certificates. Where possible, arrange a site visit or virtual factory tour and insist on sample orders to assess quality first-hand. Asking for recent customer testimonials—especially from buyers in Africa, South America, the Middle East, or Europe—strengthens your due diligence. -

What options do I have for customizing a water jet cutter for my specific business needs?

Most reputable manufacturers offer various levels of customization, including adjustments to table size, cutting head configurations (e.g., 2D/3D), software integration, power supply compatibility, and material handling systems. Clearly outline your technical and operational requirements early in negotiations, and request engineering drawings or technical proposals as part of the quote. Specify regional compliance requirements (such as CE marking for Europe or SASO for Saudi Arabia) and confirm customization lead times. Detailed specifications upfront will help minimize delays and ensure the machine fits your intended applications. -

What are the typical minimum order quantities (MOQs), lead times, and payment terms for B2B buyers?

For water jet cutters, the minimum order is usually one unit, given the high capital value. Lead times can vary from 30 to 90 days depending on customization, components, and manufacturer backlog. For international transactions, standard payment terms are 30%–50% advance deposit with the balance due after inspection prior to shipment (often via T/T or irrevocable letter of credit). Clarify all terms in a signed contract, including trade incoterms (FOB, CIF, etc), to avoid misunderstandings and ensure mutual protection. -

Which certifications and quality assurance measures should I expect from international suppliers?

Expect compliance with international quality standards such as ISO 9001 for manufacturing and, where applicable, regional safety and performance certifications (e.g., CE marking, UL, or local standards like SONCAP for Nigeria). Request quality assurance documentation—such as factory acceptance tests (FAT), material traceability records, and third-party inspection reports. For added confidence, consider hiring a local or regional inspection agency to verify the machine before shipment, and negotiate warranty terms for core components and critical spare parts. -

How do logistics, shipping, and customs clearance typically work for water jet cutter imports?

International suppliers usually ship water jet cutters by sea freight (containerized cargo), with delivery terms defined by the agreed incoterm (e.g., FOB, CFR, CIF). Ensure you understand the division of responsibilities for freight, insurance, import duties, and taxes in your country. Work with a reliable freight forwarder or customs broker who has experience with industrial machinery imports in your region. Early preparation of documentation—such as commercial invoice, packing list, bill of lading, and certificates of origin—can help minimize delays at customs. -

What should I include in contracts to manage risks related to delivery, quality, and disputes?

A robust contract should specify order details (technical specs, quantity, price), performance milestones, acceptance criteria, penalties for delays, warranty terms, and procedures for inspections. Include detailed incoterms and outline responsibilities for shipping, insurance, and customs. Define clear processes for handling non-conformance—even referencing third-party arbitration in a neutral country (such as the ICC in Paris or SIAC in Singapore) in case of unresolved disputes. Ensuring legal enforceability in both countries is crucial for risk mitigation. -

Are after-sales support, spare parts, and technical training included in typical water jet cutter deals?

Leading suppliers generally offer a warranty covering main components (typically 1–2 years), access to spare parts, and remote troubleshooting support. Many provide initial operator training via on-site visits, video calls, or detailed manuals—essential for safe and efficient operation. Clarify the scope, duration, and costs of ongoing support services, and request a spare parts list with pricing as part of the initial quotation. Consider including service-level agreements (SLAs) in your purchase contract for faster response times. -

How can I compare international water jet cutter prices and ensure cost transparency?

Compare not only the initial machine price but also the total cost of ownership—including shipping, import taxes, installation, consumables, and maintenance. Request detailed, itemized quotations highlighting optional features, software licenses, after-sales services, and spare parts. Assess price differences based on brand reputation, technical specifications, and supplier location. Insist on price guarantees in your contract, and beware of unusually low prices that might indicate hidden costs or subpar quality. Engaging a local technical expert for pre-purchase evaluation can add further assurance.

Strategic Sourcing Conclusion and Outlook for water jet cutter price

When evaluating water jet cutter prices, international B2B buyers must approach procurement with a holistic, strategic lens. Price variations are shaped by factors such as manufacturer reputation, machine specifications, technological capabilities, and regional market dynamics—meaning the lowest quote seldom tells the entire story. Buyers in Africa, South America, the Middle East, and Europe should always weigh the total cost of ownership, including after-sales support, spare parts availability, and local compliance, to ensure operational continuity and maximize ROI.

Key Takeaways for Smart Purchasing

- Assess Equipment Fit: Match machine specifications to your business’s production needs—overspending on features you won’t utilize or underestimating your operational requirements both result in added cost.

- Leverage Supplier Competition: Seek quotes from multiple reputable global suppliers; use supplier competition to negotiate pricing, warranty terms, and bundled services.

- Factor in Regional Considerations: Review local import duties, logistics, and service support to avoid unexpected costs or downtime.

- Prioritize Innovation: Machines with advanced CNC, automation, or IoT capabilities may have a higher upfront price but can deliver significant efficiencies and scalability.

Encouraging a Strategic Outlook

In today’s globalized manufacturing environment, the ability to balance cost, quality, and supplier reliability is a competitive differentiator. As water jet technology continues to evolve and global supply chains adapt, buyers who excel at strategic sourcing—actively comparing options, leveraging supplier networks, and focusing on long-term value—will be best positioned to drive sustainable growth. Now is the time to reassess sourcing strategies, build resilient partnerships, and proactively invest in technology that will future-proof your operations. Take decisive action by conducting thorough supplier evaluations and negotiating from a position of knowledge and strength.